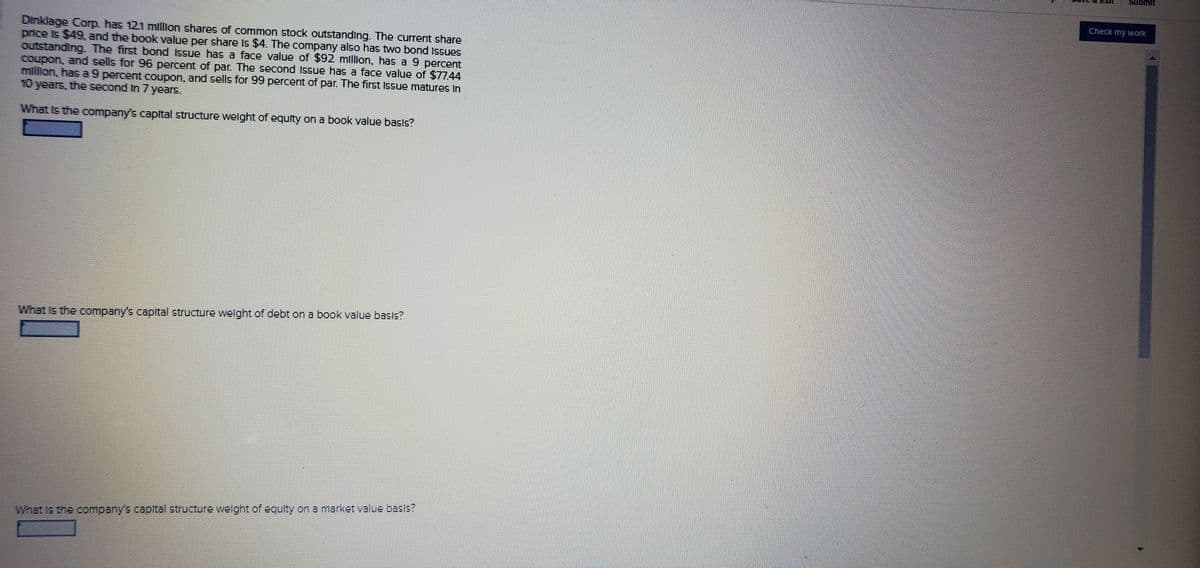

Dinklage Corp. has 121 million shares of common stock outstanding. The current share price is $49, and the book value per share is $4. The company also has two bond Issues outstanding. The first bond issue has a face value of $92 million, has a 9 percent coupon, and sells for 96 percent of par The second Issue has a face value of $7744 milion, has a 9 percent coupon, and sells for 99 percent of par. The first Issue matures in 10 years, the second in 7 years. What is the company's capital structure weight of equity on a book value basis? What is the company's capital structure welght of debt on a book value basis? What is the company's capital structure welght of equity on a market value basis?

Dinklage Corp. has 121 million shares of common stock outstanding. The current share price is $49, and the book value per share is $4. The company also has two bond Issues outstanding. The first bond issue has a face value of $92 million, has a 9 percent coupon, and sells for 96 percent of par The second Issue has a face value of $7744 milion, has a 9 percent coupon, and sells for 99 percent of par. The first Issue matures in 10 years, the second in 7 years. What is the company's capital structure weight of equity on a book value basis? What is the company's capital structure welght of debt on a book value basis? What is the company's capital structure welght of equity on a market value basis?

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 15P

Related questions

Question

Please help with correct answer asap.

Transcribed Image Text:Submit

Check my work

Dinklage Corp. has 121 mllion shares of common stock outstanding. The current share

price Is $49 and the book value per share Is $4. The company also has two bond Issues

outstanding The first bond Issue has a face value of $92 million, has a 9 percent

Coupon, and sells for 96 percent of par. The second Issue has a face value of $7744

million, has a9 percent coupon, and sells for 99 percent of par. The first Issue matures In

10 years, the second In 7 years.

What Is the company's capital structure welght of equity on a book value basIs?

What Is the company's capital structure welght of debt on a book value bass?

What Is the company's capital structure wellght of equity on a market value basls?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning