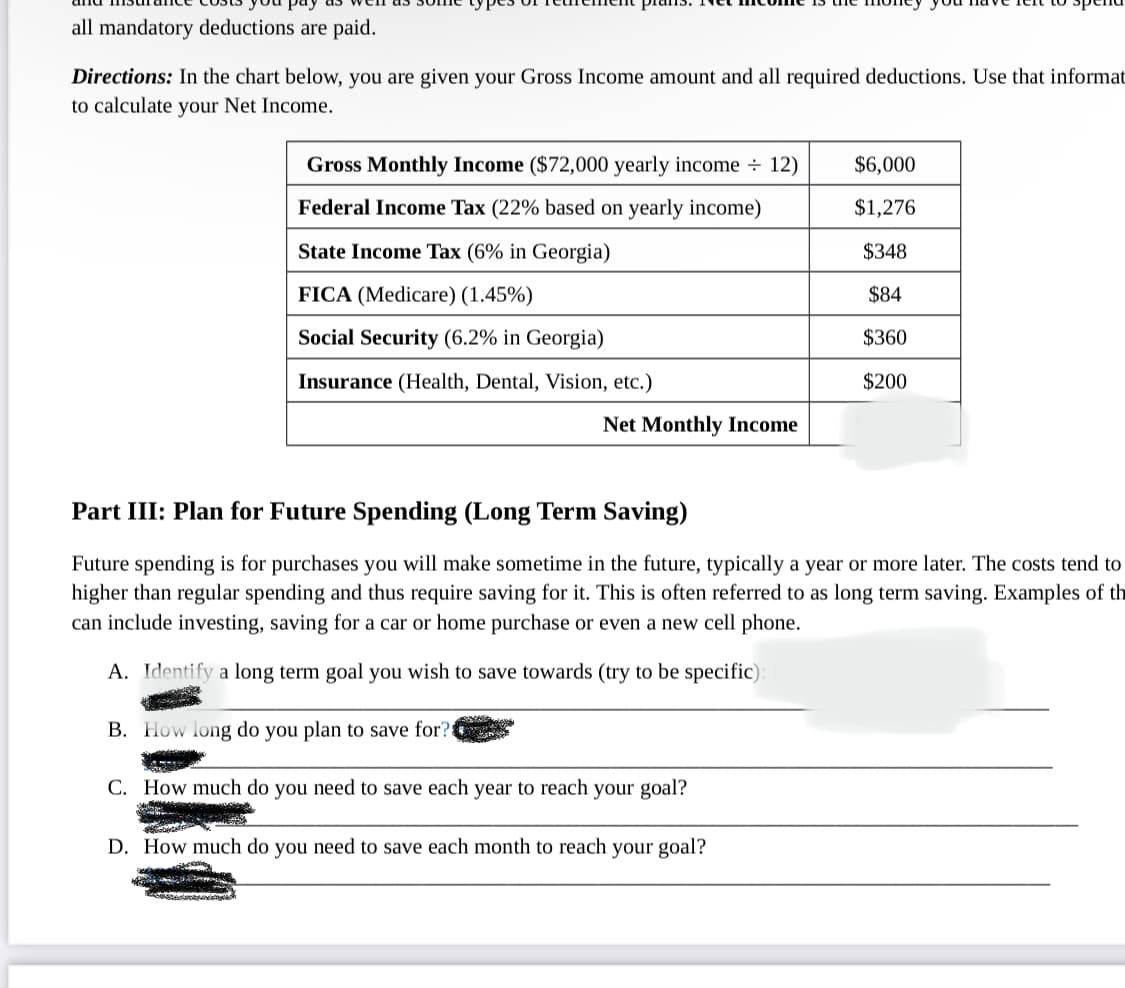

Directions: In the chart below, you are given your Gross Income amount and all required deductions. Use that informat to calculate your Net Income. Gross Monthly Income ($72,000 yearly income ÷ 12) Federal Income Tax (22% based on yearly income) State Income Tax (6% in Georgia) FICA (Medicare) (1.45%) Social Security (6.2% in Georgia) Insurance (Health, Dental, Vision, etc.) Net Monthly Income $6,000 $1,276 $348 $84 $360 $200

Directions: In the chart below, you are given your Gross Income amount and all required deductions. Use that informat to calculate your Net Income. Gross Monthly Income ($72,000 yearly income ÷ 12) Federal Income Tax (22% based on yearly income) State Income Tax (6% in Georgia) FICA (Medicare) (1.45%) Social Security (6.2% in Georgia) Insurance (Health, Dental, Vision, etc.) Net Monthly Income $6,000 $1,276 $348 $84 $360 $200

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 50BE

Related questions

Question

Not a grade

Transcribed Image Text:pay

all mandatory deductions are paid.

Directions: In the chart below, you are given your Gross Income amount and all required deductions. Use that informat

to calculate your Net Income.

Gross Monthly Income ($72,000 yearly income 12)

Federal Income Tax (22% based on yearly income)

State Income Tax (6% in Georgia)

FICA (Medicare) (1.45%)

Social Security (6.2% in Georgia)

Insurance (Health, Dental, Vision, etc.)

GENERA

Net Monthly Income

Part III: Plan for Future Spending (Long Term Saving)

Future spending is for purchases you will make sometime in the future, typically a year or more later. The costs tend to

higher than regular spending and thus require saving for it. This is often referred to as long term saving. Examples of th

can include investing, saving for a car or home purchase or even a new cell phone.

A. Identify a long term goal you wish to save towards (try to be specific):

B. How long do you plan to save for?

C. How much do you need to save each year to reach your goal?

Bombom

D. How much do you need to save each month to reach your goal?

Sebes

$6,000

$1,276

$348

$84

$360

$200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College