Directions: Read the case below and answer the questions that follow. Whitehead, CPA, is planning the audit of a newly obtained client, Henderson Energy Corporation, for the year ended December 31, 2016. Henderson Energy is regulated by the state utility commission, and because it is a publicly traded company the audited financial statements must be filed with the Securities and Exchange Commission (SEC). Henderson Energy is considerably more profitable than many of its competitors, largely due to its extensive investment in information technologies used in its energy distribution and other key business processes. Recent growth into rural markets, however, has placed some strain on 2016 operations. Additionally, Henderson Energy expanded its investments into speculative markets and is also making greater use of derivative and hedging transactions to mitigate some of its investment risks. Because of the complexities of the underlying accounting associated with these activities, Henderson Energy added several highly experienced accountants within its financial reporting team. Internal audit, which has direct reporting responsibility to the audit committee, is also actively involved in reviewing key accounting assumptions and estimates on a quarterly basis. Whitehead’s discussions with the predecessor auditor revealed that the client has experienced some difficulty in correctly tracking existing property, plant, and equipment items. This largely involves equipment located at its multiple energy production facilities. During the recent year, Henderson acquired a regional electric company, which expanded the number of energy production facilities. Whitehead plans to staff the audit engagement with several members of the firm who have experience in auditing energy and public companies. The extent of partner review of key accounts will be extensive. Based on the above information, identify factors that affect the risk of material misstatements in the December 31, 2016, financial statements of Henderson Energy. Indicate whether the factor increases or decreases the risk of material misstatements. Also, identify which audit risk model component is affected by the factor. Use the format below:

Directions: Read the case below and answer the questions that follow.

Whitehead, CPA, is planning the audit of a newly obtained client, Henderson Energy Corporation, for the year ended December 31, 2016. Henderson Energy is regulated by the state utility commission, and because it is a publicly traded company the audited financial statements must be filed with the Securities and Exchange Commission (SEC).

Henderson Energy is considerably more profitable than many of its competitors, largely due to its extensive investment in information technologies used in its energy distribution and other key business processes. Recent growth into rural markets, however, has placed some strain on 2016 operations. Additionally, Henderson Energy expanded its investments into speculative markets and is also making greater use of derivative and hedging transactions to mitigate some of its investment risks. Because of the complexities of the underlying accounting associated with these activities, Henderson Energy added several highly experienced accountants within its financial reporting team. Internal audit, which has direct reporting responsibility to the audit committee, is also actively involved in reviewing key accounting assumptions and estimates on a quarterly basis.

Whitehead’s discussions with the predecessor auditor revealed that the client has experienced some difficulty in correctly tracking existing property, plant, and equipment items. This largely involves equipment located at its multiple energy production facilities. During the recent year, Henderson acquired a regional electric company, which expanded the number of energy production facilities.

Whitehead plans to staff the audit engagement with several members of the firm who have experience in auditing energy and public companies. The extent of partner review of key accounts will be extensive.

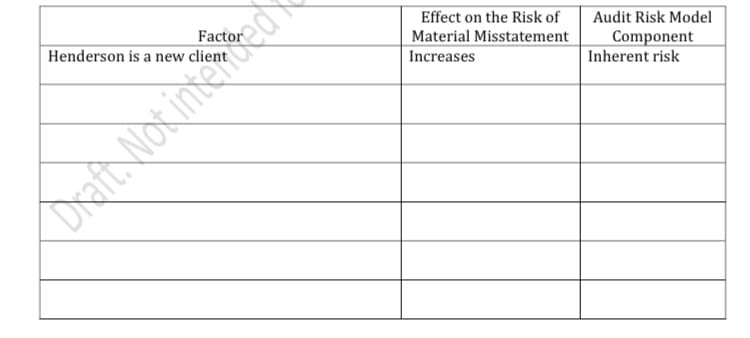

Based on the above information, identify factors that affect the risk of material misstatements in the December 31, 2016, financial statements of Henderson Energy. Indicate whether the factor increases or decreases the risk of material misstatements. Also, identify which audit risk model component is affected by the factor. Use the format below:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps