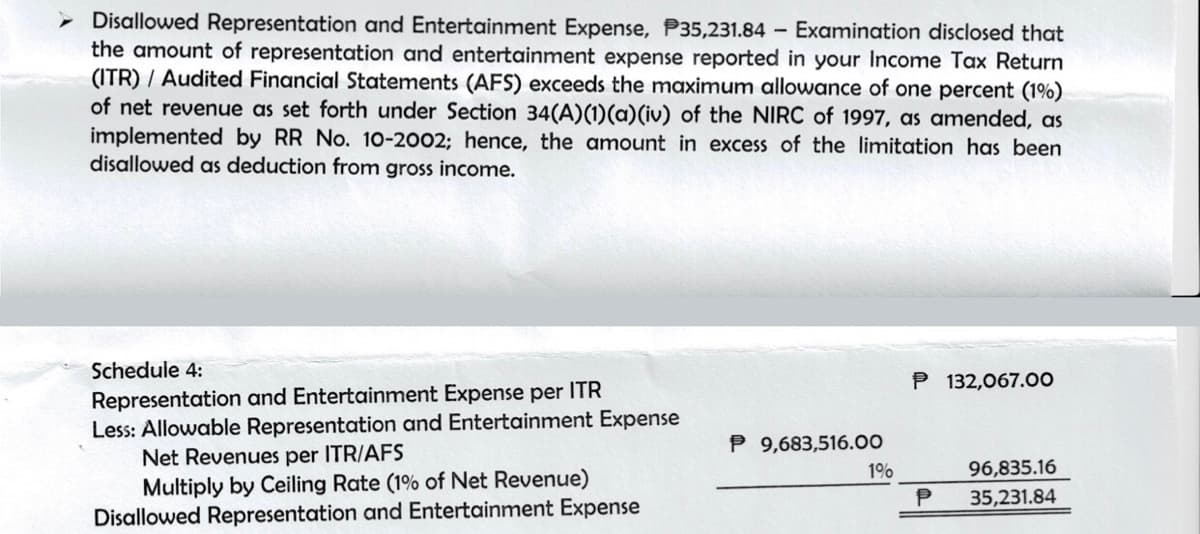

Disallowed Representation and Entertainment Expense, P35,231.84 Examination disclosed that the amount of representation and entertainment expense reported in your Income Tax Return (ITR) / Audited Financial Statements (AFS) exceeds the maximum allowance of one percent (1%) of net revenue as set forth under Section 34(A)(1)(a)(iv) of the NIRC of 1997, as amended, as implemented by RR No. 10-2002; hence, the amount in excess of the limitation has been disallowed as deduction from gross income. Schedule 4: P 132,067.0O Representation and Entertainment Expense per ITR Less: Allowable Representation and Entertainment Expense Net Revenues per ITR/AFS Multiply by Ceiling Rate (1% of Net Revenue) Disallowed Representation and Entertainment Expense P 9,683,516.00 1% 96,835.16 P 35,231.84

Disallowed Representation and Entertainment Expense, P35,231.84 Examination disclosed that the amount of representation and entertainment expense reported in your Income Tax Return (ITR) / Audited Financial Statements (AFS) exceeds the maximum allowance of one percent (1%) of net revenue as set forth under Section 34(A)(1)(a)(iv) of the NIRC of 1997, as amended, as implemented by RR No. 10-2002; hence, the amount in excess of the limitation has been disallowed as deduction from gross income. Schedule 4: P 132,067.0O Representation and Entertainment Expense per ITR Less: Allowable Representation and Entertainment Expense Net Revenues per ITR/AFS Multiply by Ceiling Rate (1% of Net Revenue) Disallowed Representation and Entertainment Expense P 9,683,516.00 1% 96,835.16 P 35,231.84

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

100%

Pls explain and expand

Transcribed Image Text:- Disallowed Representation and Entertainment Expense, P35,231.84 - Examination disclosed that

the amount of representation and entertainment expense reported in your Income Tax Return

(ITR) / Audited Financial Statements (AFS) exceeds the maximum allowance of one percent (1%)

of net revenue as set forth under Section 34(A)(1)(a)(iv) of the NIRC of 1997, as amended, as

implemented by RR No. 10-2002; hence, the amount in excess of the limitation has been

disallowed as deduction from gross income.

Schedule 4:

P 132,067.0O

Representation and Entertainment Expense per ITR

Less: Allowable Representation and Entertainment Expense

Net Revenues per ITR/AFS

Multiply by Ceiling Rate (1% of Net Revenue)

Disallowed Representation and Entertainment Expense

P 9,683,516.00

96,835.16

35,231.84

1%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you