Liam has a gross income of $120,000 and takes the standard deduction. 1) What are his total taxes due? 2) What is his marginal tax rate? 3) What is his effective tax rate? Round to the neared hundredth of a percent.

Liam has a gross income of $120,000 and takes the standard deduction. 1) What are his total taxes due? 2) What is his marginal tax rate? 3) What is his effective tax rate? Round to the neared hundredth of a percent.

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 67IIP

Related questions

Question

Liam has a gross income of $120,000 and takes the standard deduction.

1) What are his total taxes due?

2) What is his marginal tax rate?

3) What is his effective tax rate? Round to the neared hundredth of a percent.

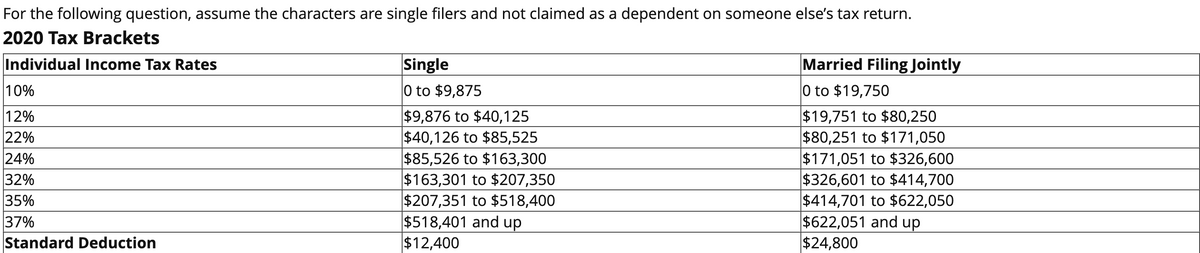

Transcribed Image Text:For the following question, assume the characters are single filers and not claimed as a dependent on someone else's tax return.

2020 Tax Brackets

Single

0 to $9,875

Individual Income Tax Rates

Married Filing Jointly

10%

0 to $19,750

12%

22%

24%

32%

35%

37%

Standard Deduction

$9,876 to $40,125

$40,126 to $85,525

$85,526 to $163,300

$163,301 to $207,350

$207,351 to $518,400

$518,401 and up

$12,400

$19,751 to $80,250

$80,251 to $171,050

$171,051 to $326,600

$326,601 to $414,700

$414,701 to $622,050

$622,051 and up

$24,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning