dit card company charges a fee of 3% for handling a credit card transaction. of the following correctly shows the effects of the sale on July 7? Assets 600 582 582 600 Multiple Choice Balance Sheet Liabilities + 18 ΝΑ ΝΑ ΝΑ O Option B O O Option D Option C O Option A Stockholders' Equity 582 582 582 600 Revenue - 582 600 600 600 Income Statement Expense = Net Income ΝΑ 車 18 18 ΝΑ 582 582 582 600 Statement of Cash Flows ΝΑ 582 OA ΝΑ ΝΑ

dit card company charges a fee of 3% for handling a credit card transaction. of the following correctly shows the effects of the sale on July 7? Assets 600 582 582 600 Multiple Choice Balance Sheet Liabilities + 18 ΝΑ ΝΑ ΝΑ O Option B O O Option D Option C O Option A Stockholders' Equity 582 582 582 600 Revenue - 582 600 600 600 Income Statement Expense = Net Income ΝΑ 車 18 18 ΝΑ 582 582 582 600 Statement of Cash Flows ΝΑ 582 OA ΝΑ ΝΑ

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4Q: American Signs allows customers to pay with their Jones credit card and cash. Jones charges American...

Related questions

Question

100%

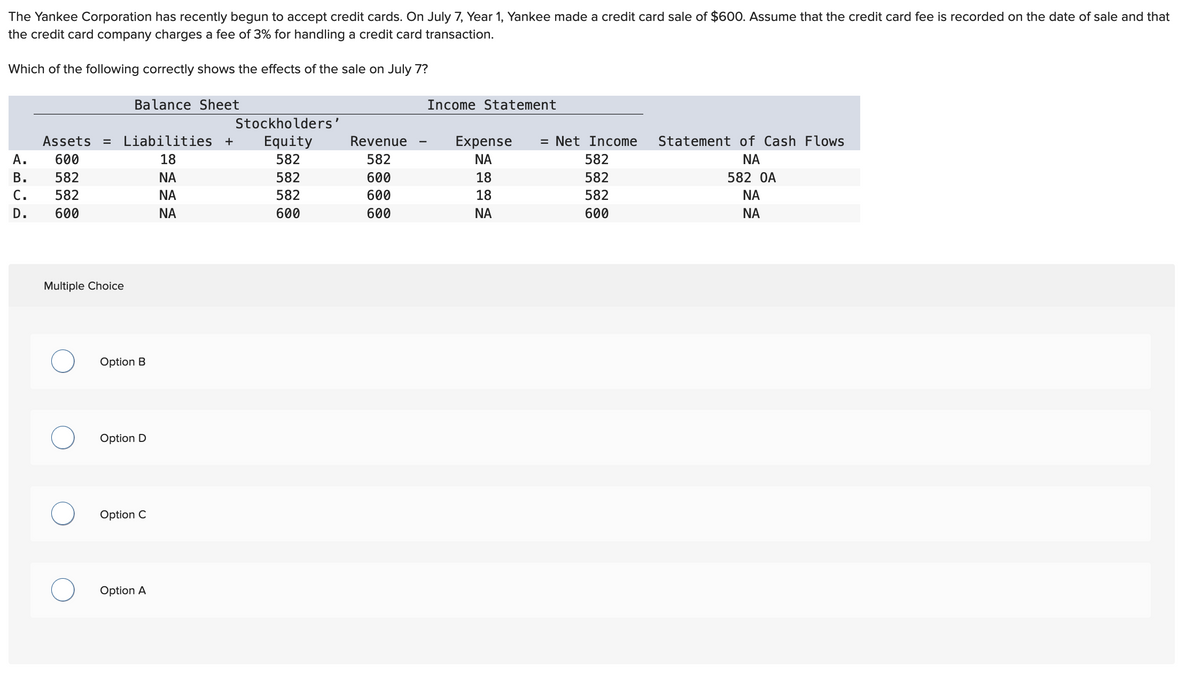

Transcribed Image Text:The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. Assume that the credit card fee is recorded on the date of sale and that

the credit card company charges a fee of 3% for handling a credit card transaction.

Which of the following correctly shows the effects of the sale on July 7?

Assets

600

A.

B. 582

C.

582

D.

600

Multiple Choice

O

Balance Sheet

Liabilities +

18

ΝΑ

ΝΑ

ΝΑ

Option B

Option D

Option C

Option A

Stockholders'

Equity

582

582

582

600

Revenue

582

600

600

600

Income Statement

Expense = Net Income Statement of Cash Flows

ΝΑ

ΝΑ

18

582 0A

18

ΝΑ

582

582

582

600

ΝΑ

ΝΑ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage