Dividend constraints The Howe Company's stockholders' equity account is as follows: . The earnings available for common stockholders from this perio operations are $100,000, which have been included as part of the $1.6 million retained earnings. a. What is the maximum dividend per share that the firm can pay? (Assume that legal capital includes all paid-in capital.) b. If the firm has $160,000 in cash, what is the largest per-share dividend it can pay without borrowing? c. Indicate the accounts and changes, if any, that will result if the firm pays the dividends indicated in parts a and b.

Dividend constraints The Howe Company's stockholders' equity account is as follows: . The earnings available for common stockholders from this perio operations are $100,000, which have been included as part of the $1.6 million retained earnings. a. What is the maximum dividend per share that the firm can pay? (Assume that legal capital includes all paid-in capital.) b. If the firm has $160,000 in cash, what is the largest per-share dividend it can pay without borrowing? c. Indicate the accounts and changes, if any, that will result if the firm pays the dividends indicated in parts a and b.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 55E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Transcribed Image Text:e Home

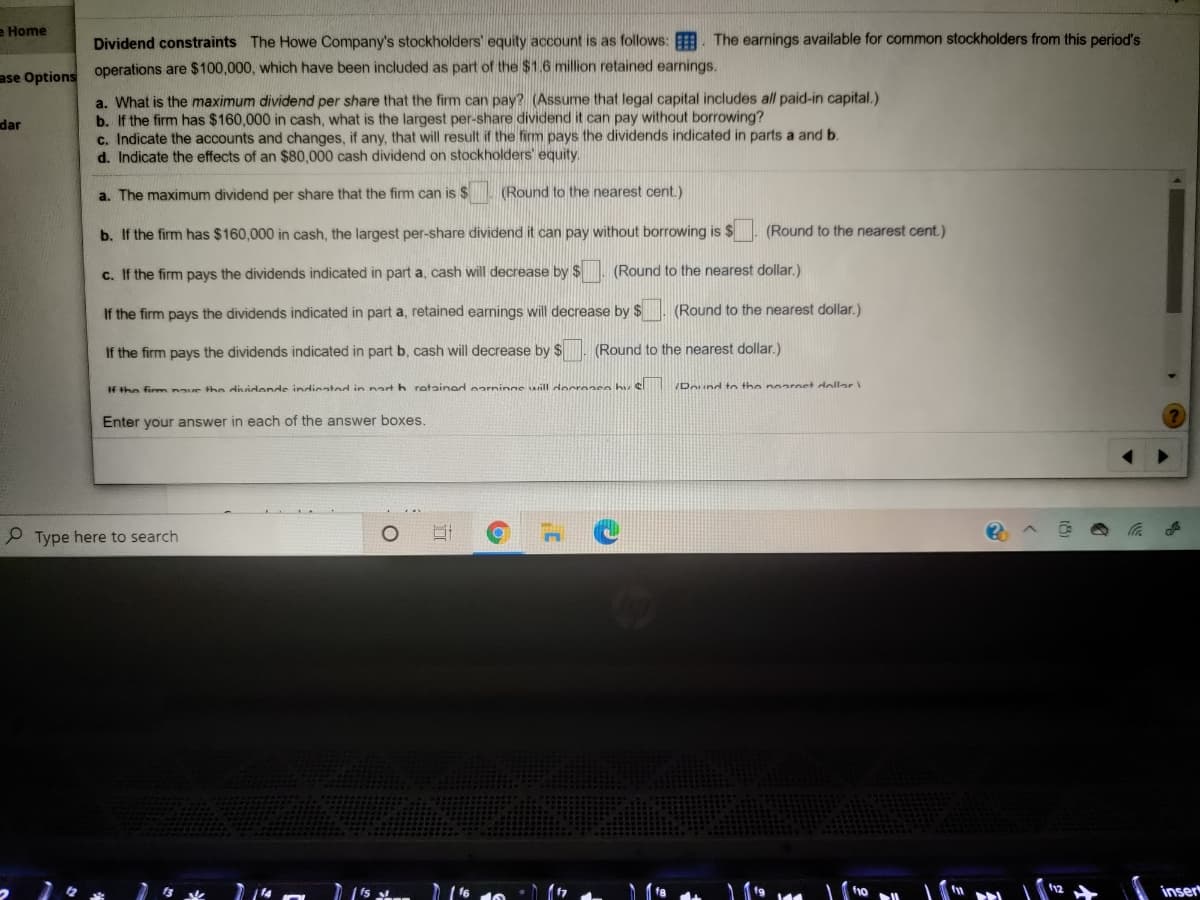

Dividend constraints The Howe Company's stockholders' equity account is as follows: . The earnings available for common stockholders from this period's

ase Options operations are $100,000, which have been included as part of the $1.6 million retained earnings.

a. What is the maximum dividend per share that the firm can pay? (Assume that legal capital includes all paid-in capital.)

b. If the firm has $160,000 in cash, what is the largest per-share dividend it can pay without borrowing?

c. Indicate the accounts and changes, if any, that will result if the firm pays the dividends indicated in parts a and b.

d. Indicate the effects of an $80,000 cash dividend on stockholders' equity.

dar

a. The maximum dividend per share that the firm can is $

(Round to the nearest cent.)

b. If the firm has $160,000 in cash, the largest per-share dividend it can pay without borrowing is $

(Round to the nearest cent.)

c. If the firm pays the dividends indicated in part a, cash will decrease by $

(Round to the nearest dollar.)

If the firm pays the dividends indicated in part a, retained earnings will decrease by $

(Round to the nearest dollar.)

If the firm pays the dividends indicated in part b, cash will decrease by $

(Round to the nearest dollar.)

If the firm naue the dvidende indicated in nart h ratained earninge wrill decreaee hy

/Dund tn the noarnet dollar 1

Enter your answer in each of the answer boxes.

P Type here to search

inser

Transcribed Image Text:Tor common stockholde

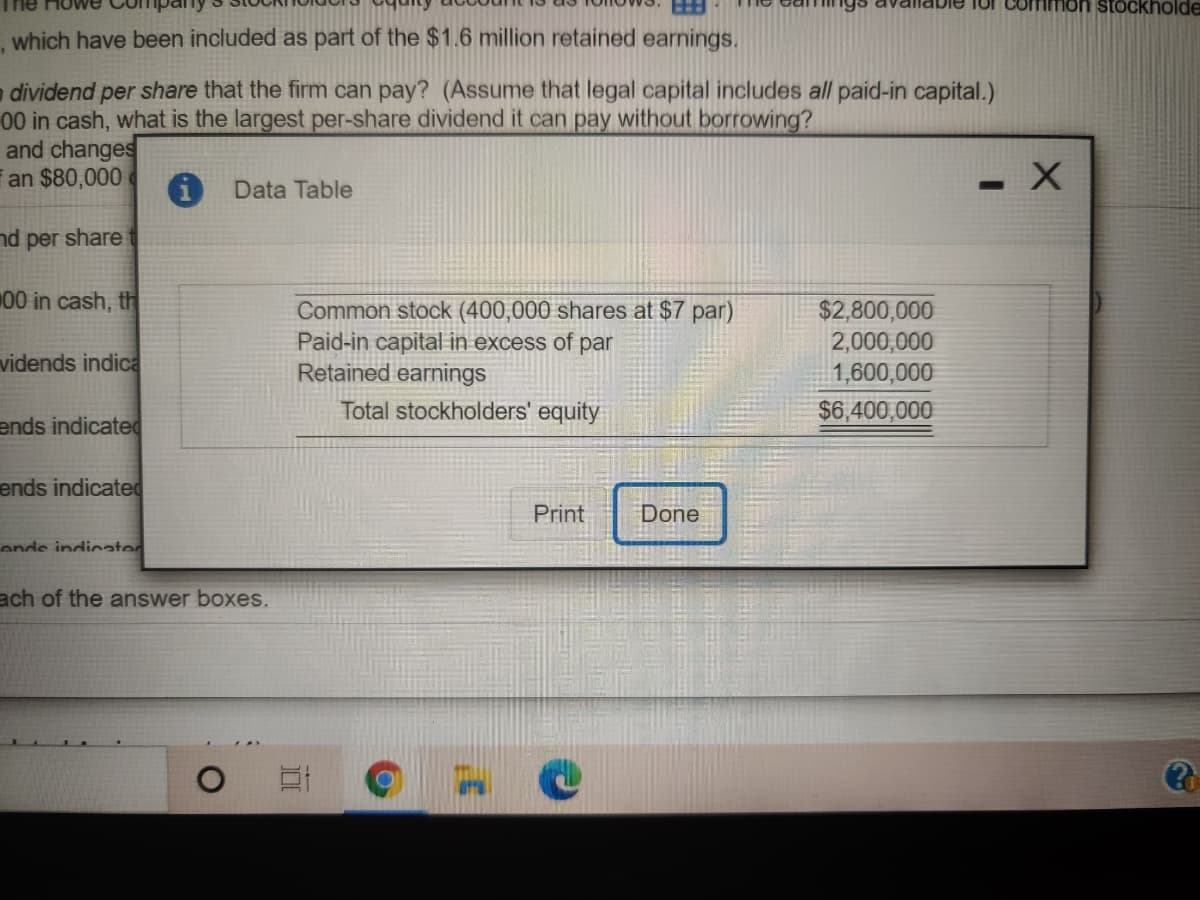

which have been included as part of the $1.6 million retained earnings.

dividend per share that the firm can pay? (Assume that legal capital includes all paid-in capital.)

00 in cash, what is the largest per-share dividend it can pay without borrowing?

and changes

an $80,000

Data Table

nd per share

00 in cash, th

Common stock (400,000 shares at $7 par)

Paid-in capital in excess of par

Retained earnings

$2,800,000

2,000,000

1,600,000

vidends indica

Total stockholders' equity

$6,400,000

ends indicated

ends indicated

Print

Done

ende indicater

ach of the answer boxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning