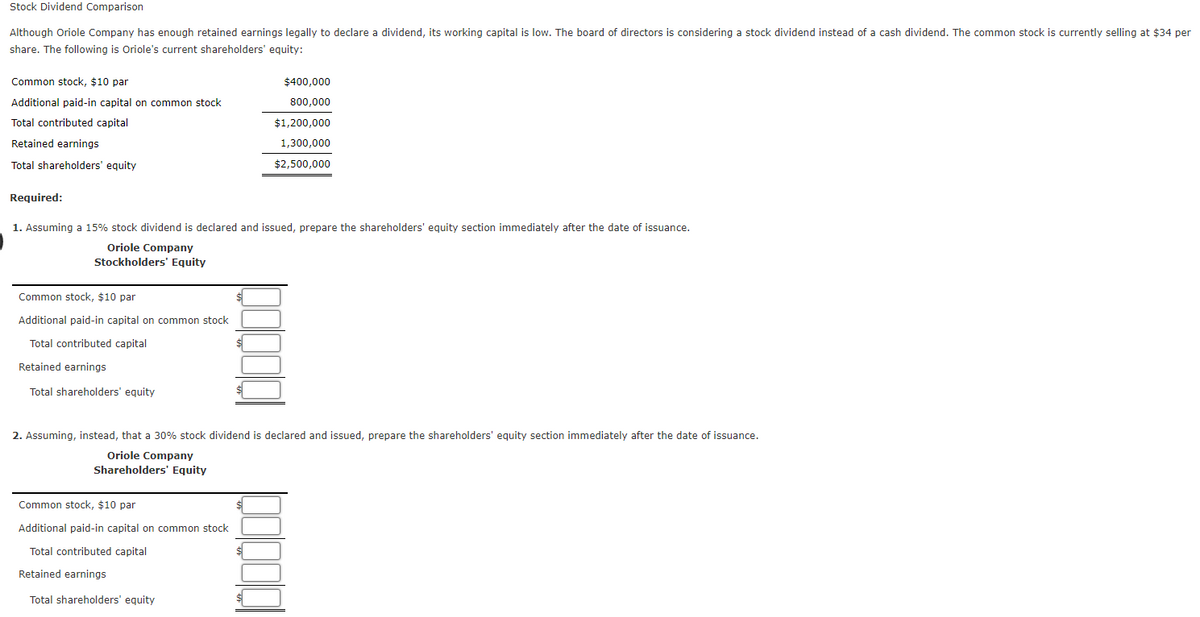

Stock Dividend Comparison Although Oriole Company has enough retained earnings legally to declare a dividend, its working capital is low. The board of directors is considering a stock dividend instead of a cash dividend. The common stock currently selling at $34 per share. The following Oriole's current shareholders' equity: Common stock, $10 par $400,000 800,000 Additional paid-in capital on common stock Total contributed capital Retained earnings $1,200,000 1,300,000 $2,500,000 Total shareholders' equity Required: 1. Assuming a 15% stock dividend is declared and issued, prepare the shareholders' equity section immediately after the date of issuance. Oriole Company Stockholders' Equity Common stock, $10 par Additional paid-in capital on common stock Total contributed capital Retained earnings Total shareholders' equity 2. Assuming, instead, that a 30 % stock dividend is declared and issued, prepare the shareholders' equity section immediately after the date of issuance. Oriole Company Shareholders' Equity Common stock, $10 par Additional paid-in capital on common stock Total contributed capital Retained earnings Total shareholders' equity

Stock Dividend Comparison Although Oriole Company has enough retained earnings legally to declare a dividend, its working capital is low. The board of directors is considering a stock dividend instead of a cash dividend. The common stock currently selling at $34 per share. The following Oriole's current shareholders' equity: Common stock, $10 par $400,000 800,000 Additional paid-in capital on common stock Total contributed capital Retained earnings $1,200,000 1,300,000 $2,500,000 Total shareholders' equity Required: 1. Assuming a 15% stock dividend is declared and issued, prepare the shareholders' equity section immediately after the date of issuance. Oriole Company Stockholders' Equity Common stock, $10 par Additional paid-in capital on common stock Total contributed capital Retained earnings Total shareholders' equity 2. Assuming, instead, that a 30 % stock dividend is declared and issued, prepare the shareholders' equity section immediately after the date of issuance. Oriole Company Shareholders' Equity Common stock, $10 par Additional paid-in capital on common stock Total contributed capital Retained earnings Total shareholders' equity

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5E: Stock Dividend Comparison Although Oriole Company has enough retained earnings legally to declare a...

Related questions

Question

Transcribed Image Text:Stock Dividend Comparison

Although Oriole Company has enough retained earnings legally to declare a dividend, its working capital is low. The board of directors is considering a stock dividend instead of a cash dividend. The common stock is currently selling at $34 per

share. The following is Oriole's current shareholders' equity:

Common stock, $10 par

Additional paid-in capital on common stock

Total contributed capital

$400,000

800,000

$1,200,000

1,300,000

$2,500,000

Retained earnings

Total shareholders' equity

Required:

1. Assuming a 15% stock dividend is declared and issued, prepare the shareholders' equity section immediately after the date of issuance.

Oriole Company

Stockholders' Equity

Common stock, $10 par

Additional paid-in capital on common stock

Total contributed capital

Retained earnings

Total shareholders' equity

2. Assuming, instead, that a 30% stock dividend is declared and issued, prepare the shareholders' equity section immediately after the date of issuance.

Oriole Company

Shareholders' Equity

Common stock, $10 par

Additional paid-in capital on common stock

Total contributed capital

Retained earnings

Total shareholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning