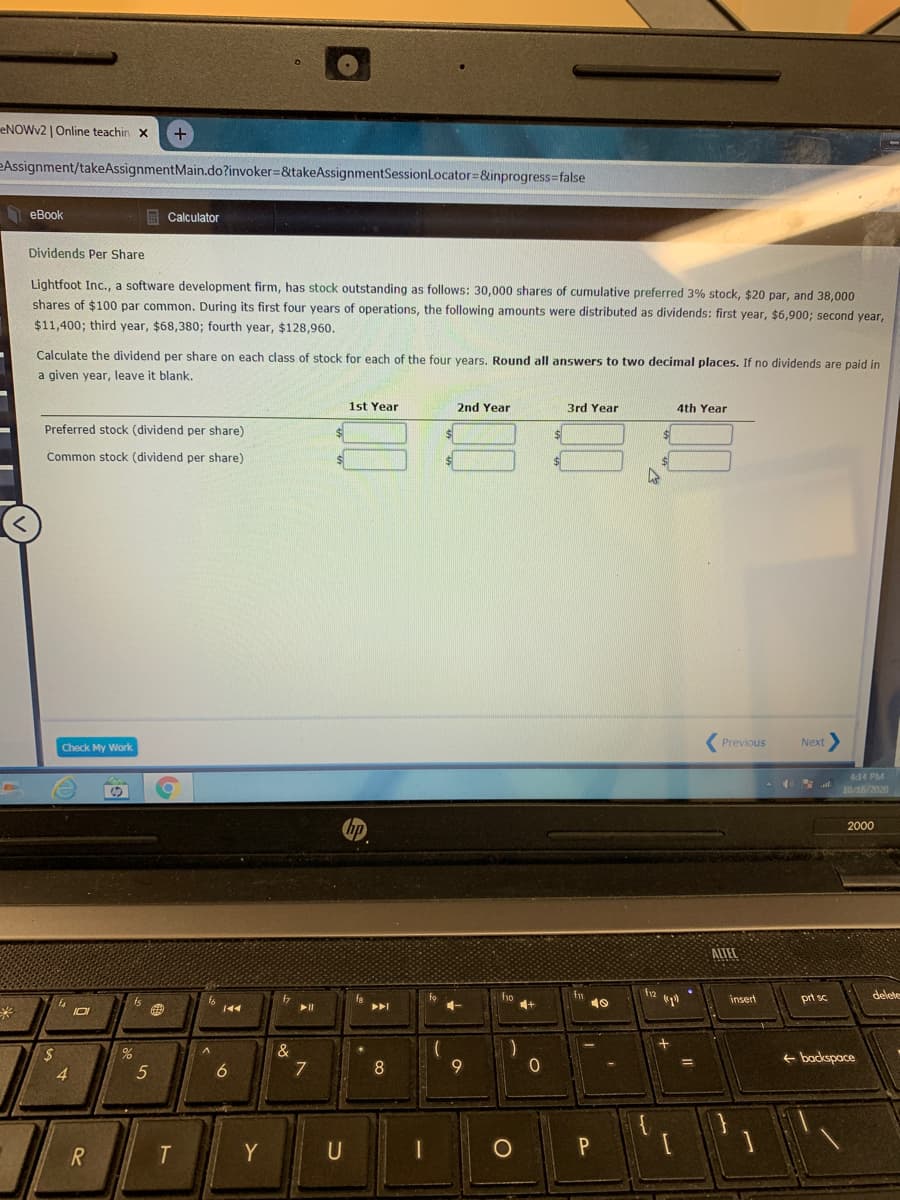

Dividends Per Share Lightfoot Inc., a software development firm, has stock outstanding as follows: 30,000 shares of cumulative preferred 3% stock, $20 par, and 38,000 shares of $100 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $6,900; second year, $11,400; third year, $68,380; fourth year, $128,960. Calculate the dividend per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, leave it blank. 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) Common stock (dividend per share)

Dividends Per Share Lightfoot Inc., a software development firm, has stock outstanding as follows: 30,000 shares of cumulative preferred 3% stock, $20 par, and 38,000 shares of $100 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $6,900; second year, $11,400; third year, $68,380; fourth year, $128,960. Calculate the dividend per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, leave it blank. 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) Common stock (dividend per share)

Chapter2: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 15SP

Related questions

Question

Transcribed Image Text:ENOWV2 | Online teachin x

+

eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

heBook

Calculator

Dividends Per Share

Lightfoot Inc., a software development firm, has stock outstanding as follows: 30,000 shares of cumulative preferred 3% stock, $20 par, and 38,000

shares of $100 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $6,900; second year,

$11,400; third year, $68,380; fourth year, $128,960.

Calculate the dividend per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in

a given year, leave it blank.

1st Year

2nd Year

3rd Year

4th Year

Preferred stock (dividend per share)

24

Common stock (dividend per share)

Check My Work

( Previous

Next

4:14 PM

10/16/2020

2000

ALTEL

12

delete

fo

4-

f10

4+

prt sc

insert

トト

e backspace

4.

6

7

8

9

Y

U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning