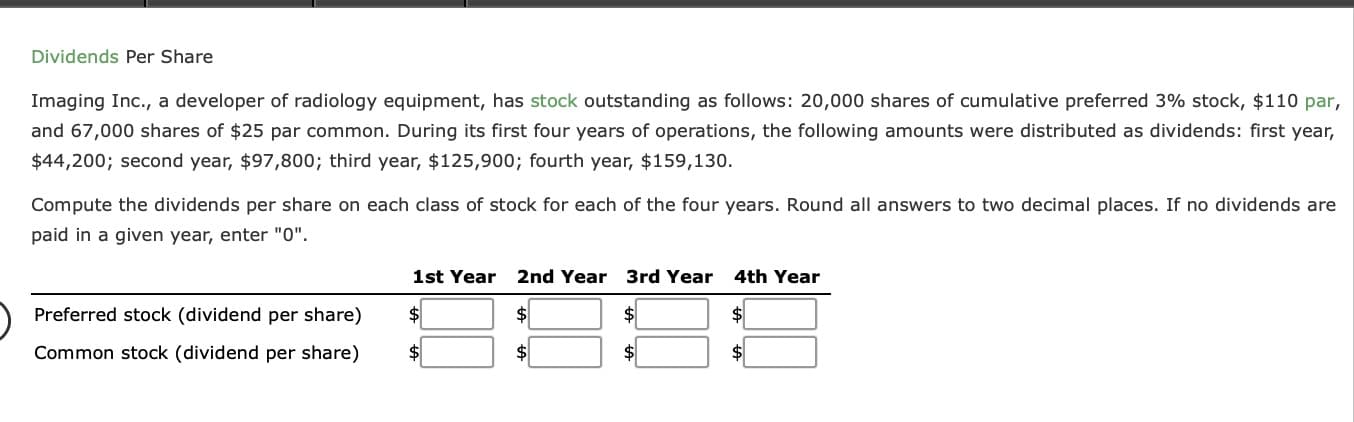

Dividends Per Share Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 3% stock, $110 par, and 67,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $44,200; second year, $97,800; third year, $125,900; fourth year, $159,130. Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) $4 $4 Common stock (dividend per share) $4

Dividends Per Share Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 3% stock, $110 par, and 67,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year, $44,200; second year, $97,800; third year, $125,900; fourth year, $159,130. Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are paid in a given year, enter "0". 1st Year 2nd Year 3rd Year 4th Year Preferred stock (dividend per share) $4 $4 Common stock (dividend per share) $4

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Question

Transcribed Image Text:Dividends Per Share

Imaging Inc., a developer of radiology equipment, has stock outstanding as follows: 20,000 shares of cumulative preferred 3% stock, $110 par,

and 67,000 shares of $25 par common. During its first four years of operations, the following amounts were distributed as dividends: first year,

$44,200; second year, $97,800; third year, $125,900; fourth year, $159,130.

Compute the dividends per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividends are

paid in a given year, enter "0".

1st Year 2nd Year 3rd Year 4th Year

Preferred stock (dividend per share)

$4

$4

Common stock (dividend per share)

$4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,