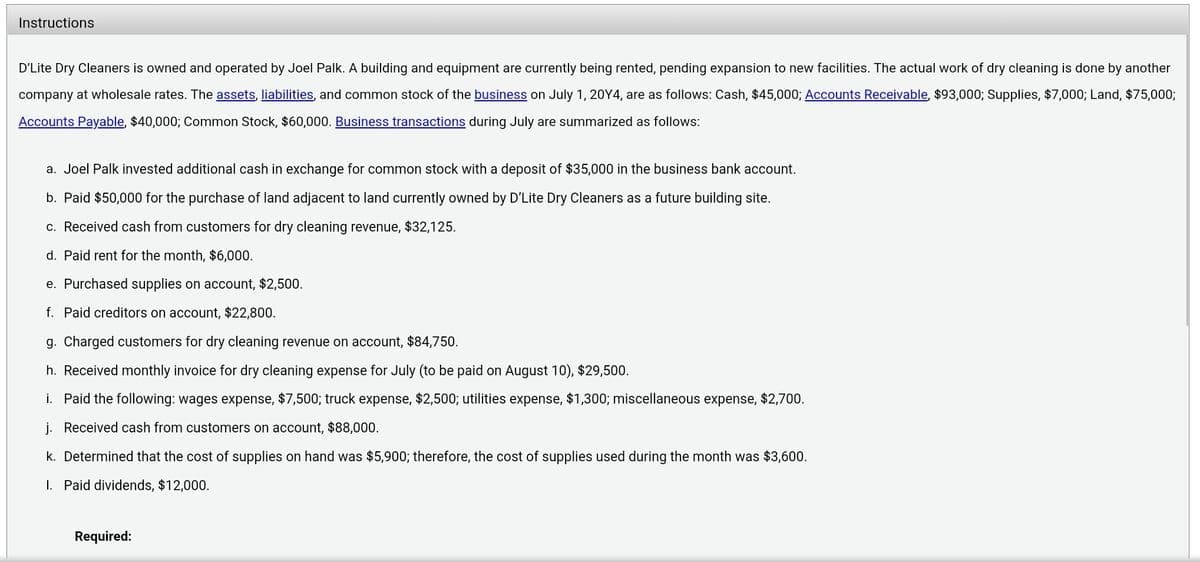

D'Lite Dry Cleaners is owned and operated by Joel Palk. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets, liabilities, and common stock of the business on July 1, 20Y4, are as follows: Cash, $45,000; Accounts Receivable, $93,000; Supplies, $7,000; Land, $75,000; Accounts Payable, $40,000; Common Stock, $60,000. Business transactions during July are summarized as follows: a. Joel Palk invested additional cash in exchange for common stock with a deposit of $35,000 in the business bank account. b. Paid $50,000 for the purchase of land adjacent to land currently owned by D'Lite Dry Cleaners as a future building site. c. Received cash from customers for dry cleaning revenue, $32,125. d. Paid rent for the month, $6,000. e. Purchased supplies on account, $2,500. f. Paid creditors on account, $22,800. g. Charged customers for dry cleaning revenue on account, $84,750. h. Received monthly invoice for dry cleaning expense for July (to be paid on August 10), $29,500. i. Paid the following: wages expense, $7,500; truck expense, $2,500; utilities expense, $1,300; miscellaneous expense, $2,700. i. Received cash from customers on account, $88,000. k. Determined that the cost of supplies on hand was $5,900; therefore, the cost of supplies used during the month was $3,600. I. Paid dividends, $12,000.

D'Lite Dry Cleaners is owned and operated by Joel Palk. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets, liabilities, and common stock of the business on July 1, 20Y4, are as follows: Cash, $45,000; Accounts Receivable, $93,000; Supplies, $7,000; Land, $75,000; Accounts Payable, $40,000; Common Stock, $60,000. Business transactions during July are summarized as follows: a. Joel Palk invested additional cash in exchange for common stock with a deposit of $35,000 in the business bank account. b. Paid $50,000 for the purchase of land adjacent to land currently owned by D'Lite Dry Cleaners as a future building site. c. Received cash from customers for dry cleaning revenue, $32,125. d. Paid rent for the month, $6,000. e. Purchased supplies on account, $2,500. f. Paid creditors on account, $22,800. g. Charged customers for dry cleaning revenue on account, $84,750. h. Received monthly invoice for dry cleaning expense for July (to be paid on August 10), $29,500. i. Paid the following: wages expense, $7,500; truck expense, $2,500; utilities expense, $1,300; miscellaneous expense, $2,700. i. Received cash from customers on account, $88,000. k. Determined that the cost of supplies on hand was $5,900; therefore, the cost of supplies used during the month was $3,600. I. Paid dividends, $12,000.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 1PB: During February of this year, H. Rose established Rose Shoe Hospital. The following asset,...

Related questions

Question

attched files

Transcribed Image Text:Instructions

D'Lite Dry Cleaners is owned and operated by Joel Palk. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another

company at wholesale rates. The assets, liabilities, and common stock of the business on July 1, 20Y4, are as follows: Cash, $45,000; Accounts Receivable, $93,000; Supplies, $7,000; Land, $75,000;

Accounts Payable, $40,000; Common Stock, $60,000. Business transactions during July are summarized as follows:

a. Joel Palk invested additional cash in exchange for common stock with a deposit of $35,000 in the business bank account.

b. Paid $50,000 for the purchase of land adjacent to land currently owned by D'Lite Dry Cleaners as a future building site.

c. Received cash from customers for dry cleaning revenue, $32,125.

d. Paid rent for the month, $6,000.

e. Purchased supplies on account, $2,500.

f. Paid creditors on account, $22,800.

g. Charged customers for dry cleaning revenue on account, $84,750.

h. Received monthly invoice for dry cleaning expense for July (to be paid on August 10), $29,500.

i. Paid the following: wages expense, $7,500; truck expense, $2,500; utilities expense, $1,300; miscellaneous expense, $2,700.

j. Received cash from customers on account, $88,000.

k. Determined that the cost of supplies on hand was $5,900; therefore, the cost of supplies used during the month was $3,600.

I. Paid dividends, $12,000.

Required:

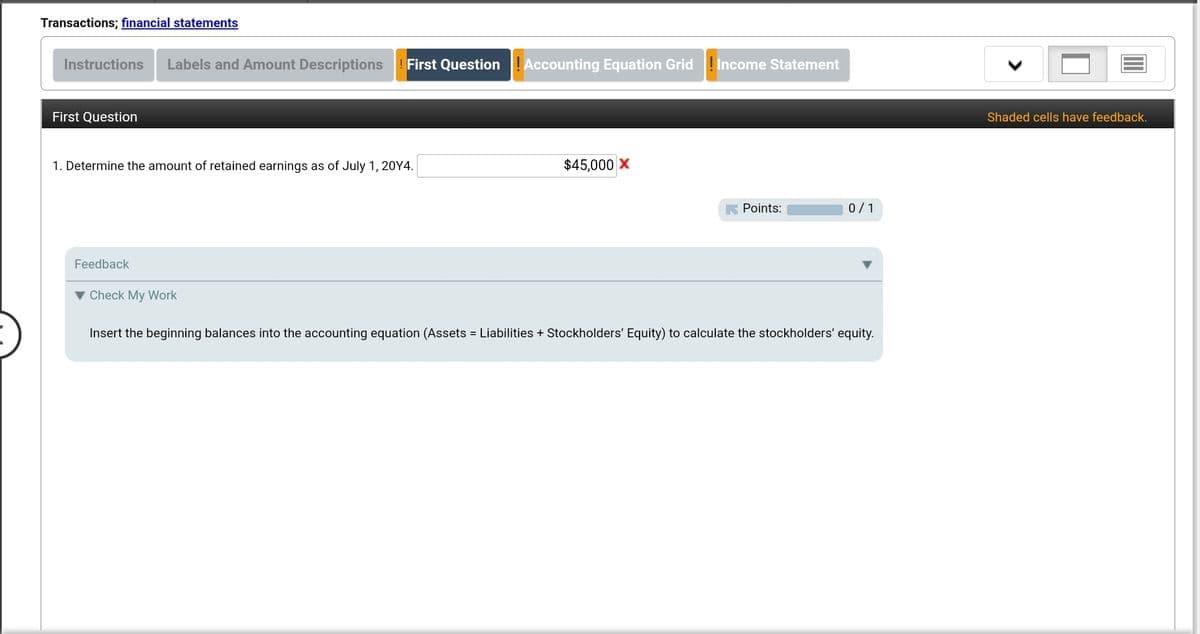

Transcribed Image Text:Transactions; financial statements

Instructions

Labels and Amount Descriptions

First Question ! Accounting Equation Grid ! Income Statement

First Question

Shaded cells have feedback.

1. Determine the amount of retained earnings as of July 1, 20Y4.

$45,000 X

K Points:

0/1

Feedback

Check My Work

Insert the beginning balances into the accounting equation (Assets = Liabilities + Stockholders' Equity) to calculate the stockholders' equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning