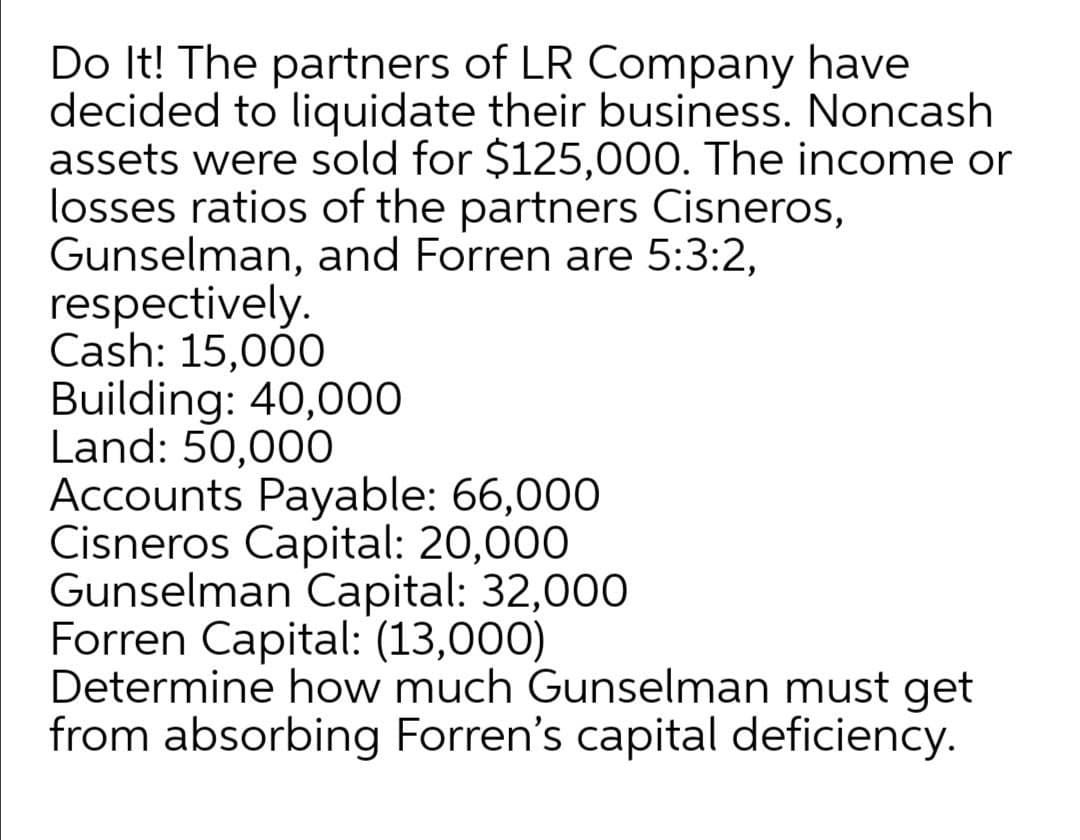

Do It! The partners of LR Company have decided to liquidate their business. Noncash assets were sold for $125,000. The income or losses ratios of the partners Cisneros, Gunselman, and Forren are 5:3:2, respectively. Cash: 15,000 Building: 40,000 Land: 50,000 Accounts Payable: 66,000 Cisneros Capital: 20,000 Gunselman Capital: 32,000 Forren Capital: (13,000) Determine how much Gunselman must get from absorbing Forren's capital deficiency.

Do It! The partners of LR Company have decided to liquidate their business. Noncash assets were sold for $125,000. The income or losses ratios of the partners Cisneros, Gunselman, and Forren are 5:3:2, respectively. Cash: 15,000 Building: 40,000 Land: 50,000 Accounts Payable: 66,000 Cisneros Capital: 20,000 Gunselman Capital: 32,000 Forren Capital: (13,000) Determine how much Gunselman must get from absorbing Forren's capital deficiency.

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:Do It! The partners of LR Company have

decided to liquidate their business. Noncash

assets were sold for $125,000. The income or

losses ratios of the partners Cisneros,

Gunselman, and Forren are 5:3:2,

respectively.

Cash: 15,000

Building: 40,000

Land: 50,000

Accounts Payable: 66,000

Cisneros Capital: 20,000

Gunselman Capital: 32,000

Forren Capital: (13,000)

Determine how much Gunselman must get

from absorbing Forren's capital deficiency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning