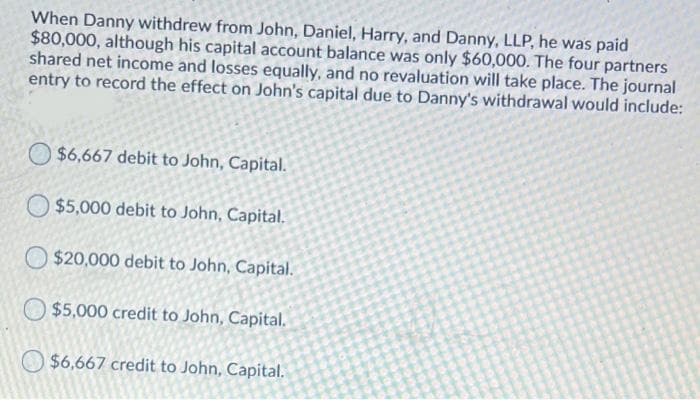

When Danny withdrew from John, Daniel, Harry, and Danny, LLP, he was paid $80,000, although his capital account balance was only $60,000. The four partners shared net income and losses equally, and no revaluation will take place. The journal entry to record the effect on John's capital due to Danny's withdrawal would include: $6,667 debit to John, Capital. O $5,000 debit to John, Capital. O $20,000 debit to John, Capital. $5,000 credit to John, Capital. $6,667 credit to John, Capital.

When Danny withdrew from John, Daniel, Harry, and Danny, LLP, he was paid $80,000, although his capital account balance was only $60,000. The four partners shared net income and losses equally, and no revaluation will take place. The journal entry to record the effect on John's capital due to Danny's withdrawal would include: $6,667 debit to John, Capital. O $5,000 debit to John, Capital. O $20,000 debit to John, Capital. $5,000 credit to John, Capital. $6,667 credit to John, Capital.

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 31P

Related questions

Question

Please explain clearly

Transcribed Image Text:When Danny withdrew from John, Daniel, Harry, and Danny, LLP, he was paid

$80,000, although his capital account balance was only $60,000. The four partners

shared net income and losses equally, and no revaluation will take place. The journal

entry to record the effect on John's capital due to Danny's withdrawal would include:

$6,667 debit to John, Capital.

O $5,000 debit to John, Capital.

O $20,000 debit to John, Capital.

$5,000 credit to John, Capital.

$6,667 credit to John, Capital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you