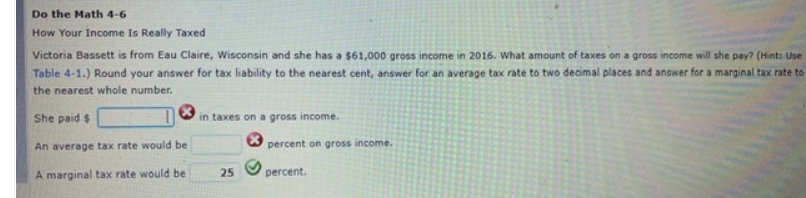

Do the Math 4-6 How Your Income Is Really Taxed Victoria Bassett is from Eau Claire, Wisconsin and she has a $61,000 gross income in 2016. What amount of taxes on a gross income will she pay? (Hint: Use Table 4-1.) Round your answer for tax liability to the nearest cent, answer for an average tax rate to two decimal places and answer for a marginal tax rate to the nearest whole number. She paid $ in taxes on a gross income. An average tax rate would be percent on gross income. A marginal tax rate would be percent. 25

Do the Math 4-6 How Your Income Is Really Taxed Victoria Bassett is from Eau Claire, Wisconsin and she has a $61,000 gross income in 2016. What amount of taxes on a gross income will she pay? (Hint: Use Table 4-1.) Round your answer for tax liability to the nearest cent, answer for an average tax rate to two decimal places and answer for a marginal tax rate to the nearest whole number. She paid $ in taxes on a gross income. An average tax rate would be percent on gross income. A marginal tax rate would be percent. 25

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 8P: PERSONAL TAXES Susan and Stan Britton are a married couple who file a joint income tax return, where...

Related questions

Question

Transcribed Image Text:Do the Math 4-6

How Your Income Is Really Taxed

Victoria Bassett is from Eau Claire, Wisconsin and she has a $61,000 gross income in 2016. What amount of taxes on a gross income will she pay? (Hint: Use

Table 4-1.) Round your answer for tax liability to the nearest cent, answer for an average tax rate to two decimal places and answer for a marginal tax rate to

the nearest whole number.

She paid $

in taxes on a gross income.

An average tax rate would be

percent on gross income.

A marginal tax rate would be

percent.

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning