$20,000 12 years $30,000 8 years $0 $188,000 $170,000 Capital Investment Life Salvage Value Annual Receipts $4,000 $150,000 $138,000 Annual Disbursements

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $258,000, has a…

A: Equivalent Annual cost (EAC) is the total cost incurred by the company annually for operating and…

Q: A $73,000 machine with a 10-year class life was purchased 6 years ago. The machine will now be sold…

A: Book value of old machine = cost - depreciation

Q: Krostel Company is planning to acquire a machine costing P 500,000 with a useful life of 3 years…

A: Accounting rate of return = Average Annual Income/ Average Investment Accounting rate of return = P…

Q: Direction: Solve the following problems completely. For problem 1 and 2, please refer to the given…

A: NOTE : As per BARTLEBY guidelines, when multiple questions are given then first question is to be…

Q: A company is considering purchasing factory equipment that costs $480,000 and is estimated to have…

A: Annual Operating Income = Annual revenues - Operating Expenses - Depreciation = $135000 - $39000 -…

Q: The Molding Department of General Santos, Inc. doing an investigation for the possibility of…

A: Net Present Value - It is the present value of cash flow for required rated of return of investment…

Q: A machine can be purchased for $60,000 and used for five years, yielding the following net incomes.…

A: Payback period refers to the time period that is required to recover the initial cost. With the help…

Q: A project under consideration by PHI Inc. is summarized. The company uses straight-line…

A: Cashflows are as follows At time 0 cash outflow = -$75000 From time 1 to 10, net after tax cash…

Q: Do you want to complete the equipment retrofit?

A: Present value of Cash outflow = $80000

Q: Peabody Corporation has the following base-case estimates for its new small engine assembly…

A: "Since you have posted the question which is quite lengthy to solve it in detail and step-by-step…

Q: HappyDay is planning to invest $20 million and acquire a new production line at the beginning of…

A: The calculation of depreciation expenses using Stright-line method: Depreciation expenses = (Cost…

Q: rizona Company is considering an investment in new machinery. The annual incremental…

A: NPV is an investment appraisal method. It is the estimated increase in wealth of shareholders of the…

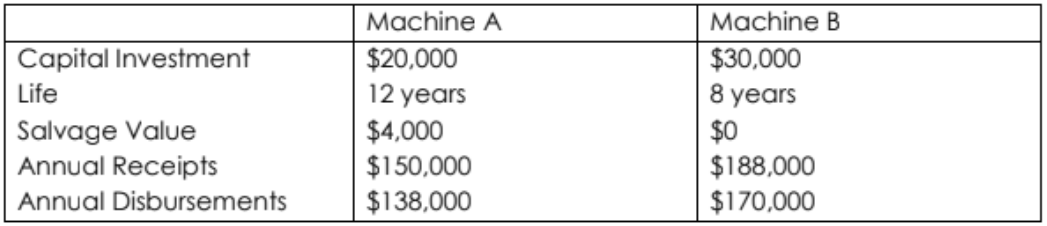

Q: Machine A Machine B Capital Investment Life $20,000 12 years $30,000 8 years $0 $188,000 $170,000…

A: Net Present Value (NPV) method is effective to differentiate between project alternative when the…

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $300,000, has a…

A: Calculation of EAC of Techron I and Techron II:The EAC is calculated using a excel spreadsheet. The…

Q: it which they use to preserve their goods. Pertinent data are given below.…

A: In this we need to calculate the equivalent annual cost and project having minimum annual cost…

Q: A machine costs $700,000 and is expected to yield an after-tax net income of $30,000 each year.…

A:

Q: A new piece of equipment has a first cost of $300,000 with no salvage value. It will generate annual…

A: Cost of equipment = $ 300000 Life = 10 Years Salvage value = 0 Annual depreciation = (Cost - Salvage…

Q: Factor Company is planning to add a new product to its line. To manufacture this product, the…

A: Capital budgeting: It is a method of evaluating the projects which required huge investments and…

Q: A machine has a first cost of $10,000 and an expected salvage value of $900 when it is sold.…

A: Payback period is the period which depicts the recovery period within which the cash outflows of the…

Q: Acorporation purchased a machine for $60,000 five years ago. It had an estimated life of 10 years…

A: Accounting: Accounting is a system, or a process of collecting and organizing economic transactions,…

Q: Kenora Industries is analyzing a new project. They have gathered the following data: Worst Case Base…

A: Operating cash flow :— It is the amount cash & cash equivalents that are related to operating of…

Q: Your new employer, Freeman Software, is considering a new project whose data are shown below. The…

A: Cash flow for a particular project is the cash revenues generated by business reduced by the cash…

Q: A company is considering purchasing a $10,000 machine that will reduce pretax operating costs by…

A: The computation of after-tax operating cash flow per year:

Q: Clemson Software is considering a new project whose data are shown below. The required equipment…

A: Straight-Line Method is used to compute depreciation on fixed asset where equal depreciation for…

Q: A machine costs $300,000 and is expected to yield an after-tax net income of $9,000 each year.…

A: The accounting rate of return can be evaluated by dividing net income by average investment. We can…

Q: Assume that a company purchased a new machine for $26,000 that has no salvage value. The machine is…

A:

Q: A firm is considering two different methods of solving a production problem. Both methods are…

A: The calculation is:

Q: A machine costs $500,000 and is expected to yield an after-tax net income of $19,000 each year.…

A: Answer: 6.33%

Q: A machine costs $600,000 and is expected to yield an after-tax net income of $23,000 each year.…

A: Accounting Rate of Return - It shows the rate of annual return from the investment made by the…

Q: A machine costs $180,000 and will have an eight-year life, a $20,000 salvage value, and…

A: Accounting rate of return (ARR) for an investment can be calculated as follows:-

Q: GIVEN: Project C requires $800,000 net initial investment for new machinery with a 8-year life and a…

A: Initial Investment on machine = $800,000 Salvage Value = $40,000 Useful Life = 8 Years Straight Line…

Q: What is the future worth of the following project of acquiring customized rollers for a…

A: Following is the future worth of the rollers

Q: A machine can be purchased for $150,000 and used for five years, yielding the following net incomes.…

A: Payback period: It can be defined as the time that is taken by an investment before it starts…

Q: Suppose that the new equipment has a cost basis of $12,000 and a salvage value of $3,0 of 6 years.…

A: The cash flow that is produced by the equipment consider the tax benefits of the depreciation so…

Q: A company is considering replacing an existing machine with a more moden one. Here are some of the…

A: NPV means PV of net benefits which may arise from the project in coming years. It can be computed by…

Q: Two alternative machines will produce the same product, but one is capable of higher-quality work,…

A: Present worth analysis is an analysis in which we convert all the cash flows to present worth using…

Q: A machine costs $600,000 and is expected to yield an after-tax net income of $23,000 each year.…

A: calculation of above requirement are as follows

Q: Crane Corp. is considering purchasing one of two new processing machines. Either machine would make…

A: The net present value is the method of finding the profitability of a project by adding up…

Q: A company is considering purchasing equipment costing $92,000. The equipment is expected to reduce…

A: IRR is the rate at which NPV is zero

Q: The Cap Company is considering the replacement of Machine A with Machine B that will cost P160,000…

A:

Q: A machine costs $600,000 and is expected to yield an after-tax net income of $23,000 each year.…

A:

Q: cooling water pumping station at a manufacturing plant in Iligan City costs P30,000,000 to…

A: Straight line method charge depreciation equally over the useful life of the assets. Declining…

Q: HappyDay is planning to invest $20 million and acquire a new production line at the beginning of…

A: Depreciation is the reduction in the value of asset due to usage, time, wear & tear or…

Q: HappyDay is planning to invest $20 million and acquire a new production line at the beginning of…

A: Straight line Method: Year Depreciation Expense Accmulated Depreciation Book Value 3 20,00,000…

Q: A machine costs $700,000 and is expected to yield an after-tax net income of $52,000 each year.…

A: A machine costs $700,000 and is expected to yield an after-tax net income of $52,000 each year.…

Q: Factor Company is planning to add a new product to its line. To manufacture this product, the…

A: Hi, since you have posted a question with multiple sub parts, as per the guidelines we will solve…

Two alternative machines will produce the same product, but one is capable of higher-quality work, which can be expected to return greater revenue. The following are relevant data:

Determine which is the better alternative, assuming using straight-line

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

- BnB Construction Inc.Balance Sheet (Millions of Dollars) Assets 2021 Est 2020 2019 Liabilities 2021 Est 2020 2019 Cash and Cash Equivalents 15 10 15 Accounts payable 115 60 30 Short-Term Investments 10 0 65 Overdrafts 115 110 60 Accounts Receivable 420 375 315 Accruals 260 140 130 Inventories 700 615 415 Total Current Liabilities 490 310 220 Total Current Assets 1145 1000 810 Long -Term Bonds and New Loan 1300 754 580 Net Plant and Equipment 1884 1190 870 Total Debt 1790 1064 800 Preferred Stock 40 40 40 Common Stock 130 130 130 Retained Earnings 1069 956 710 Total Common Equity 1199 1086 840 Total Assets 3029 2190 1680 Total Liabilities and Equity 3,029 2,190 1,680 Included is the Income Statement. Requirements: 1. Calculate the EPS, DPS, and BVPS, and Cash…1. How much is the net share in the profit or loss of the associate (investment income) in 2021? P480,000 P825,000 P420,000 P135,000 2. How much is the carrying amount of the investment as of December 31, 2021? P7,815,000 P8,025,000 P7,680,000 P7,125,000Summer Beach Bar Ltd. reported its financial statements for 2020. Assets: 100 million USD Debt: 50 million USD How much equity does Summer Beach Bar Ltd. have in million USD ? a.50 b.150 c.100 d. o

- ISSUE $50,000 (initial capital) + $30,000 (new capital contribution) + X (profit or loss for the period) = $150,000 (assets) - $68,000 (liabilities) => X = ¿¿¿$38,000??? To me this result is $2,000 of utility by ASSETS = LIABILITIES = $150,000 (double entry accounting principle). Please check it. I don´t understand your calculation2020 R0'000 2019 R0'000 ASSETS Non-current assets Property, plant and equipment 238,924 246,322 Right-of-use assets 3,246 3,479 Capital spares 566 487 242,736 250,288 Current assets Inventory 1,913 1.911 Trade and other receivables 15,249 5,118 Short term deposit 1,154 1,578 Cash and cash equivalents 1,543 1,883 19,859 10,490 TOTAL ASSETS 262,595 260,778 List all the fixed assets and categorize them in Tangible and Intangible Assets Using Notes to Accounts.Question Content Area A project is estimated to cost $273,840 and provide annual net cash inflows of $60,000 for 7 years. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 6 4.917 4.355 4.111 7 5.582 4.868 4.564 8 6.210 5.335 4.968 9 6.802 5.759 5.328 10 7.360 6.145 5.650 Determine the internal rate of return for this project by using the above present value of an annuity table.fill in the blank 1 of 1%

- Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 You are required to:iv) Calculate the cash flow from assets v) Calculate net capital spending vi) Calculate change in NWCPROJECT A PROJECT BInitial Outlay -60,000 -80,000Inflow year 1 17,000 18,000Inflow year 2 17,000 18,000Inflow year 3 17,000 18,000Inflow year 4 17,000 18,000Inflow year 5 17,000 18,000Inflow year 6 17,000 18,000: Answers the days of Working capital based on the information below: 2020 2021 Profit of the year $126,000 $175,000 Depreciation/Amortization 25,000 35,000 Trade receivables 260,000 285,000 Inventories 350,000 390,000 Trade and other payables 290,000 310,000 Revenue 1,800,000 2,100,000

- ASSET 2022 2021 CASH 260,000 200,000 TRADE RECEIVABLE 400,000 300,000 INVENTORIES 360,000 400,000 LAND 3,000,000 2,000,000 BUILDING 3,000,000 3,000,000 EQUIPMENT 80,000 150,000 ACCUMULATED DEPRECIATION -EQUIPMENT (30,000) (70,000) TOTAL 7,070,000 5,980,000 LIABILITIES & EQUITY TRADE PAYABLE 240,000 200,000 BOND PAYABLE 1,200,000 2,000,000 COMMON SHARES 2,400,000 1,200,000 RETAINED EARNING 3,230,000 2,580,000 TOTAL 7,070,000 5,980,000 ADDITIONAL INFORMATION PROFIT FOR 2022…39 Atlanta Corporation, a domestic corporation, had the following data for the years 2022 and 2023: 2022 2023 Sales P 10,000,000 P 15,000,000 Cost of sales 4,000,000 6,000,000 Deductible expenses 6,100,000 7,000,000 Capital gains 50,000 100,000 Interest income on trade notes receivable 10,000 30,000 Rent income 430,000 600,000 Total assets 500,000,000 550,000,000 How much is the total deferred charges in 2023?Project A has the following information: Year 0 1 2 3 4 5 Initial investment outlay 125,000 Cash inflows 75,000 80,000 95,000 95,000 86,250 Personnel expenses 22,500 22,500 22,500 22,500 22,500 Material expesnes 15,000 20,000 22,500 22,500 22,500 Maintenance expenses 2,500 2,500 5,000 8,750 10,000 Other cash outflows 3,750 3,750 3,750 5,000 5,625 Liquidation value 12,500 Project B has the following information: Year 0 1 2 3 4 5 Initial investment outlay 225,000 Cash inflows 155,000 140,000 108,750 93,750 125,000 Personnel expenses 27,500 27,500 27,500 27,500 27,500 Material expenses 25,000 22,500 22,500 22,500 24,000 Maintenance expesnses 8,750 11,250 17,500 15,000 14,000 Other cash outflows 6,250 3,750 3,750 3,750 4,000 Liquidation value 15,000 The Discount Rate is 8%Assess the relative profitability of the two options using the following methods:(i) The Annuity Method(ii) The Net…