Don Beldon earns $7.50/hour, and worked 43 hours during the most recent week. He participates in a cafeteria plan, to which he pays $100 each period. Don Beldon is single, and claims three federal and two state withholding allowances.

Don Beldon earns $7.50/hour, and worked 43 hours during the most recent week. He participates in a cafeteria plan, to which he pays $100 each period. Don Beldon is single, and claims three federal and two state withholding allowances.

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 5PB

Related questions

Question

I need help getting the answer to question #2!!

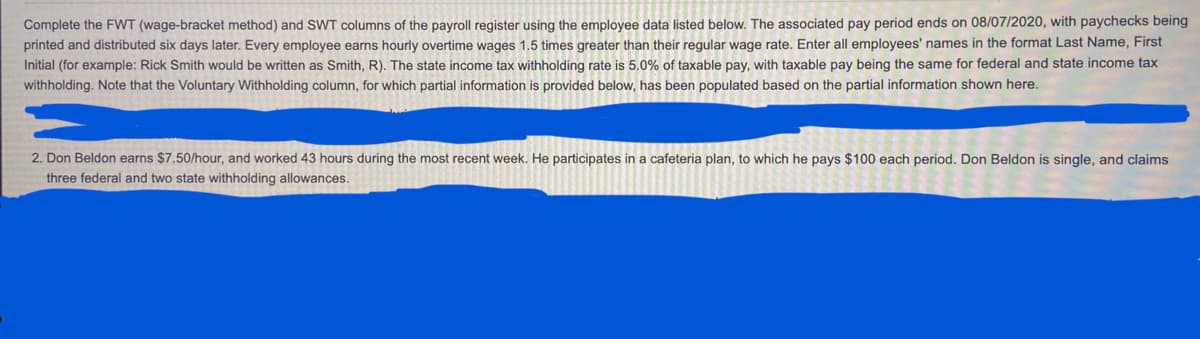

Transcribed Image Text:Complete the FWT (wage-bracket method) and SWT columns of the payroll register using the employee data listed below. The associated pay period ends on 08/07/2020, with paychecks being

printed and distributed six days later. Every employee earns hourly overtime wages 1.5 times greater than their regular wage rate. Enter all employees' names in the format Last Name, First

Initial (for example: Rick Smith would be written as Smith, R). The state income tax withholding rate is 5.0% of taxable pay, with taxable pay being the same for federal and state income tax

withholding. Note that the Voluntary Withholding column, for which partial information is provided below, has been populated based on the partial information shown here.

2. Don Beldon earns $7.50/hour, and worked 43 hours during the most recent week. He participates in a cafeteria plan, to which he pays $100 each period. Don Beldon is single, and claims

three federal and two state withholding allowances.

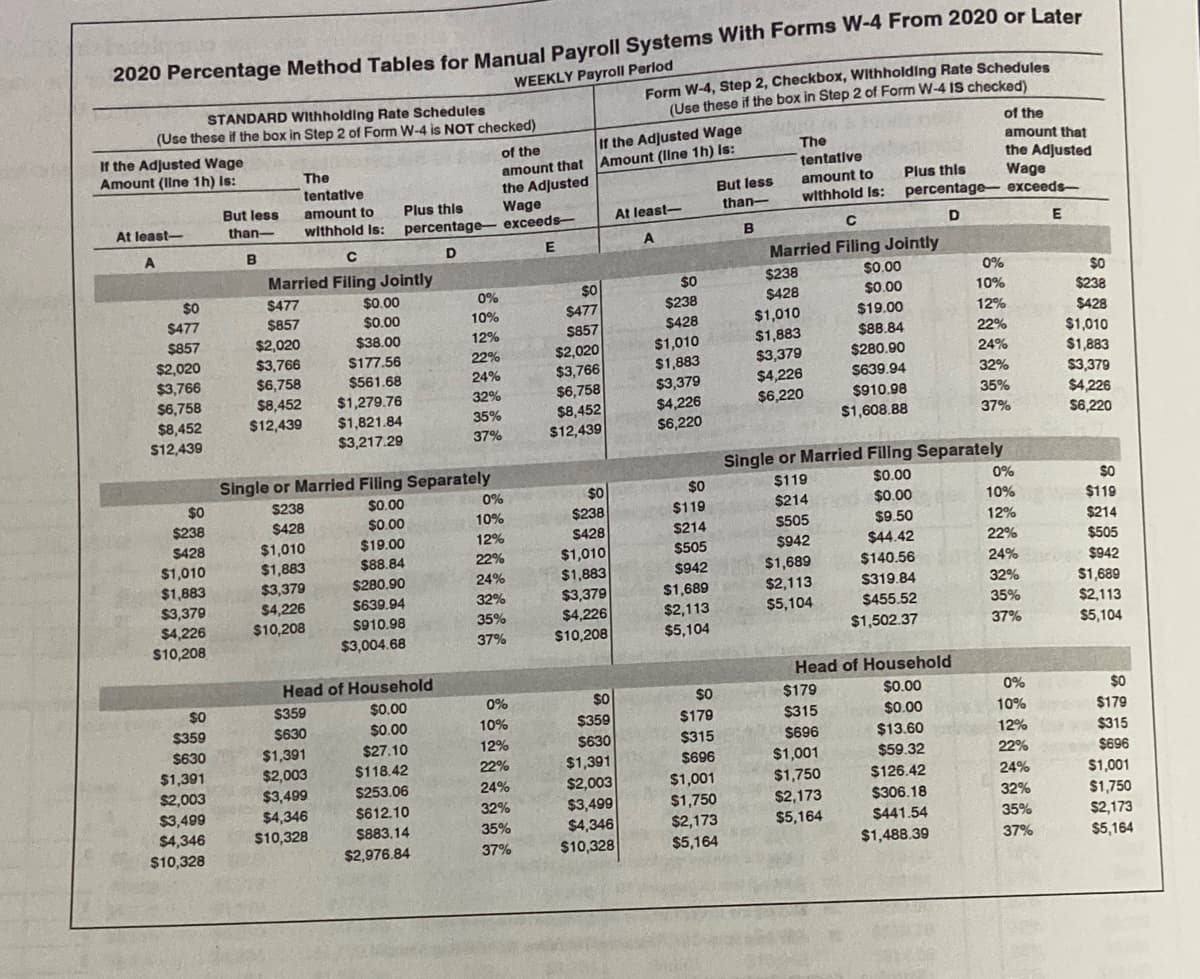

Transcribed Image Text:2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later

WEEKLY Payroll Perlod

STANDARD Withholding Rate Schedules

(Use these if the box in Step 2 of Form W-4 is NOT checked)

Form W-4, Step 2, Checkbox, Withholding Rate Schedules

(Use these if the box in Step 2 of Form W-4 IS checked)

of the

If the Adjusted Wage

Amount (Ilne 1h) Is:

If the Adjusted Wage

Amount (Ilne 1h) Is:

amount that

the Adjusted

Wage

of the

The

amount that

the Adjusted

Wage

The

tentative

tentative

Plus this

But less

than-

amount to

withhold Is:

But less

amount to

Plus this

percentage- exceeds-

At least-

than-

withhold Is:

At least-

percentage- exceeds-

C

E

B

D

Married Filing Jointly

Married Filing Jointly

$0.00

0%

$238

$428

$0

sO

$0

$477

$0.00

0%

$0

$238

$0.00

10%

$238

$477

$857

$2,020

$3,766

$6,758

$8,452

$12,439

$477

$857

$0.00

10%

$19.00

$1,010

$1,883

$3,379

$4,226

$6,220

$428

12%

$428

$857

$2,020

$3,766

$6,758

$8,452

$12,439

$38.00

12%

$88.84

22%

$1,010

$1,883

$3,379

$4,226

$6,220

$1,010

$1,883

$3,379

$4,226

S6,220

$2,020

$177.56

22%

$280.90

24%

$3,766

$561.68

24%

S639.94

32%

$6,758

$1,279.76

32%

$910.98

35%

$8,452

$1,821.84

35%

$1,608.88

37%

S12,439

$3,217.29

37%

Single or Married Filing Separately

Single or Married Filing Separately

$0.00

$0

$0

$119

$0.00

0%

$0

$0

$238

0%

$214

$0.00

10%

$119

$238

S428

$1,010

$1,883

$3,379

$4,226

$238

$428

$0.00

10%

$119

$428

$19.00

12%

$214

S505

$9.50

12%

$214

$1,010

$1,883

$3,379

$4,226

$10,208

$1,010

$88.84

22%

$505

$942

$44.42

22%

$505

$1,689

$2,113

$5,104

24%

$942

$140.56

24%

$942

$1,883

$3,379

$4,226

$10,208

$280.90

32%

$1,689

$2,113

$5,104

$319.84

$1,689

$2,113

$639.94

32%

$910.98

35%

$455.52

35%

$3,004.68

37%

$10,208

$1,502.37

37%

$5,104

Head of Household

Head of Household

$359

$0.00

0%

$0

$0

$179

$0.00

0%

$0

$359

$630

$1,391

$2,003

$3,499

$4,346

$359

$630

$0.00

10%

$179

$315

$0.00

10%

$179

$630

$315

$696

$13.60

$1,391

$2,003

$3,499

$4,346

$10,328

$27.10

12%

12%

$315

$1,001

$1,750

$696

$59.32

$1,391

$2,003

$3,499

$4,346

$10,328

$118.42

22%

22%

$696

$1,001

$1,750

$2,173

$5,164

$253.06

24%

$126.42

24%

$1,001

$2,173

$5,164

$612.10

32%

$306.18

32%

$1,750

$2,173

$883,14

35%

$441.54

35%

$2,976.84

37%

$10,328

$1,488.39

37%

$5,164

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning