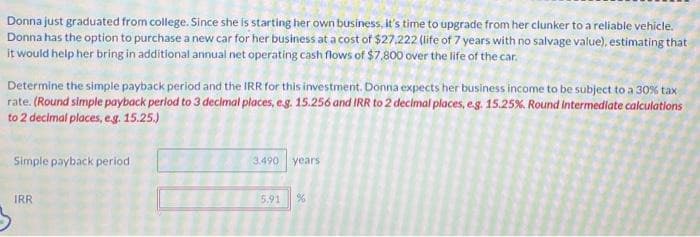

Donna just graduated from college. Since she is starting her own business, it's time to upgrade from her clunker to a reliable vehicle. Donna has the option to purchase a new car for her business at a cost of $27.222 (life of 7 years with no salvage value), estimating that it would help her bring in additional annual net operating cash flows of $7,800 over the life of the car. Determine the simple payback period and the IRR for this investment. Donna expects her business income to be subject to a 30 % tax rate. (Round simple payback period to 3 decimal places, e.g. 15.256 and IRR to 2 decimal places, e.g. 15.25%. Round intermediate calculations to 2 decimal places, e.g. 15.25.) Simple payback period IRR 3.490 years 5.91 %

Donna just graduated from college. Since she is starting her own business, it's time to upgrade from her clunker to a reliable vehicle. Donna has the option to purchase a new car for her business at a cost of $27.222 (life of 7 years with no salvage value), estimating that it would help her bring in additional annual net operating cash flows of $7,800 over the life of the car. Determine the simple payback period and the IRR for this investment. Donna expects her business income to be subject to a 30 % tax rate. (Round simple payback period to 3 decimal places, e.g. 15.256 and IRR to 2 decimal places, e.g. 15.25%. Round intermediate calculations to 2 decimal places, e.g. 15.25.) Simple payback period IRR 3.490 years 5.91 %

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 79TPC

Related questions

Question

jitu

Transcribed Image Text:Donna just graduated from college. Since she is starting her own business, it's time to upgrade from her clunker to a reliable vehicle.

Donna has the option to purchase a new car for her business at a cost of $27.222 (life of 7 years with no salvage value), estimating that

it would help her bring in additional annual net operating cash flows of $7,800 over the life of the car.

Determine the simple payback period and the IRR for this investment. Donna expects her business income to be subject to a 30 % tax

rate. (Round simple payback period to 3 decimal places, e.g. 15.256 and IRR to 2 decimal places, e.g. 15.25%. Round intermediate calculations

to 2 decimal places, e.g. 15.25.)

Simple payback period

IRR

3.490 years

5.91

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College