erry owns a restaurant and has the opportunity to buy a high-quality espresso coffee machine for $5,000. After carefully studying projected costs and revenues, Jerry estimates that the machine will produce a net cash flow of $1,600 annually and will last for five years. He determines that an interest rate of 10% is an adequate return on investment for his business. Calculate the present value of the machine to Jerry. Based on your calculation, do you think a decision to purchase the machine would be wise?

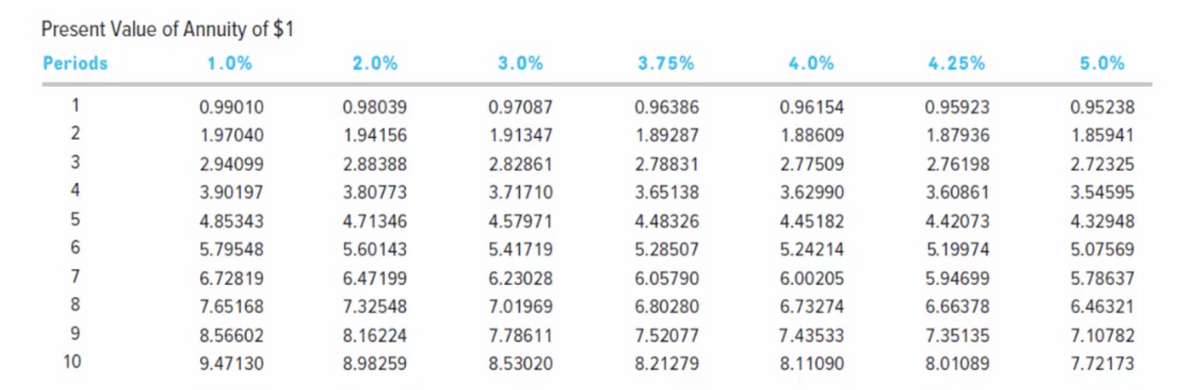

Jerry owns a restaurant and has the opportunity to buy a high-quality espresso coffee machine for $5,000. After carefully studying projected costs and revenues, Jerry estimates that the machine will produce a net cash flow of $1,600 annually and will last for five years. He determines that an interest rate of 10% is an adequate return on investment for his business.

Calculate the present value of the machine to Jerry. Based on your calculation, do you think a decision to purchase the machine would be wise?

Net present value means the difference between the present value of cash inflow and present value of cash outflow.

If it is positive , then project should be accepted , otherwise rejected.

Necessary calculations has been made.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps