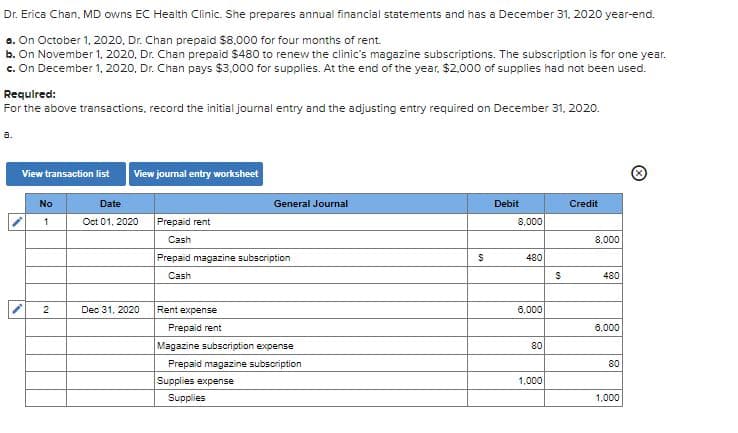

Dr. Erica Chan, MD owns EC Health Clinic. She prepares annual financial statements and has a December 31, 2020 year-end. o. On October 1, 2020, Dr. Chan prepaid $8.000 for four months of rent. b. On November 1, 2020, Dr. Chan prepaid $480 to renew the clinic's magazine subscriptions. The subscription is for one year. c. On December 1, 2020, Dr. Chan pays $3,000 for supplies. At the end of the year, $2.000 of supplies had not been used. Required: For the above transactions, record the initial journal entry and the adjusting entry required on December 31. 2020.

Dr. Erica Chan, MD owns EC Health Clinic. She prepares annual financial statements and has a December 31, 2020 year-end. o. On October 1, 2020, Dr. Chan prepaid $8.000 for four months of rent. b. On November 1, 2020, Dr. Chan prepaid $480 to renew the clinic's magazine subscriptions. The subscription is for one year. c. On December 1, 2020, Dr. Chan pays $3,000 for supplies. At the end of the year, $2.000 of supplies had not been used. Required: For the above transactions, record the initial journal entry and the adjusting entry required on December 31. 2020.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 7EA: Homeland Plus specializes in home goods and accessories. In order for the company to expand its...

Related questions

Question

Only the question in 2b photo. thanks!

Transcribed Image Text:Dr. Erica Chan, MD owns EC Health Clinic. She prepares annual financial statements and has a December 31, 2020 year-end.

a. On October 1, 2020, Dr. Chan prepaid $8,000 for four months of rent.

b. On November 1, 2020, Dr. Chan prepaid $480 to renew the clinic's magazine subscriptions. The subscription is for one year.

c. On December 1, 2020, Dr. Chan pays $3,000 for supplies. At the end of the year, $2.000 of supplies had not been used.

Requlred:

For the above transactions, record the initial journal entry and the adjusting entry required on December 31, 2020.

a.

View transaction list

View joumal entry worksheet

No

Date

General Journal

Debit

Credit

Oct 01, 2020

Prepaid rent

8,000

Cash

8,000

Prepaid magazine subscription

480

Cash

480

2

Dec 31, 2020

Rent expense

6,000

Prepaid rent

6,000

Magazine subscription expense

80

Prepaid magazine subscription

80

Supplies expense

1,000

Supplies

1,000

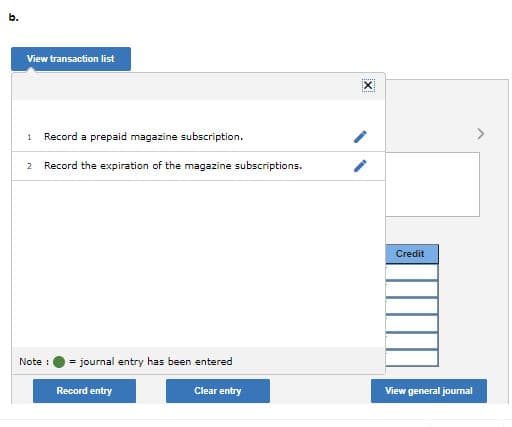

Transcribed Image Text:b.

View transaction list

1

Record a prepaid magazine subscription.

2 Record the expiration of the magazine subscriptions.

Credit

Note :

= journal entry has been entered

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning