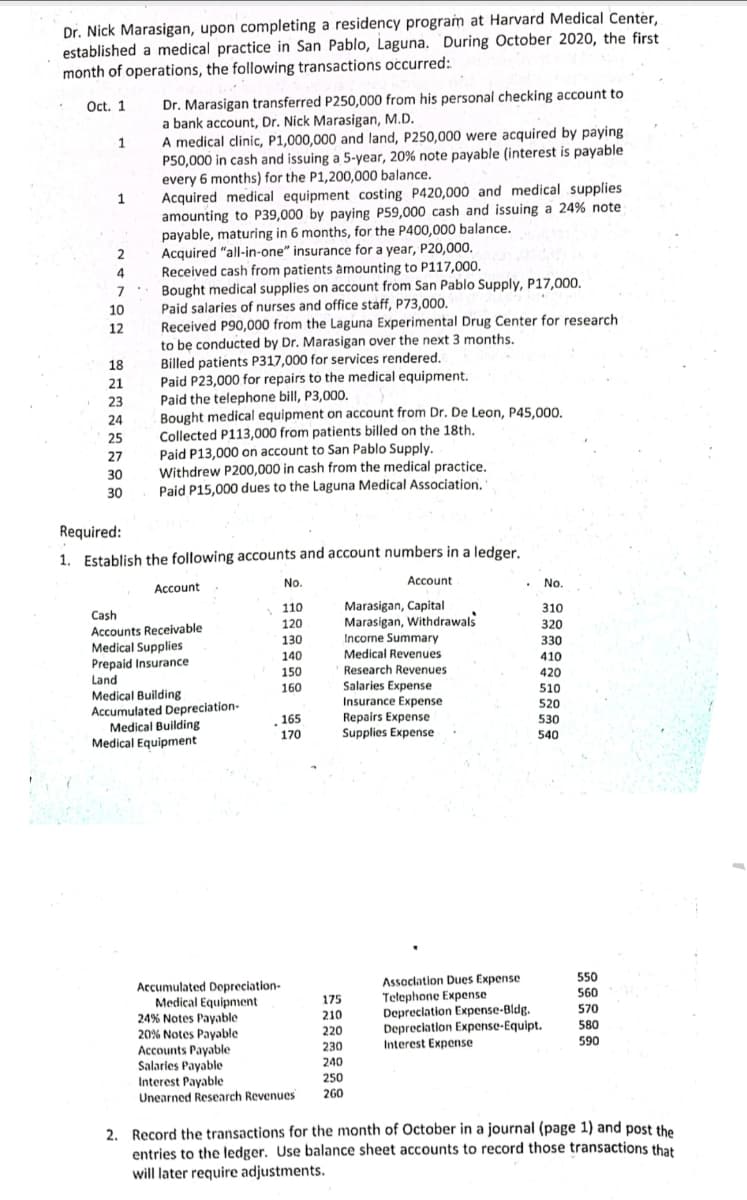

Dr. Nick Marasigan, upon completing a residency program at Harvard Medical Center, established a medical practice in San Pablo, Laguna. During October 2020, the first month of operations, the following transactions occurred: Dr. Marasigan transferred P250,000 from his personal checking account to a bank account, Dr. Nick Marasigan, M.D. A medical clinic, P1,000,000 and land, P250,000 were acquired by paying P50,000 in cash and issuing a 5-year, 20% note payable (interest is payable every 6 months) for the P1,200,000 balance. Acquired medical equipment costing P420,000 and medical supplies amounting to P39,000 by paying P59,000 cash and issuing a 24% note payable, maturing in 6 months, for the P400,000 balance. Acquired "all-in-one" insurance for a year, P20,000. Received cash from patients amounting to P117,000. Bought medical supplies on account from San Pablo Supply, P17,000. Paid salaries of nurses and office staff, P73,000. Received P90,000 from the Laguna Experimental Drug Center for research to be conducted by Dr. Marasigan over the next 3 months. Oct. 1 1 1 2 4 10 12 Billed patients P317,000 for services rendered. Paid P23,000 for repairs to the medical equipment. Paid the telephone bill, P3,000. Bought medical equipment on account from Dr. De Leon, P45,000. Collected P113,000 from patients billed on the 18th. Paid P13,000 on account to San Pablo Supply. Withdrew P200,000 in cash from the medical practice. Paid P15,000 dues to the Laguna Medical Association. 18 21 23 24 25 27 30 30 Required: 1. Establish the following accounts and account numbers in a ledger. No. Account No. Account Marasigan, Capital Marasigan, Withdrawals Income Summary 110 310 Cash 120 320 Accounts Receivable Medical Supplies Prepaid Insurance Land 130 330 140 Medical Revenues 410 150 Research Revenues 420 160 Salaries Expense 510 Medical Building Accumulated Depreciation- Medical Building Medical Equipment Insurance Expense Repairs Expense Supplies Expense 520 165 530 170 540

Dr. Nick Marasigan, upon completing a residency program at Harvard Medical Center, established a medical practice in San Pablo, Laguna. During October 2020, the first month of operations, the following transactions occurred: Dr. Marasigan transferred P250,000 from his personal checking account to a bank account, Dr. Nick Marasigan, M.D. A medical clinic, P1,000,000 and land, P250,000 were acquired by paying P50,000 in cash and issuing a 5-year, 20% note payable (interest is payable every 6 months) for the P1,200,000 balance. Acquired medical equipment costing P420,000 and medical supplies amounting to P39,000 by paying P59,000 cash and issuing a 24% note payable, maturing in 6 months, for the P400,000 balance. Acquired "all-in-one" insurance for a year, P20,000. Received cash from patients amounting to P117,000. Bought medical supplies on account from San Pablo Supply, P17,000. Paid salaries of nurses and office staff, P73,000. Received P90,000 from the Laguna Experimental Drug Center for research to be conducted by Dr. Marasigan over the next 3 months. Oct. 1 1 1 2 4 10 12 Billed patients P317,000 for services rendered. Paid P23,000 for repairs to the medical equipment. Paid the telephone bill, P3,000. Bought medical equipment on account from Dr. De Leon, P45,000. Collected P113,000 from patients billed on the 18th. Paid P13,000 on account to San Pablo Supply. Withdrew P200,000 in cash from the medical practice. Paid P15,000 dues to the Laguna Medical Association. 18 21 23 24 25 27 30 30 Required: 1. Establish the following accounts and account numbers in a ledger. No. Account No. Account Marasigan, Capital Marasigan, Withdrawals Income Summary 110 310 Cash 120 320 Accounts Receivable Medical Supplies Prepaid Insurance Land 130 330 140 Medical Revenues 410 150 Research Revenues 420 160 Salaries Expense 510 Medical Building Accumulated Depreciation- Medical Building Medical Equipment Insurance Expense Repairs Expense Supplies Expense 520 165 530 170 540

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 32P

Related questions

Question

100%

Transcribed Image Text:Dr. Nick Marasigan, upon completing a residency program at Harvard Medical Center,

established a medical practice in San Pablo, Laguna. During October 2020, the first

month of operations, the following transactions occurred:

Dr. Marasigan transferred P250,000 from his personal checking account to

a bank account, Dr. Nick Marasigan, M.D.

A medical clinic, P1,000,000 and land, P250,000 were acquired by paying

P50,000 in cash and issuing a 5-year, 20% note payable (interest is payable

every 6 months) for the P1,200,000 balance.

Acquired medical equipment costing P420,000 and medical supplies

amounting to P39,000 by paying P59,000 cash and issuing a 24% note

payable, maturing in 6 months, for the P400,000 balance.

Acquired "all-in-one" insurance for a year, P20,000.

Received cash from patients amounting to P117,000.

Bought medical supplies on account from San Pablo Supply, P17,000.

Paid salaries of nurses and office staff, P73,000.

Received P90,000 from the Laguna Experimental Drug Center for research

to be conducted by Dr. Marasigan over the next 3 months.

Oct. 1

1

1

2

4

10

12

Billed patients P317,000 for services rendered.

Paid P23,000 for repairs to the medical equipment.

Paid the telephone bill, P3,000.

Bought medical equipment on account from Dr. De Leon, P45,000.

Collected P113,000 from patients billed on the 18th.

Paid P13,000 on account to San Pablo Supply.

Withdrew P200,000 in cash from the medical practice.

Paid P15,000 dues to the Laguna Medical Association.

18

21

23

24

25

27

30

30

Required:

1. Establish the following accounts and account numbers in a ledger.

No.

Account

No.

Account

Marasigan, Capital

Marasigan, Withdrawals

Income Summary

110

310

Cash

120

320

Accounts Receivable

Medical Supplies

130

330

140

Medical Revenues

410

Prepaid Insurance

Land

150

Research Revenues

420

Salaries Expense

Insurance Expense

160

510

Medical Building

Accumulated Depreciation-

Medical Building

Medical Equipment

520

165

Repairs Expense

530

170

Supplies Expense

540

Association Dues Expense

Telephone Expense

Depreciation Expense-Bldg.

Depreciation Expense-Equipt.

Interest Expense

550

Accumulated Dopreciation-

Medical Equipment

24% Notes Payable

20% Notes Payable

Accounts Payable

Salaries Payable

560

175

570

210

580

220

590

230

240

250

Interest Payable

Unearned Research Revenues

260

2. Record the transactions for the month of October in a journal (page 1) and post the

entries to the ledger. Use balance sheet accounts to record those transactions that

will later require adjustments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning