Dr. Zhivago Diagnostics Corporation's income statement for 20X1 is as follows: $ 2,790,000 2.070.000 $720,000 Sales Cost of goods sold Gross profit Selling and administrative expense Operating profit Interest expense Income before taxes Taxes (30%) Income after taxes Profit margin 350.000 $ 370,000 51,400 a. Compute the profit margin for 20X1. Note: Input the profit margin as a percent rounded to 2 decimal places. % $ 318,600 95,580 $223,020

Dr. Zhivago Diagnostics Corporation's income statement for 20X1 is as follows: $ 2,790,000 2.070.000 $720,000 Sales Cost of goods sold Gross profit Selling and administrative expense Operating profit Interest expense Income before taxes Taxes (30%) Income after taxes Profit margin 350.000 $ 370,000 51,400 a. Compute the profit margin for 20X1. Note: Input the profit margin as a percent rounded to 2 decimal places. % $ 318,600 95,580 $223,020

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Sh2

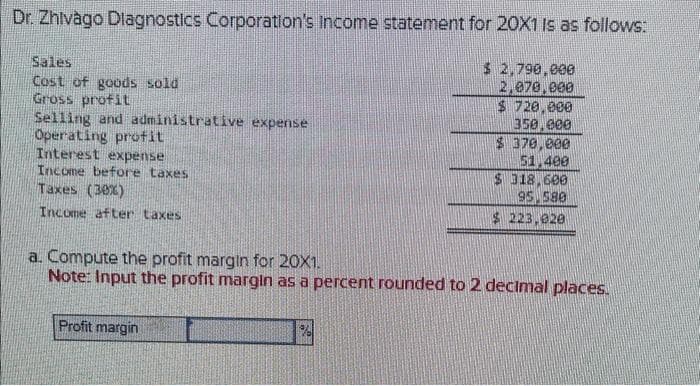

Transcribed Image Text:Dr. Zhivago Diagnostics Corporation's income statement for 20X1 is as follows:

$ 2,790,000

2,070,000

Sales

Cost of goods sold

Gross profit

Selling and administrative expense

Operating profit

Interest expense

Income before taxes

Taxes (30%)

Income after taxes

a. Compute the profit margin for 20X1.

Note: Input the profit margin as a percent rounded to 2 decimal places.

Profit margin

$ 720.000

350.000

$ 370,000

51.400

$ 318,600

95 580

$223,920

%

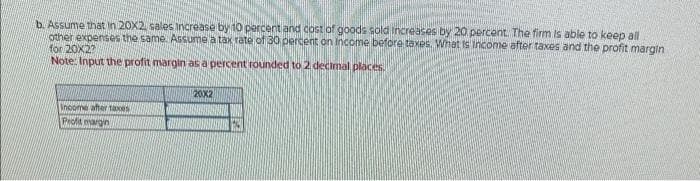

Transcribed Image Text:b. Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all

other expenses the same. Assume a tax rate of 30 percent on income before taxes. What is income after taxes and the profit margin

for 20X2?

Note: Input the profit margin as a percent rounded to 2 decimal places.

Income after taxes

Profit margin

20X2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning