a. Materials purchased on account, $412,000. Description c. Factory labor during the period was $550,000. $30,000 of this was indirect. Description b. Materials requisitioned for use in production, $398,000. $18,000 of this was for general factory use. Description Debit Credit d. Depreciation of the factory equipment, $26,000. Description e. Depreciation of the office equipment, $15,000. Description f. Factory prepaid rent that expired during the period, $6,000. Description Debit g. Office prepaid rent that expired during the period, $2,000. Description Debit Debit Debit Debit Credit Debit Credit Credit Credit Credit Credit

a. Materials purchased on account, $412,000. Description c. Factory labor during the period was $550,000. $30,000 of this was indirect. Description b. Materials requisitioned for use in production, $398,000. $18,000 of this was for general factory use. Description Debit Credit d. Depreciation of the factory equipment, $26,000. Description e. Depreciation of the office equipment, $15,000. Description f. Factory prepaid rent that expired during the period, $6,000. Description Debit g. Office prepaid rent that expired during the period, $2,000. Description Debit Debit Debit Debit Credit Debit Credit Credit Credit Credit Credit

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 12PA: The following data summarize the operations during the year. Prepare a journal entry for each...

Related questions

Question

please answer parts A to L

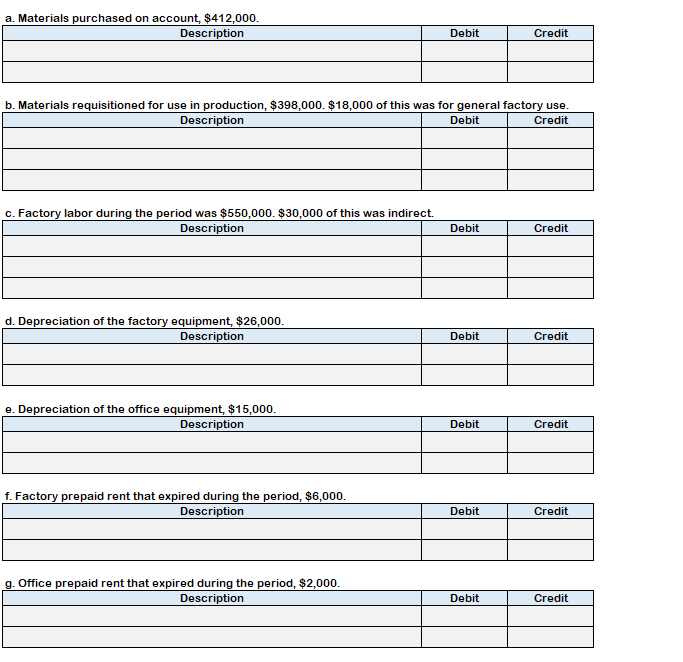

Transcribed Image Text:h. Other costs incurred on account for factory overhead included $40,000.

Description

j. Close out the factory overhead balance to cost of goods sold.

Description

i. Estimated factory overhead cost for the period was $120,000 and estimated direct labor hours for the period were 40,000 hours. Assuming that overhead

is applied based on direct labor hours and that the company used 42,000 direct labor hours during the period, apply factory overhead.

Description

Debit

Credit

k. Jobs completed during the period, $900,000.

Description

1. Cost of goods sold, $850,000.

Debit

Description

Debit

Debit

Credit

Debit

Credit

Credit

Credit

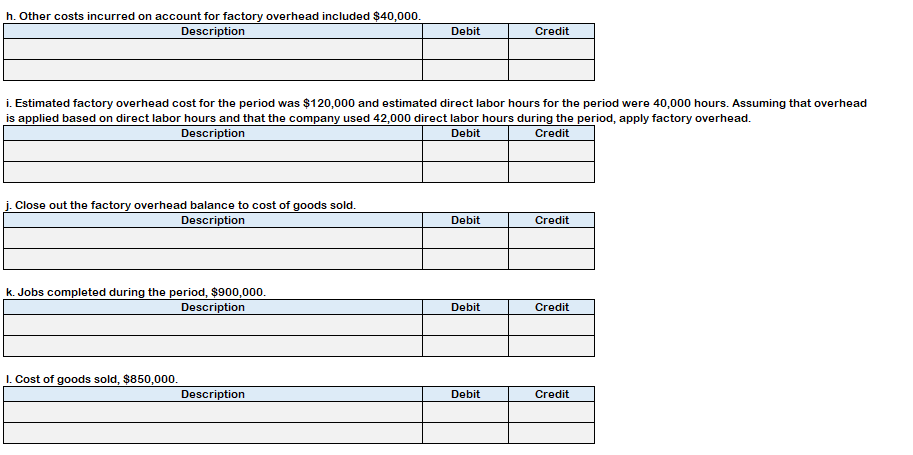

Transcribed Image Text:a. Materials purchased on account, $412,000.

Description

c. Factory labor during the period was $550,000. $30,000 of this was indirect.

Description

b. Materials requisitioned for use in production, $398,000. $18,000 of this was for general factory use.

Description

Debit

Credit

d. Depreciation of the factory equipment, $26,000.

Description

e. Depreciation of the office equipment, $15,000.

Description

f. Factory prepaid rent that expired during the period, $6,000.

Description

Debit

g. Office prepaid rent that expired during the period, $2,000.

Description

Debit

Debit

Debit

Debit

Credit

Debit

Credit

Credit

Credit

Credit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning