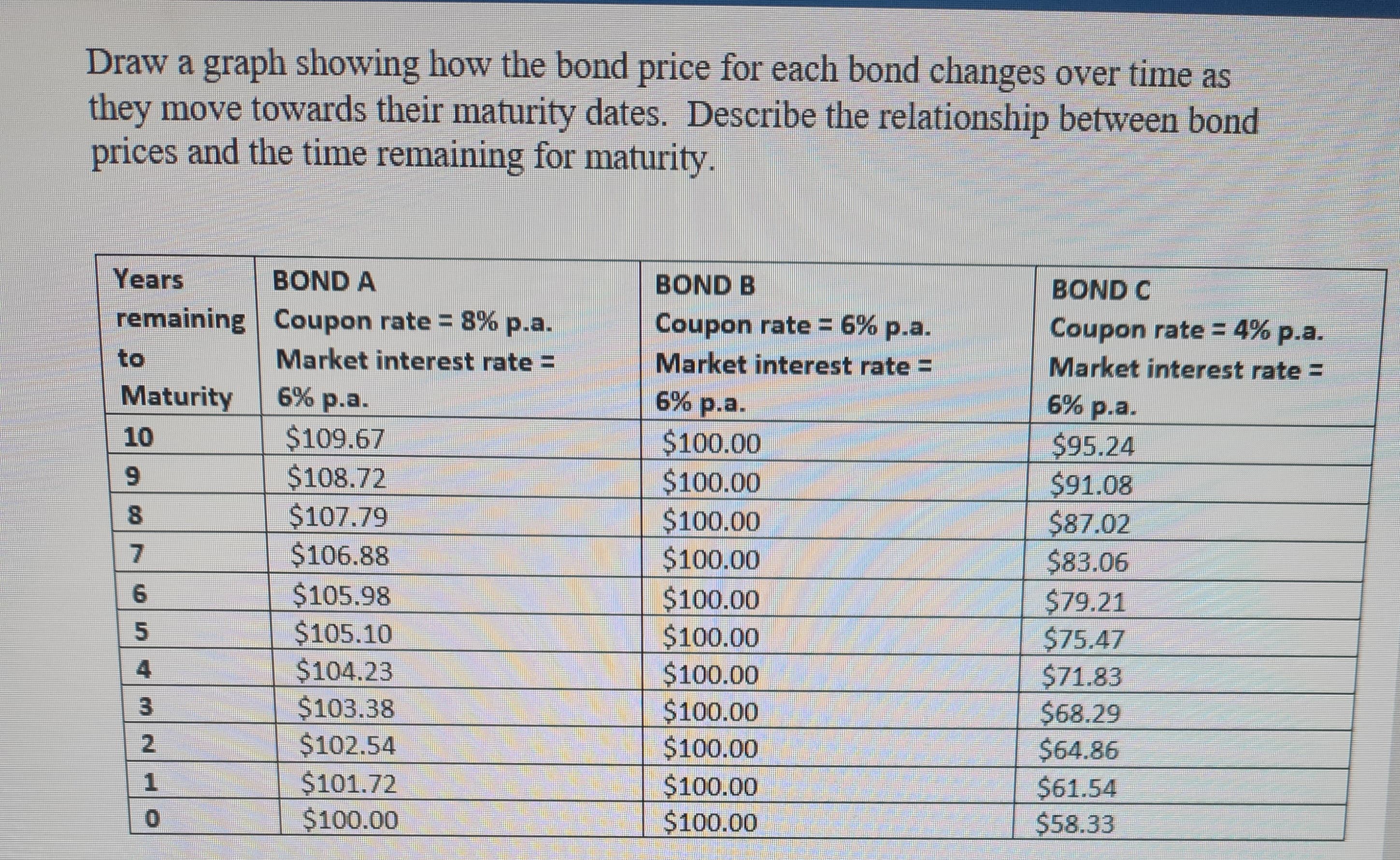

Draw a graph showing how the bond price for each bond changes over time as they move towards their maturity dates. Describe the relationship between bond prices and the time remaining for maturity. Years remaining to Maturity 10 9 8 0765 40 NA 3 2 0 BOND A Coupon rate = 8% p.a. Market interest rate = 6% p.a. $109.67 $108.72 $107.79 $106.88 $105.98 $105.10 $104.23 $103.38 $102.54 $101.72 $100.00 BOND B Coupon rate = 6% p.a. Market interest rate = 6% p.a. $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 BOND C Coupon rate = 4% p.a. Market interest rate = 6% p.a. $95.24 $91.08 $87.02 $83.06 $79.21 $75.47 $71.83 $68.29 $64.86 $61.54 $58.33

Draw a graph showing how the bond price for each bond changes over time as they move towards their maturity dates. Describe the relationship between bond prices and the time remaining for maturity. Years remaining to Maturity 10 9 8 0765 40 NA 3 2 0 BOND A Coupon rate = 8% p.a. Market interest rate = 6% p.a. $109.67 $108.72 $107.79 $106.88 $105.98 $105.10 $104.23 $103.38 $102.54 $101.72 $100.00 BOND B Coupon rate = 6% p.a. Market interest rate = 6% p.a. $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 $100.00 BOND C Coupon rate = 4% p.a. Market interest rate = 6% p.a. $95.24 $91.08 $87.02 $83.06 $79.21 $75.47 $71.83 $68.29 $64.86 $61.54 $58.33

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.1E

Related questions

Question

Please see question attached.

Thank you.

Transcribed Image Text:Draw a graph showing how the bond price for each bond changes over time as

they move towards their maturity dates. Describe the relationship between bond

prices and the time remaining for maturity.

Years

remaining

to

Maturity

10

9

8

0765 40 NA

3

2

0

BOND A

Coupon rate = 8% p.a.

Market interest rate =

6% p.a.

$109.67

$108.72

$107.79

$106.88

$105.98

$105.10

$104.23

$103.38

$102.54

$101.72

$100.00

BOND B

Coupon rate = 6% p.a.

Market interest rate =

6% p.a.

$100.00

$100.00

$100.00

$100.00

$100.00

$100.00

$100.00

$100.00

$100.00

$100.00

$100.00

BOND C

Coupon rate = 4% p.a.

Market interest rate =

6% p.a.

$95.24

$91.08

$87.02

$83.06

$79.21

$75.47

$71.83

$68.29

$64.86

$61.54

$58.33

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT