You have accumulated $8,000 toward the down payment on a piece of lake front propert wish to accumulate a total of $12,000 (i.e. an additional $4,000) for the down payment in not to contribute more new funds to your down payment fund, what rate of return must y your objective in the specified time? Assume that your investment fund compounds ann Select one: a. 10.67% per year O b. 50.00% per year O c. 12.50% per year Od. There is not enough information to answer this question.

You have accumulated $8,000 toward the down payment on a piece of lake front propert wish to accumulate a total of $12,000 (i.e. an additional $4,000) for the down payment in not to contribute more new funds to your down payment fund, what rate of return must y your objective in the specified time? Assume that your investment fund compounds ann Select one: a. 10.67% per year O b. 50.00% per year O c. 12.50% per year Od. There is not enough information to answer this question.

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 40P

Related questions

Question

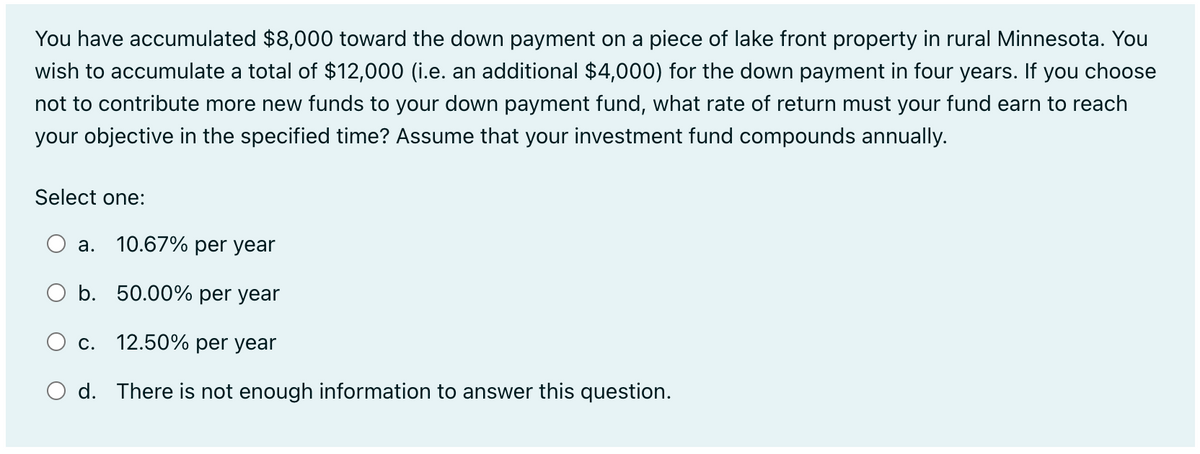

Transcribed Image Text:You have accumulated $8,000 toward the down payment on a piece of lake front property in rural Minnesota. You

wish to accumulate a total of $12,000 (i.e. an additional $4,000) for the down payment in four years. If you choose

not to contribute more new funds to your down payment fund, what rate of return must your fund earn to reach

your objective in the specified time? Assume that your investment fund compounds annually.

Select one:

a. 10.67% per year

O b. 50.00% per year

12.50% per year

O d. There is not enough information to answer this question.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning