Drongo Corporation's 4-year bonds currently yield premium of 3,7%. The real risk-free rate of interest, r*, is 2.6 percent and is assum constant. The maturity risk premium (MRP) is estimated to be 0.1% (t-1), where t the time to maturity. The default risk and liquidity premiums for this company's bone percent and are believed to be the same for all bonds issued by this company. If t

Drongo Corporation's 4-year bonds currently yield premium of 3,7%. The real risk-free rate of interest, r*, is 2.6 percent and is assum constant. The maturity risk premium (MRP) is estimated to be 0.1% (t-1), where t the time to maturity. The default risk and liquidity premiums for this company's bone percent and are believed to be the same for all bonds issued by this company. If t

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Question

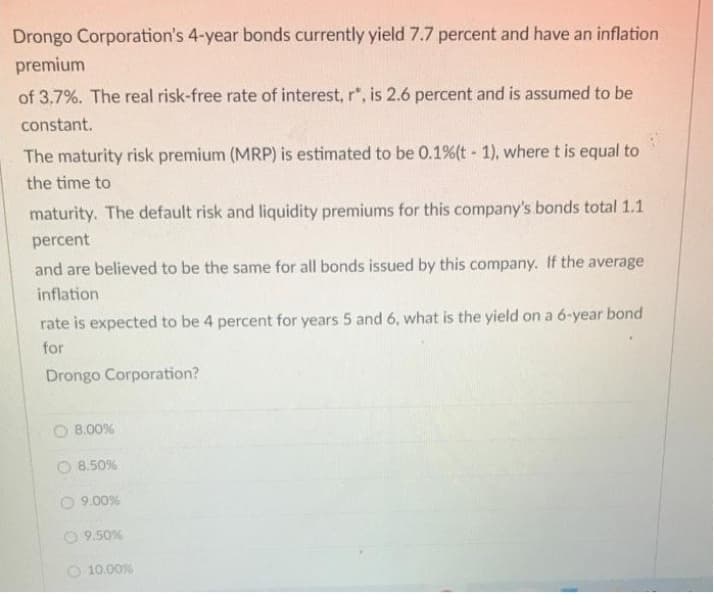

Transcribed Image Text:Drongo Corporation's 4-year bonds currently yield 7.7 percent and have an inflation

premium

of 3.7%. The real risk-free rate of interest, r*, is 2.6 percent and is assumed to be

constant.

The maturity risk premium (MRP) is estimated to be 0.1% (t-1), where t is equal to

the time to

maturity. The default risk and liquidity premiums for this company's bonds total 1.1

percent

and are believed to be the same for all bonds issued by this company. If the average

inflation

rate is expected to be 4 percent for years 5 and 6, what is the yield on a 6-year bond

for

Drongo Corporation?

8.00%

O 8.50%

9.00%

9.50%

10.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,