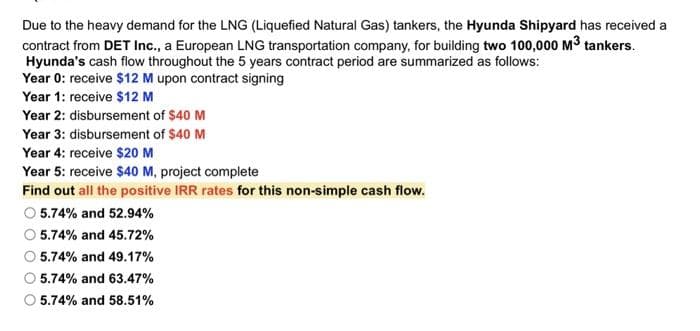

Due to the heavy demand for the LNG (Liquefied Natural Gas) tankers, the Hyunda Shipyard has received a contract from DET Inc., a European LNG transportation company, for building two 100,000 M³ tankers. Hyunda's cash flow throughout the 5 years contract period are summarized as follows: Year 0: receive $12 M upon contract signing Year 1: receive $12 M Year 2: disbursement of $40 M Year 3: disbursement of $40 M Year 4: receive $20 M Year 5: receive $40 M, project complete Find out all the positive IRR rates for this non-simple cash flow. 5.74% and 52.94% 5.74% and 45.72% 5.74% and 49.17% 5.74% and 63.47% 5.74% and 58.51%

Due to the heavy demand for the LNG (Liquefied Natural Gas) tankers, the Hyunda Shipyard has received a contract from DET Inc., a European LNG transportation company, for building two 100,000 M³ tankers. Hyunda's cash flow throughout the 5 years contract period are summarized as follows: Year 0: receive $12 M upon contract signing Year 1: receive $12 M Year 2: disbursement of $40 M Year 3: disbursement of $40 M Year 4: receive $20 M Year 5: receive $40 M, project complete Find out all the positive IRR rates for this non-simple cash flow. 5.74% and 52.94% 5.74% and 45.72% 5.74% and 49.17% 5.74% and 63.47% 5.74% and 58.51%

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 18P

Related questions

Question

2

Transcribed Image Text:Due to the heavy demand for the LNG (Liquefied Natural Gas) tankers, the Hyunda Shipyard has received a

contract from DET Inc., a European LNG transportation company, for building two 100,000 M³ tankers.

Hyunda's cash flow throughout the 5 years contract period are summarized as follows:

Year 0: receive $12 M upon contract signing

Year 1: receive $12 M

Year 2: disbursement of $40 M

Year 3: disbursement of $40 M

Year 4: receive $20 M

Year 5: receive $40 M, project complete

Find out all the positive IRR rates for this non-simple cash flow.

O 5.74% and 52.94%

5.74% and 45.72%

O 5.74% and 49.17%

5.74% and 63.47%

5.74% and 58.51%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College