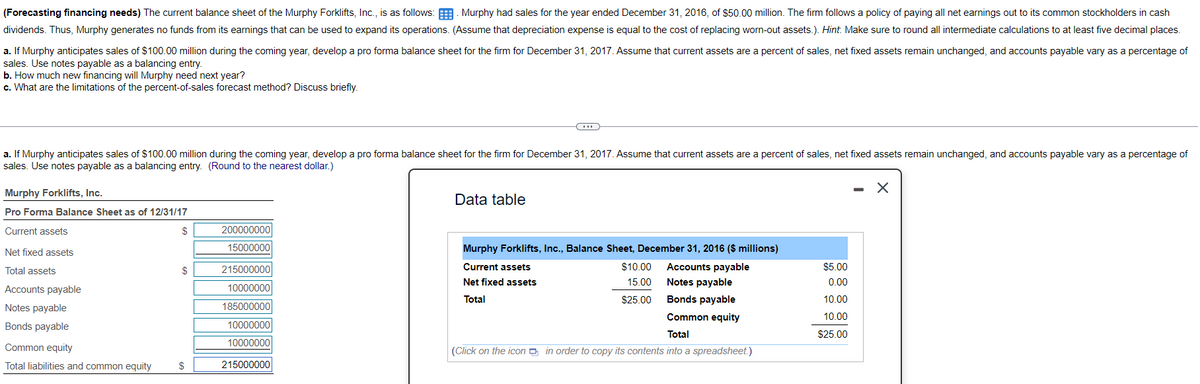

(Forecasting financing needs) The current balance sheet of the Murphy Forklifts, Inc., is as follows: Murphy had sales for the year ended December 31, 2016, of $50.00 million. The firm follows a policy of paying all net earnings out to its common stockholders in cash dividends. Thus, Murphy generates no funds from its earnings that can be used to expand its operations. (Assume that depreciation expense is equal to the cost of replacing worn-out assets.). Hint. Make sure to round all intermediate calculations to at least five decimal places. a. If Murphy anticipates sales of $100.00 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage o sales. Use notes payable as a balancing entry. b. How much new financing will Murphy need next year? c. What are the limitations of the percent-of-sales forecast method? Discuss briefly. a. If Murphy anticipates sales of $100.00 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage o sales. Use notes payable as a balancing entry. (Round to the nearest dollar.) Murphy Forklifts, Inc. Pro Forma Balance Sheet as of 12/31/17 Current assets $ Net fixed assets Total assets Accounts payable Notes payable Bonds payable Common equity Total liabilities and common equity $ S 200000000 15000000 215000000 10000000 185000000 10000000 10000000 215000000 Data table Murphy Forklifts, Inc., Balance Sheet, December 31, 2016 ($ millions) Current assets $10.00 Accounts payable 15.00 Notes payable $25.00 Net fixed assets Total Bonds payable Common equity Total (Click on the icon in order to copy its contents into a spreadsheet.) $5.00 0.00 10.00 10.00 $25.00 - X X

(Forecasting financing needs) The current balance sheet of the Murphy Forklifts, Inc., is as follows: Murphy had sales for the year ended December 31, 2016, of $50.00 million. The firm follows a policy of paying all net earnings out to its common stockholders in cash dividends. Thus, Murphy generates no funds from its earnings that can be used to expand its operations. (Assume that depreciation expense is equal to the cost of replacing worn-out assets.). Hint. Make sure to round all intermediate calculations to at least five decimal places. a. If Murphy anticipates sales of $100.00 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage o sales. Use notes payable as a balancing entry. b. How much new financing will Murphy need next year? c. What are the limitations of the percent-of-sales forecast method? Discuss briefly. a. If Murphy anticipates sales of $100.00 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage o sales. Use notes payable as a balancing entry. (Round to the nearest dollar.) Murphy Forklifts, Inc. Pro Forma Balance Sheet as of 12/31/17 Current assets $ Net fixed assets Total assets Accounts payable Notes payable Bonds payable Common equity Total liabilities and common equity $ S 200000000 15000000 215000000 10000000 185000000 10000000 10000000 215000000 Data table Murphy Forklifts, Inc., Balance Sheet, December 31, 2016 ($ millions) Current assets $10.00 Accounts payable 15.00 Notes payable $25.00 Net fixed assets Total Bonds payable Common equity Total (Click on the icon in order to copy its contents into a spreadsheet.) $5.00 0.00 10.00 10.00 $25.00 - X X

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 8P

Related questions

Question

I worked out part a, but not sure what I did wrong. Please show work and explain, thank you.

Question 5

Transcribed Image Text:(Forecasting financing needs) The current balance sheet of the Murphy Forklifts, Inc., is as follows: Murphy had sales for the year ended December 31, 2016, of $50.00 million. The firm follows a policy of paying all net earnings out to its common stockholders in cash

dividends. Thus, Murphy generates no funds from its earnings that can be used to expand its operations. (Assume that depreciation expense is equal to the cost of replacing worn-out assets.). Hint. Make sure to round all intermediate calculations to at least five decimal places.

a. If Murphy anticipates sales of $100.00 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage of

sales. Use notes payable as a balancing entry.

b. How much new financing will Murphy need next year?

c. What are the limitations of the percent-of-sales forecast method? Discuss briefly.

a. If Murphy anticipates sales of $100.00 million during the coming year, develop a pro forma balance sheet for the firm for December 31, 2017. Assume that current assets are a percent of sales, net fixed assets remain unchanged, and accounts payable vary as a percentage of

sales. Use notes payable as a balancing entry. (Round to the nearest dollar.)

Murphy Forklifts, Inc.

Pro Forma Balance Sheet as of 12/31/17

Current assets

Net fixed assets

Total assets

Accounts payable

Notes payable

Bonds payable

Common equity

Total liabilities and common equity

$

$

$

200000000

15000000

215000000

10000000

185000000

10000000

10000000

215000000

***

Data table

Murphy Forklifts, Inc., Balance Sheet, December 31, 2016 ($ millions)

$10.00

Current assets

Accounts payable

15.00 Notes payable

$25.00

Net fixed assets

Total

Bonds payable

Common equity

Total

(Click on the icon in order to copy its contents into a spreadsheet.)

$5.00

0.00

10.00

10.00

$25.00

-

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning