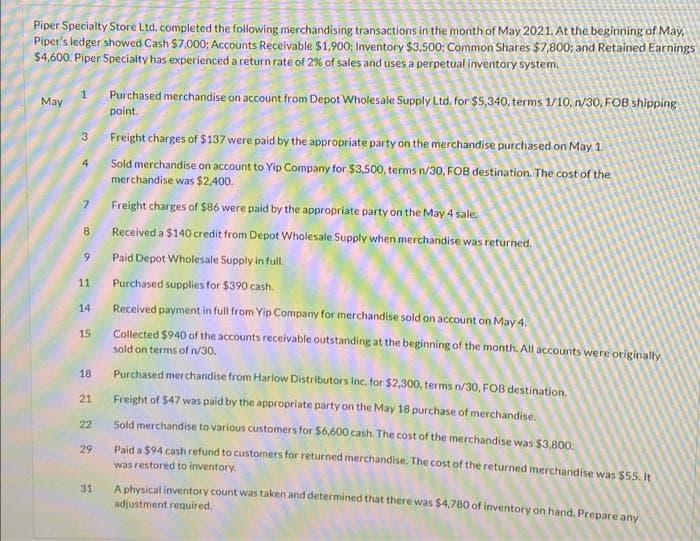

Piper Specialty Store Ltd. completed the following merchandising transactions in the month of May 2021. At the beginning of May, Piper's ledger showed Cash $7,000; Accounts Receivable $1,900; Inventory $3,500; Common Shares $7,800; and Retained Earnings $4,600. Piper Specialty has experienced a return rate of 2% of sales and uses a perpetual inventory system. Purchased merchandise on account from Depot Wholesale Supply Ltd. for $5,340, terms 1/10, n/30, FOB shipping point. May Freight charges of $137 were paid by the appropriate party on the merchandise purchased on May 1. 4. Sold merchandise on account to Yip Company for $3,500, terms n/30, FOB destination. The cost of the merchandise was $2,400. 7. Freight charges of $86 were paid by the appropriate party on the May 4 sale. 8. Received a $140 credit from Depot Wholesale Supply when merchandise was returned. 6. Paid Depot Wholesale Supply in full. 11 Purchased supplies for $390 cash. 14 Received payment in full from Yip Company for merchandise sold on account on May 4. 15 Collected $940 of the accounts receivable outstanding at the beginning of the month. All accounts were originally sold on terms of n/30. 18 Purchased merchandise from Harlow Distributors Inc. for $2,300, terms n/30, FOB destination, 21 Freight of $47 was paid by the appropriate party on the May 18 purchase of merchandise. 22 Sold merchandise to various customers for $6,600 cash. The cost of the merchandise was $3.800. 29 Paid a $94 cash refund to customers for returned merchandise. The cost of the returned merchandise was $s5, I was restored to inventory. 31 A physical inventory count was taken and determined that there was $4,780 of inventory on hand, Prepare any adjustment required,

Piper Specialty Store Ltd. completed the following merchandising transactions in the month of May 2021. At the beginning of May, Piper's ledger showed Cash $7,000; Accounts Receivable $1,900; Inventory $3,500; Common Shares $7,800; and Retained Earnings $4,600. Piper Specialty has experienced a return rate of 2% of sales and uses a perpetual inventory system. Purchased merchandise on account from Depot Wholesale Supply Ltd. for $5,340, terms 1/10, n/30, FOB shipping point. May Freight charges of $137 were paid by the appropriate party on the merchandise purchased on May 1. 4. Sold merchandise on account to Yip Company for $3,500, terms n/30, FOB destination. The cost of the merchandise was $2,400. 7. Freight charges of $86 were paid by the appropriate party on the May 4 sale. 8. Received a $140 credit from Depot Wholesale Supply when merchandise was returned. 6. Paid Depot Wholesale Supply in full. 11 Purchased supplies for $390 cash. 14 Received payment in full from Yip Company for merchandise sold on account on May 4. 15 Collected $940 of the accounts receivable outstanding at the beginning of the month. All accounts were originally sold on terms of n/30. 18 Purchased merchandise from Harlow Distributors Inc. for $2,300, terms n/30, FOB destination, 21 Freight of $47 was paid by the appropriate party on the May 18 purchase of merchandise. 22 Sold merchandise to various customers for $6,600 cash. The cost of the merchandise was $3.800. 29 Paid a $94 cash refund to customers for returned merchandise. The cost of the returned merchandise was $s5, I was restored to inventory. 31 A physical inventory count was taken and determined that there was $4,780 of inventory on hand, Prepare any adjustment required,

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 7CP

Related questions

Question

Transcribed Image Text:Piper Specialty Store Ltd. completed the following merchandising transactions in the month of May 2021. At the beginning of May,

Piper's ledger showed Cash $7,000; Accounts Receivable $1,900; Inventory $3,500; Common Shares $7,800; and Retained Earnings

$4,600. Piper Specialty has experienced a return rate of 2% of sales and uses a perpetual inventory system.

Purchased merchandise on account from Depot Wholesale Supply Ltd. for $5,340, terms 1/10, n/30, FOB shipping

point.

May

3

Freight charges of $137 were paid by the appropriate party on the merchandise purchased on May 1.

Sold merchandise on account to Yip Company for $3,500, terms n/30, FOB destination. The cost of the

merchandise was $2,400.

7

Freight charges of $86 were paid by the appropriate party on the May 4 sale.

8.

Received a $140 credit from Depot Wholesale Supply when merchandise was returned.

Paid Depot Wholesale Supply in full.

11

Purchased supplies for $390 cash.

14

Received payment in full from Yip Company for merchandise sold on account on May 4.

Collected $940 of the accounts receivable outstanding at the beginning of the month. All accounts were originally

sold on terms of n/30.

15

18

Purchased merchandise from Harlow Distributors Inc. for $2,300, terms n/30, FOB destination.

21

Freight of $47 was paid by the appropriate party on the May 18 purchase of merchandise.

22

Sold merchandise to various customers for $6,600 cash. The cost of the merchandise was $3.800,

29

Paid a $94 cash refund to customers for returned merchandise. The cost of the returned merchandise was $55, It

was restored to inventory.

31

A physical inventory count was taken and determined that there was $4,780 of inventory on hand, Prepare any

adjustment required.

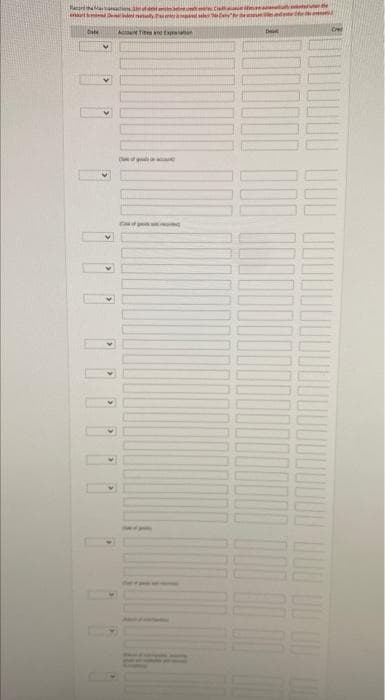

Transcribed Image Text:Date

Acont Te nd txpaen

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning