During 2017 Holy land Corporation spent $150,000 in research costs. As a result a new product was patented. The patent was obtained on October 1, 2017. The company paid $24,000 on October 1, 2017 as legal cost for the patent. It had a useful life of 10 years and legal life 20 years. On January 1, 2019, Holy land spent $9,000 to successfully defend the patent in a lawsuit. Holy land feels that as of that date, the remaining useful life is 5 years.

During 2017 Holy land Corporation spent $150,000 in research costs. As a result a new product was patented. The patent was obtained on October 1, 2017. The company paid $24,000 on October 1, 2017 as legal cost for the patent. It had a useful life of 10 years and legal life 20 years. On January 1, 2019, Holy land spent $9,000 to successfully defend the patent in a lawsuit. Holy land feels that as of that date, the remaining useful life is 5 years.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7MC

Related questions

Question

I need the answer as soon as possible

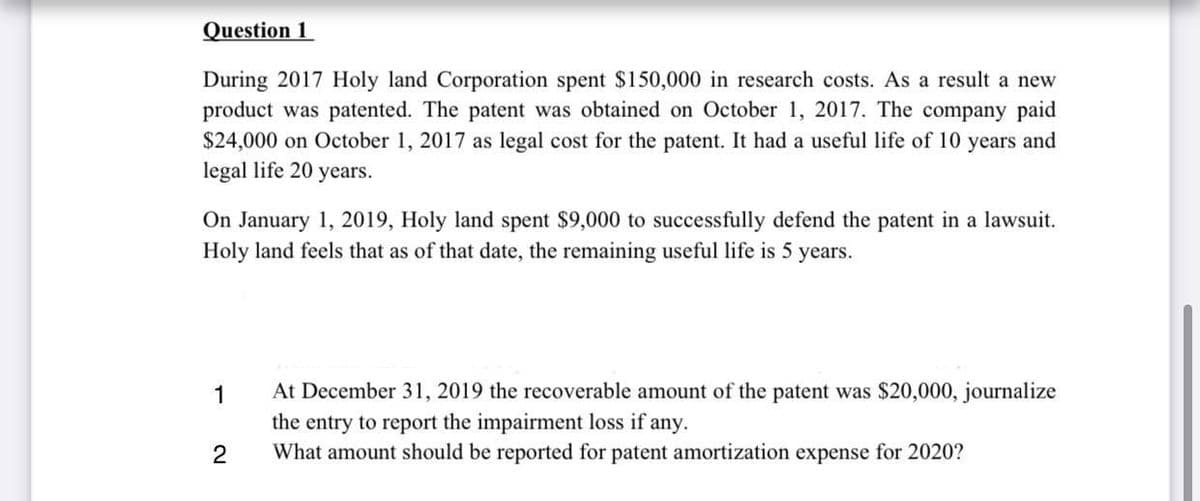

Transcribed Image Text:Question 1

During 2017 Holy land Corporation spent $150,000 in research costs. As a result a new

product was patented. The patent was obtained on October 1, 2017. The company paid

$24,000 on October 1, 2017 as legal cost for the patent. It had a useful life of 10 years and

legal life 20 years.

On January 1, 2019, Holy land spent $9,000 to successfully defend the patent in a lawsuit.

Holy land feels that as of that date, the remaining useful life is 5 years.

At December 31, 2019 the recoverable amount of the patent was $20,000, journalize

the entry to report the impairment loss if any.

What amount should be reported for patent amortization expense for 2020?

1

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning