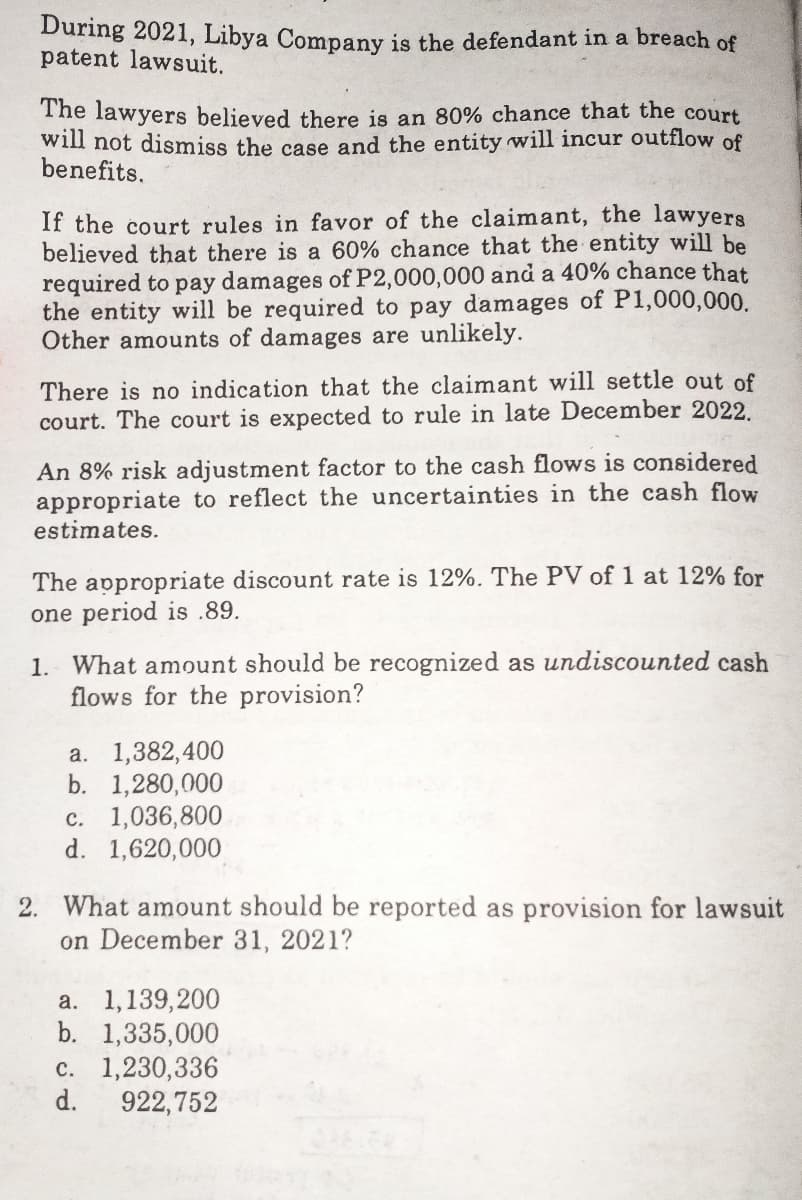

During 2021, Libya Company is the defendant in a breach of patent lawsuit. The lawyers believed there is an 80% chance that the court will not dismiss the case and the entity will incur outflow of benefits. If the court rules in favor of the claimant, the lawyers believed that there is a 60% chance that the entity will be required to pay damages of P2,000,000 and a 40% chance that the entity will be required to pay damages of P1,000,000. Other amounts of damages are unlikely. There is no indication that the claimant will settle out of court. The court is expected to rule in late December 2022. An 8% risk adjustment factor to the cash flows is considered appropriate to reflect the uncertainties in the cash flow estimates. The appropriate discount rate is 12%. The PV of 1 at 12% for one period is .89. 1. What amount should be recognized as undiscounted cash flows for the provision? a. 1,382,400 b. 1,280,000 c. 1,036,800 d. 1,620,000 : What amount should be reported as provision for lawsuit on December 31, 2021? a. 1,139,200 b. 1,335,000 c. 1,230,336 d. 922,752

During 2021, Libya Company is the defendant in a breach of patent lawsuit. The lawyers believed there is an 80% chance that the court will not dismiss the case and the entity will incur outflow of benefits. If the court rules in favor of the claimant, the lawyers believed that there is a 60% chance that the entity will be required to pay damages of P2,000,000 and a 40% chance that the entity will be required to pay damages of P1,000,000. Other amounts of damages are unlikely. There is no indication that the claimant will settle out of court. The court is expected to rule in late December 2022. An 8% risk adjustment factor to the cash flows is considered appropriate to reflect the uncertainties in the cash flow estimates. The appropriate discount rate is 12%. The PV of 1 at 12% for one period is .89. 1. What amount should be recognized as undiscounted cash flows for the provision? a. 1,382,400 b. 1,280,000 c. 1,036,800 d. 1,620,000 : What amount should be reported as provision for lawsuit on December 31, 2021? a. 1,139,200 b. 1,335,000 c. 1,230,336 d. 922,752

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 4P

Related questions

Question

What is the correct answer in numbers 1 and 2? Show solution.

Transcribed Image Text:During 2021, Libya Company is the defendant in a breach of

patent lawsuit.

The lawyers believed there is an 80% chance that the court

will not dismiss the case and the entity will incur outflow of

benefits.

If the court rules in favor of the claimant, the lawyers

believed that there is a 60% chance that the entity will be

required to pay damages of P2,000,000 and a 40% chance that

the entity will be required to pay damages of P1,000,000.

Other amounts of damages are unlikely.

There is no indication that the claimant will settle out of

court. The court is expected to rule in late December 2022.

An 8% risk adjustment factor to the cash flows is considered

appropriate to reflect the uncertainties in the cash flow

estimates.

The appropriate discount rate is 12%. The PV of 1 at 12% for

one period is .89.

1. What amount should be recognized as undiscounted cash

flows for the provision?

a. 1,382,400

b. 1,280,000

c. 1,036,800

d. 1,620,000

2. What amount should be reported as provision for lawsuit

on December 31, 2021?

a. 1,139,200

b. 1,335,000

c. 1,230,336

d.

922,752

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you