January 1, 20x8,Parent Company purchased 8C res of Subsidiary Company for P800,000. On t sidiary Company reported Ordinary Shares of ained Earnings of P200,00O. Suhridin

Q: nDecember 31, 2020, Rebel Corporation's balance sheet reported the following. Common stock, $1 par…

A: A journal entry is used to register a commercial transaction in a corporation's accounting records.…

Q: Bolles Corporation manufactures products on a job-order basis. The job cost sheet for Job #902 shows…

A: Introduction:- Job costing includes the following as follows:- direct labor direct materials…

Q: ROSE Corporation has a premiums payable balance of P242,000 on December 31, 2019 for a promotional

A: These are obligation which are to be paid with in one year and one operating cycle, whichever is…

Q: During the current year, Royal Industries sold treasury stock for $32.000 cash. The treasury stock…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in statement of cash…

Q: QUESTION 1 Explain the following terms. Include the definition, how they are calculated, treated in…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Which of the following statements is TRUE? * A business should credit Revenue when the business…

A: Accounting The recording of a financial transaction related to a business is known as accounting.…

Q: Which statement is true of digital legal tender?

A: Answer: a.Digital legal tender replaces physical notes and coin.

Q: Complete the balance sheet with the data provided in the pictures. 1. Prepare Asset section (left…

A: A Balance sheet is a statement that shows the financial position of a business enterprise at a given…

Q: A. In the long run it is more important for a business to have positive cash flows from its…

A: A. Cash flow statement (CFS), financial statements summarizing cash flows and cash equivalents…

Q: Account Name Debit Credit Sales 750.C00 Sales Returms and Allowances 15,000 Sales Discounts 10.000…

A: Solution Net purchase is calculated by substracting purchase return and purchase discount . It…

Q: EXERCISE-3 DEPRECIATION AND DEPLETION 6. A concrete hollow block (CHB) machine costs P40,000 and the…

A: Depreciation can be termed as wear and tear of an asset and method of allocating cost of the asset…

Q: D. Name and explain the three (3) categories of cash-flow activities.

A: There are mainly three types of cash flow activities. They are mainly as follows: 1.Operating…

Q: he year for a selling price of $26 each—These items cost $16 each and had $2 of variable selling…

A: The income statement is one of three basic financial statements that describe a company's financial…

Q: Contractual savings institutions include: a.Commercial Banks b.Credit Unions c.Savings and Loans…

A: Contractual savings institutions are intermediaries that purchase money on a contractual basis and…

Q: tatic Budget versus Flexible Budget The production supervisor of the Machining Department for…

A: The budget is prepared on the basis of estimated results for the business. The budget helps to plan…

Q: A machine is to be purchased for P155,000 it has an estimated life of 8 years and a salvage value of…

A: Given information, Purchase price=P155,000 Salvage value =P6000 Therefore, Future value (F)=P155,000…

Q: Levi Co. is calculating earnings per share for inclusion in the annual report to share holders. The…

A: Diluted Earning Per Share: The diluted earnings per share (diluted EPS) of a corporation is…

Q: Oblivion Corporation produced 10,000 units of Product A during the month of November. Costs incurred…

A: Absorption cost includes all the costing that is associated with production process whereas in…

Q: A business owner throwing out ruined supplies would result in: * A credit to Bank. A debit to…

A: Ruined supplies means the amount of supplies which is damaged and irreplaceable. Supplies is the…

Q: affected the ordinary shares February 1issued 120, 000 shares March 1issued a 20% share dividend…

A: Basic earnings per share is the amount of earning attributable to per share. It is calculated by…

Q: Curtent Attempt in Progress The management of Riverbed Industries estimates that credit sales for…

A: The term "credit sales" means the transfer of ownership of goods and services to a consumer with the…

Q: A company preparing for a Chapter 7 liquidation has listed the following liabilities: Note payable A…

A: The process of liquidating a business and transferring its assets to claimants is known as…

Q: QUESTION 3 Simple T's, Inc. sells plain T-shirts in a very competitve market and thus needs to price…

A: Formula: Sales = Target Total Costs + Target Profit

Q: The inventory of Royal Decking consisted of five products. Information about the December 31, 2021,…

A: The question is related to Inventory Valuation. The details are given regarding the same. The…

Q: Required information [The following information applies to the questions displayed below.] Victory…

A: In this question we compute Assign costs to the department's output-specifically, to the units…

Q: Prepare a Cash Flow Statement using the DIRECT Method. DO NOT use the INDIRECT Method Not all…

A: Using Direct Method of preparation of Statement of Cash Flows, Cash Collections and Cash payments…

Q: Your company declared $13,800 cash dividends on stock. There were $6,400 in dividends payable at the…

A: Formula: Dividends paid during the year = Beginning dividends + Dividends declared - Ending…

Q: A Company is contemplating the purchase of a new milling machine. The purchase price of the new…

A: Answer) The rate of return on investment will be the internal rate of return. This the rate at which…

Q: As part of its accounting process, estimated incon ed each month for 28% of the current month's net…

A: Companies estimates the uncertain amount for the benefits of employees like pension, vacation pay,…

Q: Which financial item of a bank is audited when the auditor pays particular attention to establishing…

A: During the audit, auditor should perform procedures to obatian reasonable assurance about the item…

Q: The assets and liabilities of Matt Wesley Auto Shop are as follows: Cash, S10,000; Accounts…

A: Since Basic accounts equation is Assets = Liabilities + Owners Equity

Q: Net Income (Loss) $ 185, 000 179, 600 157, 250 188, 100 Interest Expense $ 59, 200 80, 820 44,030…

A: Times interest Earned = EBIT / Interest Expense The company with the highest Times Interest Earned…

Q: Rox Corp planned and actually produced 100,000 units of its only product in 2021, its first year of…

A: Variable costing is also known as Marginal costing. Under variable costing, only variable cost is…

Q: what-type-of-analysis-is-indicated-by-the-following

A: Horizontal analysis is a type of financial statements that examines historical data throughout many…

Q: You are the Senior Financial Accountant of Smarties (Pty) Ltd – a distributor of party foods and…

A: Here information given for the different users of the business and important information which are…

Q: The following revenue data were taken from the December 31, 2017, Coca-Cola annual report (10-K):…

A: The total sales revenues are reported in the income statement of the company. The income statement…

Q: Use the information below to answer the two questions that follow. A company provides delivery…

A: Variance analysis is a vital tool used by managers to control cost.

Q: Swifty Company expects to produce 1,464,000 units of Product XX in 2022. Monthly production is…

A: Budget means the expected value of future. Budget is not affected by the actual value as it is…

Q: Jake's Röof Repair has provided the following data concerning its costs: Fixed Coet Wages and…

A: Flexible Budget Particulars Activity = 2700 hours Activity = 2600 hours Hours Worked 2700 2600…

Q: ABC Company acquired all of XYZ Corporation’s assets and liabilities on June 30, 20X1. XYZ reported…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Budgeted variable overheads = Rs. 8,00,000 Budgeted fixed overheads 5,00,000 Overheads are recovered…

A:

Q: Analyze each of the following transactions: (a) the copier's sale; (b) the adjustment to recognize…

A: Warranty expense are costs associated with repairing a defective product, replacement, or return.…

Q: Even though most corporate bonds in Canada and the United States make coupon payments semiannually,…

A: The bond price is calculated as present value of cash flows from the bond

Q: Bee, Cee and Dee, accountants, agree to form a partnership and to share profits in the ratio of…

A: The question requires the amount that need to be credited into Bee's capital account from Net…

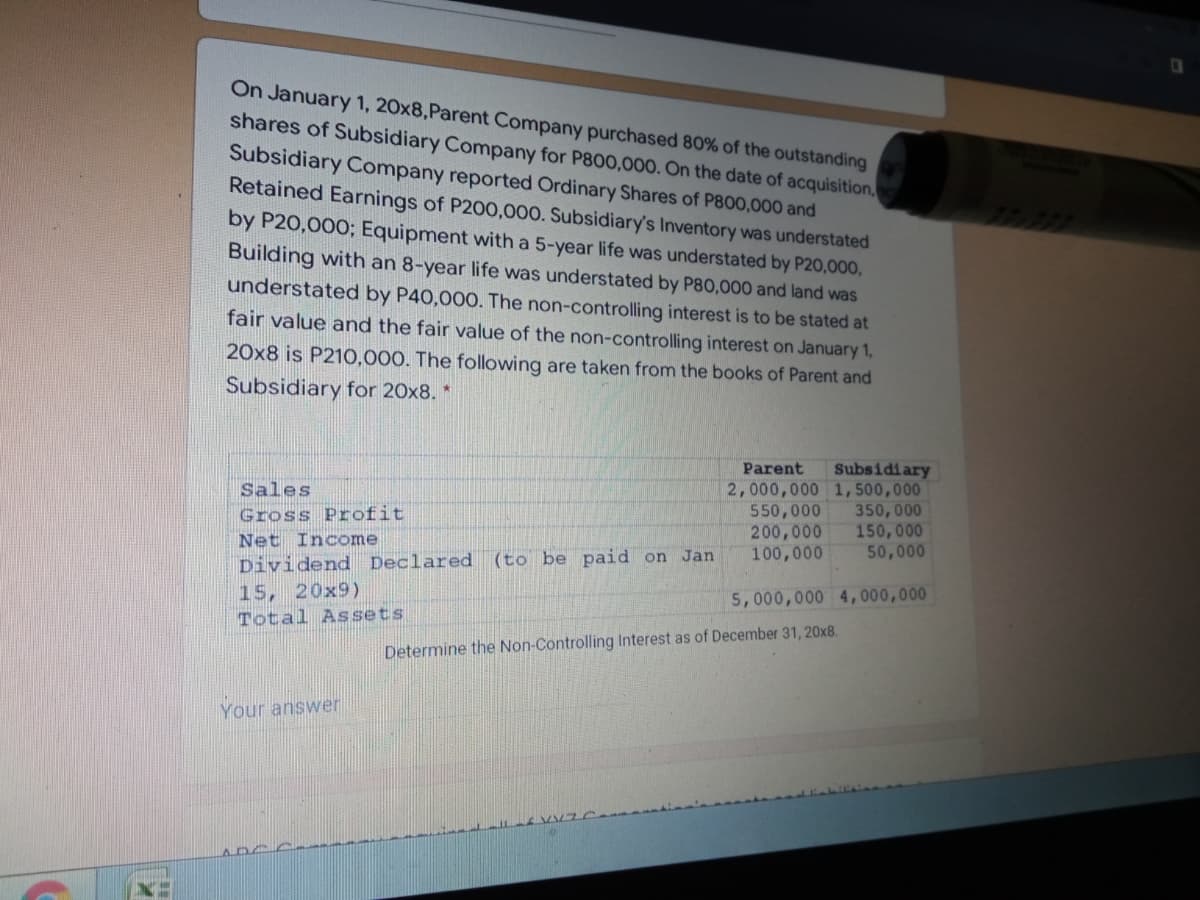

Q: On January 1, 20x8,Parent Company purchased 80% of the outstanding shares of Subsidiary Company for…

A: Non-controlling interest refers to those shareholders that hold less than 50% of the shareholding of…

Q: Chiyeyeye Enterprises Ltd sells equestrian boots and has three brands: Riding boots, work boots and…

A: The question is based on the concept of Cost Accounting.

Q: s 40%. The company has not yet recorded its 2020 income tax expense and payable amounts so…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Net Income Interest (Loss) $ 185, 000 179, 600 157, 250 188, 100 Expense $ 59,200 80, 820 44, 030…

A: The question requires the calculation of times interest earned ratio. Times interest earned ratio is…

Q: On January 1, 2021, had 2, 000, 0000 ordinary shares outstanding. On July 1, 2021, the entity issued…

A: Diluted earnings per share refers to a company’s per-share profit based on the number of common…

Q: Hoi Chong Transport, Ltd., operates a fleet of delivery trucks in Singapore. The company has…

A: The question is related to High-low method of segregation of Cost into Variable cost and Fixed cost…

Step by step

Solved in 2 steps with 2 images

- On January 1, 20x8, Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. During the year, Parent sold goods to Subsidiary for P150,000 at a 25% mark-up and in turn purchased P200,000 of Subsidiary’s goods which Subsidiary sold at a 20% mark-up. From the goods purchased, P50,000 remain in Parent’s books at the end of the year, while P20,000 remain in Subsidiary’s books at the end of the year. 30% of the undervalued inventory of Subsidiary still remain unsold by the end of 20x8. The following are…On January 1, 20x8,Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. The following are taken from the books of Parent and Subsidiary for 20x8: Determine the Non-Controlling Interest as of December 31, 20x8. Your answerOn January 1, 20x8,Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. The following are taken from the books of Parent and Subsidiary for 20x8. 1. Determine the Non-Controlling Interest as of December 31, 20x8. 2.

- On January 1, 20x8,Parent Company purchased 80% of the outstanding shares of Subsidiary Company for P800,000. On the date of acquisition, Subsidiary Company reported Ordinary Shares of P800,000 and Retained Earnings of P200,000. Subsidiary’s Inventory was understated by P20,000; Equipment with a 5-year life was understated by P20,000, Building with an 8-year life was understated by P80,000 and land was understated by P40,000. The non-controlling interest is to be stated at fair value and the fair value of the non-controlling interest on January 1, 20x8 is P210,000. The following are taken from the books of Parent and Subsidiary for 20x8. 1) From the given data, determine the total assets as of December 31, 20x1. 2) From the given data, assuming the retained earning of Subsidiary on December 31, 20x11 is P350,000, determine the non-controlling interest to be reported in the consolidated financial statements on December 31, 20x11 assuming no changes to Subsidiary company’s ordinary…On January 1, 20x1, Pine Corp acquired 75% interest in Sine Inc. for P2,400,000. On that date Sine Ordinary share and Retained earnings were P2,000,000 and P1,000,000. The non-controlling interest on the date of acquisition was P800,000. The assets and liabilities of Sine’s book values approximates their fair values except for the inventories and equipment which were undervalued by P30,000 and P50,000, respectively. The equipment has a remaining estimated life of five years. On October 1, 20x1, Sine Inc. sold equipment to Pine Corp. costing P300,000 with accumulated depreciation of P120,000 for P200,000. The remaining useful life of equipment was 4 years. In year 20x1, the goodwill is impaired by P5,000. On April 30, 20x2, Pine Corp. sold equipment to Sine Inc, costing P500,000 with accumulated depreciation P100,000 for P300,000. The remaining estimated life of equipment was five years. The following information were extracted from the separate financial statements of Pine and Sine for…Parent Company acquired 15% of Subsidiary Company’s common stock for P500,000 cash and carried the investment using the cost method. A few months later, Parent purchased another 60% of Subsidiary’s stock for P2,160,000. At that date, Subsidiary had identifiable assets of P3,900,000 and a fair value of P5,100,000, and had liabilities with a book value and fair value of P1,900,000. The fair value of the 25% non-controlling interest is P900,000.The amount of goodwill to be recognized resulting from this combination: A. 400,000 B. 84,000 C. 100,000 D. 300,000

- Parent Company acquired 15% of Subsidiary Company’s common stock for P500,000 cash and carried the investment using the cost method. A few months later, Parent purchased another 60% of Subsidiary’s stock for P2,160,000. At that date, Subsidiary had identifiable assets of P3,900,000 and a fair value of P5,100,000, and had liabilities with a book value and fair value of P1,900,000. The fair value of the 25% non-controlling interest is P900,000.The amount of goodwill to be recognized resulting from this combination:On January 2, 2022, Parent Company purchased 90% of the outstanding shares of Subsidiary Company by paying P300,000. On this date, Subsidiary had Share Capital and Retained Earnings amounting to P150,000 and P230,000 respectively. Also, on this date, an equipment was undervalued by P20,000 with remaining useful life of 10 years. On the same date, Parent had P1,000,000 of Share Capital and P700,000 of Retained Earnings. The parent opted to measure the NCI using proportionate share. Parent and Subsidiary reported the following for the year ended December 31, 2022 (see image below).On July 31, 2022, Parent sold a machinery with a 5-year remaining useful life costing P1,500,000 with accumulated depreciation of P1,000,000 for P530,000 to Subsidiary. Questions:a. How much is the Consolidated Retained Earnings at December 31, 2022? b. How much is the Consolidated Net Income? .....On January 2, 2022, Parent Company purchased 90% of the outstanding shares of Subsidiary Company by paying P300,000. On this date, Subsidiary had Share Capital and Retained Earnings amounting to P150,000 and P230,000 respectively. Also, on this date, an equipment was undervalued by P20,000 with remaining useful life of 10 years. On the same date, Parent had P1,000,000 of Share Capital and P700,000 of Retained Earnings. The parent opted to measure the NCI using proportionate share. Parent and Subsidiary reported the following for the year ended December 31, 2022 (see image below).On July 31, 2022, Parent sold a machinery with a 5-year remaining useful life costing P1,500,000 with accumulated depreciation of P1,000,000 for P530,000 to Subsidiary. Questions: a. How much is the Net Income Attributable to Parent? b. How much is the Net Income Attributable to NCI? .......

- Parent Company acquired 80% of the outstanding shares of Subsidiary Company for 4,500,000 on January 2, 2020 and paid P50,000 for direct acquisition related costs. On this date, Subsidiary Company’s stockholders’ equity was composed of: Share Capital – P2,000,000; Share Premium – P1,200,000 and Retained Earnings – P1,600,000. The excess of cost over book value was allocated as follows: 10% to undervalued inventory, 40% to over depreciated fixed assets which has a remaining life of 5 years and the remainder to goodwill. Subsidiary reported net income of P200,000 and paid dividends of P150,000 in 2020. The impairment on goodwill for 2020 was reported to be P5,000. The NCI in the consolidated balance sheet on December 31, 2020 is?On January 1, 2022, Pet Company purchased 80% of the shares of Sam Company for P1,000,000. The shareholders' equity of Sam Company on that date showed: Ordinary Shares - P570,000 and Retained Earnings - P490,000. Non-controlling interest is initially measured at proportionate share of subsidiary's net assets.On April 30, 2022, Pet acquired used machinery for P84,000 from Sam that was being carried in the latter's books at P105,000. The asset still has a remaining useful life of 5 years. On the other hand, on August 31, 2022, Sam purchased an equipment that was already 20% depreciated from Pet for P345,000. The original cost of this equipment was P375,000 and had a remaining life of 8 years.Net income of Pet Company and Sam Company for 2022 amounted to P360,000 and P155,000. Dividends paid totaled to P115,000 and P52,500 for Pet and Sam, respectively.Required:On the consolidated financial statements in 2022, how much would be the Net income attributable to parents' shareholders'…On January 1, 2022, Pet Company purchased 80% of the shares of Sam Company for P1,000,000. The shareholders' equity of Sam Company on that date showed: Ordinary Shares - P570,000 and Retained Earnings - P490,000. Non-controlling interest is initially measured at proportionate share of subsidiary's net assets.On April 30, 2022, Pet acquired used machinery for P84,000 from Sam that was being carried in the latter's books at P105,000. The asset still has a remaining useful life of 5 years. On the other hand, on August 31, 2022, Sam purchased an equipment that was already 20% depreciated from Pet for P345,000. The original cost of this equipment was P375,000 and had a remaining life of 8 years.Net income of Pet Company and Sam Company for 2022 amounted to P360,000 and P155,000. Dividends paid totaled to P115,000 and P52,500 for Pet and Sam, respectively.Required:On the consolidated financial statements in 2022, how much would be the Non-controlling interest in net asset of subsidiary…