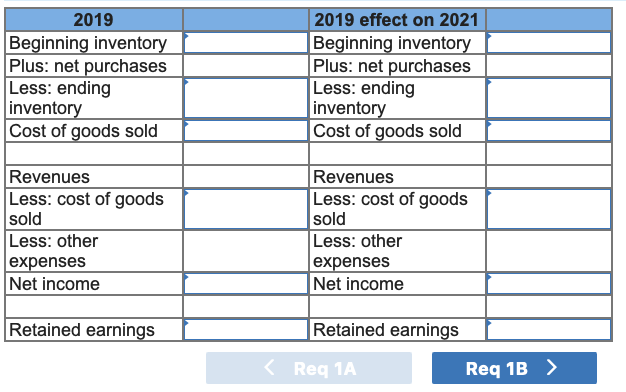

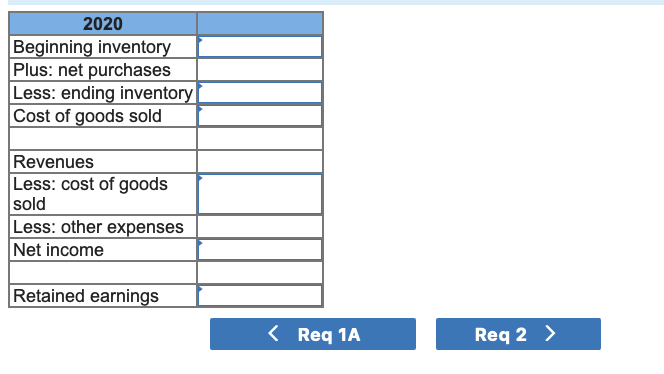

During 2021, WMC Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts: 2019 understated by $ 142,000 2020 overstated by 194,000 WMC uses the periodic inventory system and the FIFO cost method. Required: 1-a. Determine the effect of 2019 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 1-b. Determine the effect of 2020 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the error in 2021. 3. Will WMC account for the error (a) retrospectively or (b) prospectively?

During 2021, WMC Corporation discovered that its ending inventories reported on its financial statements were misstated by the following amounts:

| 2019 | understated by | $ | 142,000 | |

| 2020 | overstated by | 194,000 | ||

WMC uses the periodic inventory system and the FIFO cost method.

Required:

1-a. Determine the effect of 2019 errors on

1-b. Determine the effect of 2020 errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.)

2. Prepare a

3. Will WMC account for the error (a) retrospectively or (b) prospectively?

a. & b. are attached images

c. & d. are below (they are short please please answer)

c. Record correction of error journal entry form.

d. Will WMC account for the error (a) retrospectively or (b) prospectively?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps