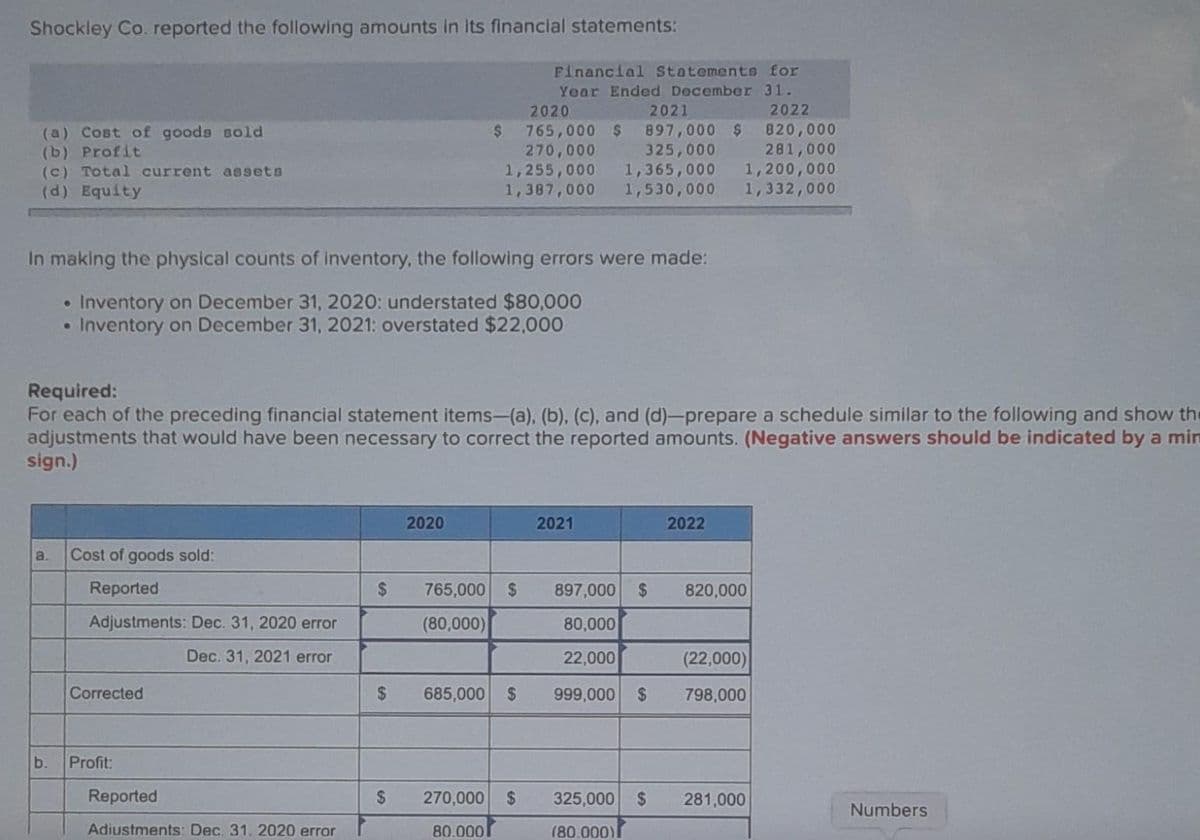

Shockley Co. reported the following amounts in its financial statements: (a) Cost of goods sold (b) Profit (c) Total current assets (d) Equity In making the physical counts of inventory, the following errors were made: • Inventory on December 31, 2020: understated $80,000 • Inventory on December 31, 2021: overstated $22,000 Required: For each of the preceding financial statement items-(a), (b), (c), and (d)-prepare a schedule similar to the following and show the adjustments that would have been necessary to correct the reported amounts. (Negative answers should be indicated by a min sign.) a. Cost of goods sold: Reported Adjustments: Dec. 31, 2020 error Dec. 31, 2021 error Corrected b. Profit: Reported Adiustments: Dec. 31. 2020 error $ $ Financial Statements for Year Ended December 31. 2022 2020 2021 $ 765,000 $ 897,000 $ 820,000 270,000 325,000 281,000 1,255,000 1,365,000 1,200,000 1,387,000 1,530,000 1,332,000 $ 2020 765,000 $ (80,000) 2021 270,000 $ 80.000 685,000 $ 999,000 $ 897,000 $ 820,000 80,000 22,000 2022 325,000 $ (80.000) (22,000) 798,000 281,000 Numbers

Shockley Co. reported the following amounts in its financial statements: (a) Cost of goods sold (b) Profit (c) Total current assets (d) Equity In making the physical counts of inventory, the following errors were made: • Inventory on December 31, 2020: understated $80,000 • Inventory on December 31, 2021: overstated $22,000 Required: For each of the preceding financial statement items-(a), (b), (c), and (d)-prepare a schedule similar to the following and show the adjustments that would have been necessary to correct the reported amounts. (Negative answers should be indicated by a min sign.) a. Cost of goods sold: Reported Adjustments: Dec. 31, 2020 error Dec. 31, 2021 error Corrected b. Profit: Reported Adiustments: Dec. 31. 2020 error $ $ Financial Statements for Year Ended December 31. 2022 2020 2021 $ 765,000 $ 897,000 $ 820,000 270,000 325,000 281,000 1,255,000 1,365,000 1,200,000 1,387,000 1,530,000 1,332,000 $ 2020 765,000 $ (80,000) 2021 270,000 $ 80.000 685,000 $ 999,000 $ 897,000 $ 820,000 80,000 22,000 2022 325,000 $ (80.000) (22,000) 798,000 281,000 Numbers

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 59E: Effects of an Error in Ending Inventory Waymire Company prepared the partial income statements...

Related questions

Question

Transcribed Image Text:Shockley Co. reported the following amounts in its financial statements:

(a) Cost of goods sold

(b) Profit

(c) Total current assets

(d) Equity

a.

Cost of goods sold:

Reported

Adjustments: Dec. 31, 2020 error

Dec. 31, 2021 error

In making the physical counts of inventory, the following errors were made:

• Inventory on December 31, 2020: understated $80,000

• Inventory on December 31, 2021: overstated $22,000

Corrected

b. Profit:

Required:

For each of the preceding financial statement items-(a), (b), (c), and (d)-prepare a schedule similar to the following and show the

adjustments that would have been necessary to correct the reported amounts. (Negative answers should be indicated by a min

sign.)

Reported

Adiustments: Dec. 31. 2020 error

$

$

$

$

2020

Financial Statements for

Year Ended December 31.

2022

820,000

281,000

2020

2021

765,000 $ 897,000 $

270,000 325,000

1,255,000 1,365,000

1,387,000 1,530,000

270,000 $

80.0001

2021

1,200,000

1,332,000

2022

765,000 $ 897,000 $ 820,000

(80,000)

80,000

22,000

685,000 $ 999,000 $

(22,000)

798,000

325,000 $ 281,000

(80.000)

Numbers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College