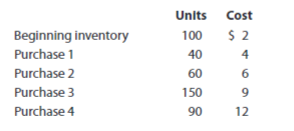

During July 2014, Leesburg, Inc., sold 250 units of its product Empire for $4,000. The following units were available (see image). A sale of 250 units was made after purchase 3. Of the units sold, 100 came from begin-ning inventory and 150 came from purchase 3.Determine cost of goods available for sale and ending inventory in units. Then determine the costs that should be assigned to cost of goods sold and ending inventory under each of the following assumptions: (For each alternative, show the gross margin. Round unit costs to the nearest cent and totals to dollars.) 1.Costs are assigned under the periodic inventory system using (a) the specific iden-tification method, (b) the average-cost method, (c) the FIFO method, and (d) the LIFO method. 2.Costs are assigned under the perpetual inventory system using (a) the average-cost method, (b) the FIFO method, and (c) the LIFO method.

During July 2014, Leesburg, Inc., sold 250 units of its product Empire for $4,000. The following units were available (see image).

A sale of 250 units was made after purchase 3. Of the units sold, 100 came from begin-ning inventory and 150 came from purchase 3.Determine cost of goods available for sale and ending inventory in units. Then determine the costs that should be assigned to cost of goods sold and ending inventory under each of the following assumptions: (For each alternative, show the gross margin. Round unit costs to the nearest cent and totals to dollars.)

1.Costs are assigned under the periodic inventory system using (a) the specific iden-tification method, (b) the average-cost method, (c) the FIFO method, and (d) the LIFO method.

2.Costs are assigned under the perpetual inventory system using (a) the average-cost method, (b) the FIFO method, and (c) the LIFO method.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 11 images