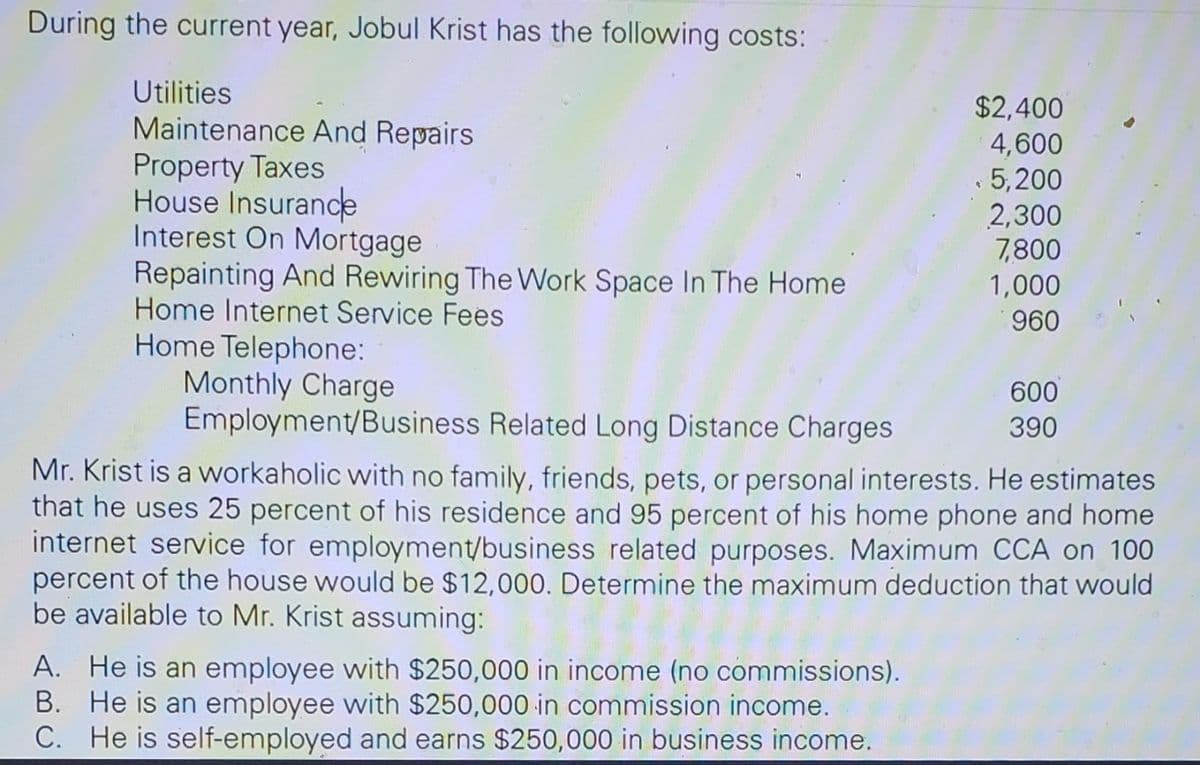

During the current year, Jobul Krist has the following costs: Utilities Maintenance And Repairs Property Taxes House Insurance Interest On Mortgage Repainting And Rewiring The Work Space In The Home Home Internet Service Fees Home Telephone: Monthly Charge Employment/Business Related Long Distance Charges $2,400 4,600 5,200 2,300 7,800 1,000 960 A. He is an employee with $250,000 in income (no commissions). B. He is an employee with $250,000 in commission income. C. He is self-employed and earns $250,000 in business income. 600 390 Mr. Krist is a workaholic with no family, friends, pets, or personal interests. He estimates that he uses 25 percent of his residence and 95 percent of his home phone and home internet service for employment/business related purposes. Maximum CCA on 100 percent of the house would be $12,000. Determine the maximum deduction that would be available to Mr. Krist assuming:

During the current year, Jobul Krist has the following costs: Utilities Maintenance And Repairs Property Taxes House Insurance Interest On Mortgage Repainting And Rewiring The Work Space In The Home Home Internet Service Fees Home Telephone: Monthly Charge Employment/Business Related Long Distance Charges $2,400 4,600 5,200 2,300 7,800 1,000 960 A. He is an employee with $250,000 in income (no commissions). B. He is an employee with $250,000 in commission income. C. He is self-employed and earns $250,000 in business income. 600 390 Mr. Krist is a workaholic with no family, friends, pets, or personal interests. He estimates that he uses 25 percent of his residence and 95 percent of his home phone and home internet service for employment/business related purposes. Maximum CCA on 100 percent of the house would be $12,000. Determine the maximum deduction that would be available to Mr. Krist assuming:

Chapter3: Social Security Taxes

Section: Chapter Questions

Problem 4SSQ: Lori Kinmark works as a jeweler for a local company. She earns 1,000 per week, plus a year-end bonus...

Related questions

Question

Transcribed Image Text:During the current year, Jobul Krist has the following costs:

Utilities

Maintenance And Repairs

Property Taxes

House Insurance

Interest On Mortgage

Repainting And Rewiring The Work Space In The Home

Home Internet Service Fees

Home Telephone:

Monthly Charge

Employment/Business Related Long Distance Charges

$2,400

4,600

5,200

A. He is an employee with $250,000 in income (no commissions).

He is an employee with $250,000 in commission income.

B.

C. He is self-employed and earns $250,000 in business income.

2,300

7,800

1,000

960

600

390

Mr. Krist is a workaholic with no family, friends, pets, or personal interests. He estimates

that he uses 25 percent of his residence and 95 percent of his home phone and home

internet service for employment/business related purposes. Maximum CCA on 100

percent of the house would be $12,000. Determine the maximum deduction that would

be available to Mr. Krist assuming:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT