For each requirement, change the values of the given information as shown and keep all other original data the same. Then enter your updated final answers for each scenario. Scenario A: Future value to be received $ 10,000 Future date received 3 years Discount Rate 6% 10% 16% Scenario B: Annual Cash Receipt $ 5,000 Number of Years 6 years Discount Rate 6% 10% 16% Scenario C: Discount Rate 8% Investment Project Cash Flow Initial Investment $ (6,500) Year 1 $ 700 Year 2 $ 800 Year 3 $ 1,400 Year 4 $ 3,600 Year 5 $ 6,800 Required: a. A company is expecting to receive a lump sum of money at a future date from now. Using the PV formula in Excel, what is the Present Value of that money at three different rates? (Round your answers to 2 decimal places.)

For each requirement, change the values of the given information as shown and keep all other original data the same. Then enter your updated final answers for each scenario. Scenario A: Future value to be received $ 10,000 Future date received 3 years Discount Rate 6% 10% 16% Scenario B: Annual Cash Receipt $ 5,000 Number of Years 6 years Discount Rate 6% 10% 16% Scenario C: Discount Rate 8% Investment Project Cash Flow Initial Investment $ (6,500) Year 1 $ 700 Year 2 $ 800 Year 3 $ 1,400 Year 4 $ 3,600 Year 5 $ 6,800 Required: a. A company is expecting to receive a lump sum of money at a future date from now. Using the PV formula in Excel, what is the Present Value of that money at three different rates? (Round your answers to 2 decimal places.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 11E

Related questions

Question

For each requirement, change the values of the given information as shown and keep all other original data the same. Then enter your updated final answers for each scenario.

Scenario A:

| Future value to be received | $ | 10,000 | |

| Future date received | 3 | years | |

| Discount Rate |

| 6% |

| 10% |

| 16% |

Scenario B:

| Annual Cash Receipt | $ | 5,000 | |

| Number of Years | 6 | years | |

| Discount Rate |

| 6% |

| 10% |

| 16% |

Scenario C:

Discount Rate 8%

| Investment Project | |||

| Initial Investment | $ | (6,500) | |

| Year 1 | $ | 700 | |

| Year 2 | $ | 800 | |

| Year 3 | $ | 1,400 | |

| Year 4 | $ | 3,600 | |

| Year 5 | $ | 6,800 | |

Required:

a. A company is expecting to receive a lump sum of money at a future date from now. Using the PV formula in Excel, what is the Present Value of that money at three different rates? (Round your answers to 2 decimal places.)

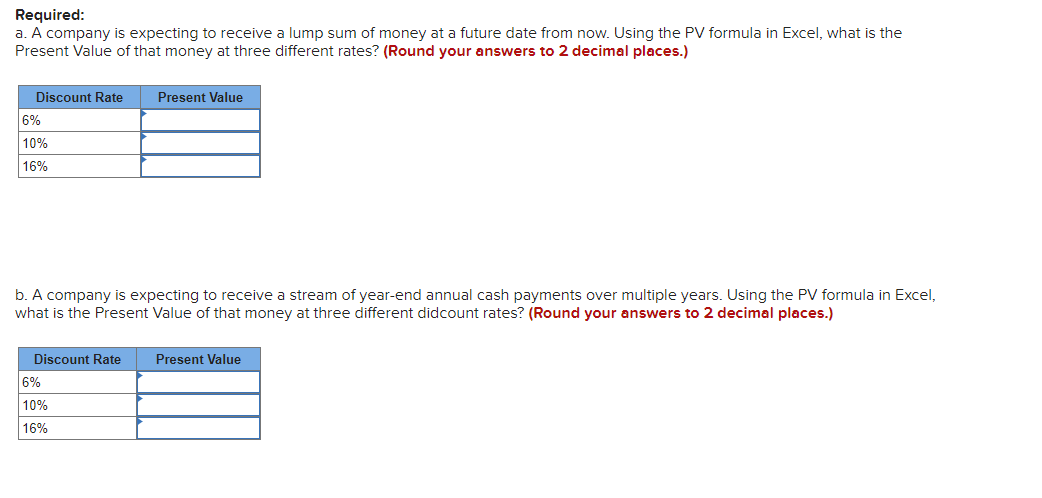

Transcribed Image Text:Required:

a. A company is expecting to receive a lump sum of money at a future date from now. Using the PV formula in Excel, what is the

Present Value of that money at three different rates? (Round your answers to 2 decimal places.)

Discount Rate

6%

10%

16%

b. A company is expecting to receive a stream of year-end annual cash payments over multiple years. Using the PV formula in Excel,

what is the Present Value of that money at three different didcount rates? (Round your answers to 2 decimal places.)

Discount Rate

Present Value

6%

10%

16%

Present Value

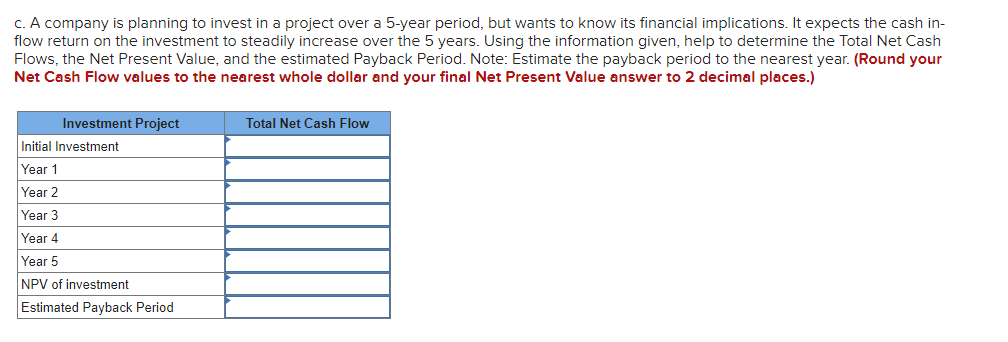

Transcribed Image Text:c. A company is planning to invest in a project over a 5-year period, but wants to know its financial implications. It expects the cash in-

flow return on the investment to steadily increase over the 5 years. Using the information given, help to determine the Total Net Cash

Flows, the Net Present Value, and the estimated Payback Period. Note: Estimate the payback period to the nearest year. (Round your

Net Cash Flow values to the nearest whole dollar and your final Net Present Value answer to 2 decimal places.)

Investment Project

Initial Investment

Year 1

Year 2

Year 3

Year 4

Year 5

NPV of investment

Estimated Payback Period

Total Net Cash Flow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub