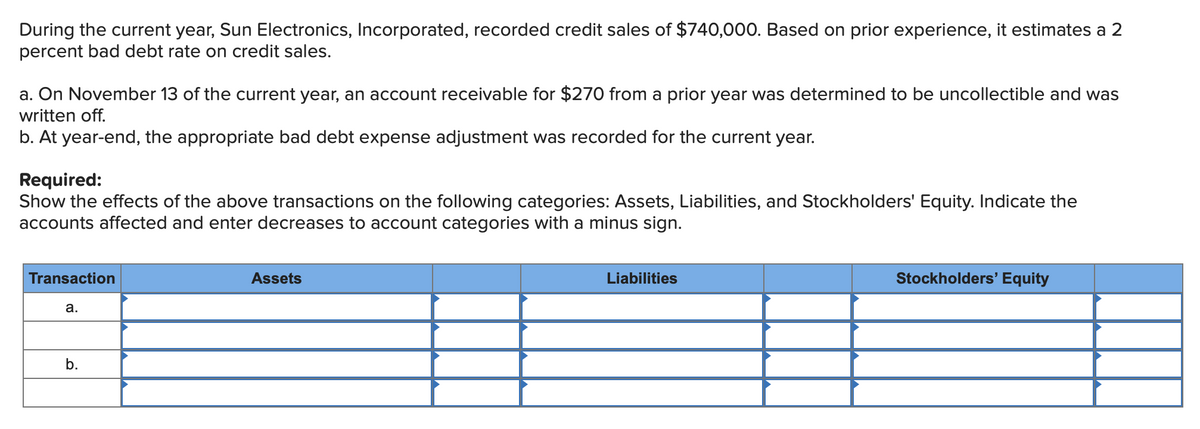

During the current year, Sun Electronics, Incorporated, recorded credit sales of $740,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. a. On November 13 of the current year, an account receivable for $270 from a prior year was determined to be uncollectible and was written off. b. At year-end, the appropriate bad debt expense adjustment was recorded for the current year. Required: Show the effects of the above transactions on the following categories: Assets, Liabilities, and Stockholders' Equity. Indicate the accounts affected and enter decreases to account categories with a minus sign. Transaction Assets Liabilities Stockholders' Equity а. b.

During the current year, Sun Electronics, Incorporated, recorded credit sales of $740,000. Based on prior experience, it estimates a 2 percent bad debt rate on credit sales. a. On November 13 of the current year, an account receivable for $270 from a prior year was determined to be uncollectible and was written off. b. At year-end, the appropriate bad debt expense adjustment was recorded for the current year. Required: Show the effects of the above transactions on the following categories: Assets, Liabilities, and Stockholders' Equity. Indicate the accounts affected and enter decreases to account categories with a minus sign. Transaction Assets Liabilities Stockholders' Equity а. b.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 2CE: Tonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit...

Related questions

Question

Please answer the question. I provided a picture's so I do not have to type out everything!

Transcribed Image Text:During the current year, Sun Electronics, Incorporated, recorded credit sales of $740,000. Based on prior experience, it estimates a 2

percent bad debt rate on credit sales.

a. On November 13 of the current year, an account receivable for $270 from a prior year was determined to be uncollectible and was

written off.

b. At year-end, the appropriate bad debt expense adjustment was recorded for the current year.

Required:

Show the effects of the above transactions on the following categories: Assets, Liabilities, and Stockholders' Equity. Indicate the

accounts affected and enter decreases to account categories with a minus sign.

Transaction

Assets

Liabilities

Stockholders' Equity

a.

b.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,