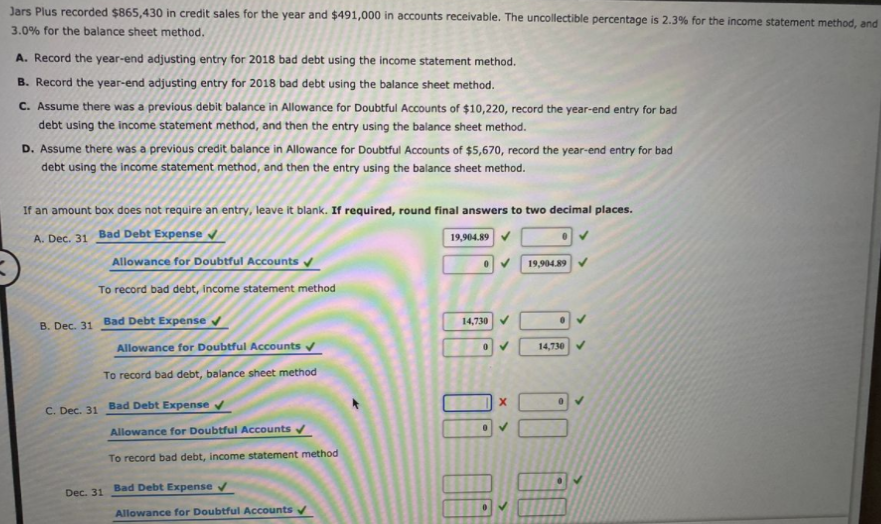

Jars Plus recorded $865,430 in credit sales for the year and $491,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,670, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 Bad Debt Expense v 19,904.89 Allowance for Doubtful Accounts 19,904.89 To record bad debt, income statement method B. Dec. 31 Bad Debt Expense v 14,730 V Allowance for Doubtful Accounts 14,730 V To record bad debt, balance sheet method C. Dec. 31 Bad Debt Expense v Allowance for Doubtful Accounts To record bad debt, income statement method Dec. 31 Bad Debt Expense v Allowance for Doubtful Accounts

Jars Plus recorded $865,430 in credit sales for the year and $491,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,670, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 Bad Debt Expense v 19,904.89 Allowance for Doubtful Accounts 19,904.89 To record bad debt, income statement method B. Dec. 31 Bad Debt Expense v 14,730 V Allowance for Doubtful Accounts 14,730 V To record bad debt, balance sheet method C. Dec. 31 Bad Debt Expense v Allowance for Doubtful Accounts To record bad debt, income statement method Dec. 31 Bad Debt Expense v Allowance for Doubtful Accounts

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 4PA: Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The...

Related questions

Question

Practice Pack

Transcribed Image Text:Jars Plus recorded $865,430 in credit sales for the year and $491,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and

3.0% for the balance sheet method.

A. Record the year-end adjusting entry for 2018 bad debt using the income statement method.

B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method.

C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad

debt using the income statement method, and then the entry using the balance sheet method.

D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,670, record the year-end entry for bad

debt using the income statement method, and then the entry using the balance sheet method.

If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places.

A. Dec. 31 Bad Debt Expense v

19,904.89

Allowance for Doubtful Accounts

19,904.89

To record bad debt, income statement method

B. Dec. 31 Bad Debt Expense v

14,730 V

Allowance for Doubtful Accounts

14,730 V

To record bad debt, balance sheet method

C. Dec. 31 Bad Debt Expense v

Allowance for Doubtful Accounts

To record bad debt, income statement method

Dec. 31 Bad Debt Expense v

Allowance for Doubtful Accounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning