During the U.S. financial crisis, the Fed used which of the following to have a significant impact upon long-term interest rates? I. Buying long-term treasury securities II. "Operation Twist" II. Commercial paper funding facilities Select one: only and Il only and III only d. L.ILand. economic fallout?", David Wessel of the Brookings Institution makes the following observations: I. Monetary policy, the Fed's emergency powers, and a large fiscal stimulus by Congress would be required The coronavirus crisis, unlike the previous financial crisis, was caused by an imbalance in the financial system II. Consumer spending was not a concern, since some businesses would make money in spite of the shutdown a. I only b. I and Il only C. I and III only d. I, II, and II 3. According to the article "Why Fed Officials Are Begging for More Stimulus", the Federal Reserve plans uses "forward guidance" to: I. Specify how long it tends to keep interest rates very low II. Provide information that will help stimulate the economy III. Reduce interest rates to less than zero percent if necessary a. ! only b. I and Il only C. I and III only d. I, II, and III 4. According to the article "Covid-19's Toll on U.S. Business? 200,000 Extra Closures", determining how many businesses have actually failed is difficult due to: I. Lags in the availability of official government data II. Temporary versus permanent business closures II. Duplicity on the part of reporting entities I only Lar and II only | and II only I, II, and III According to the video "What are Shadow Banks", which of the following is an example of a shadow bank? а. Most commercial banks, investment banks, and hedge funds Investment banks, hedge funds, and money market funds C. Money market funds, FDIC insured banks, and issuers of asset-backed securities d. Issuers of asset-backed securities, investment banks, and regulated traditional banks

During the U.S. financial crisis, the Fed used which of the following to have a significant impact upon long-term interest rates? I. Buying long-term treasury securities II. "Operation Twist" II. Commercial paper funding facilities Select one: only and Il only and III only d. L.ILand. economic fallout?", David Wessel of the Brookings Institution makes the following observations: I. Monetary policy, the Fed's emergency powers, and a large fiscal stimulus by Congress would be required The coronavirus crisis, unlike the previous financial crisis, was caused by an imbalance in the financial system II. Consumer spending was not a concern, since some businesses would make money in spite of the shutdown a. I only b. I and Il only C. I and III only d. I, II, and II 3. According to the article "Why Fed Officials Are Begging for More Stimulus", the Federal Reserve plans uses "forward guidance" to: I. Specify how long it tends to keep interest rates very low II. Provide information that will help stimulate the economy III. Reduce interest rates to less than zero percent if necessary a. ! only b. I and Il only C. I and III only d. I, II, and III 4. According to the article "Covid-19's Toll on U.S. Business? 200,000 Extra Closures", determining how many businesses have actually failed is difficult due to: I. Lags in the availability of official government data II. Temporary versus permanent business closures II. Duplicity on the part of reporting entities I only Lar and II only | and II only I, II, and III According to the video "What are Shadow Banks", which of the following is an example of a shadow bank? а. Most commercial banks, investment banks, and hedge funds Investment banks, hedge funds, and money market funds C. Money market funds, FDIC insured banks, and issuers of asset-backed securities d. Issuers of asset-backed securities, investment banks, and regulated traditional banks

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: The Influence Of Monetary And Fiscal Policy On Aggregate Demand

Section: Chapter Questions

Problem 2PA

Related questions

Question

F2

Transcribed Image Text:ACning to the article "Why Fed Officials Are

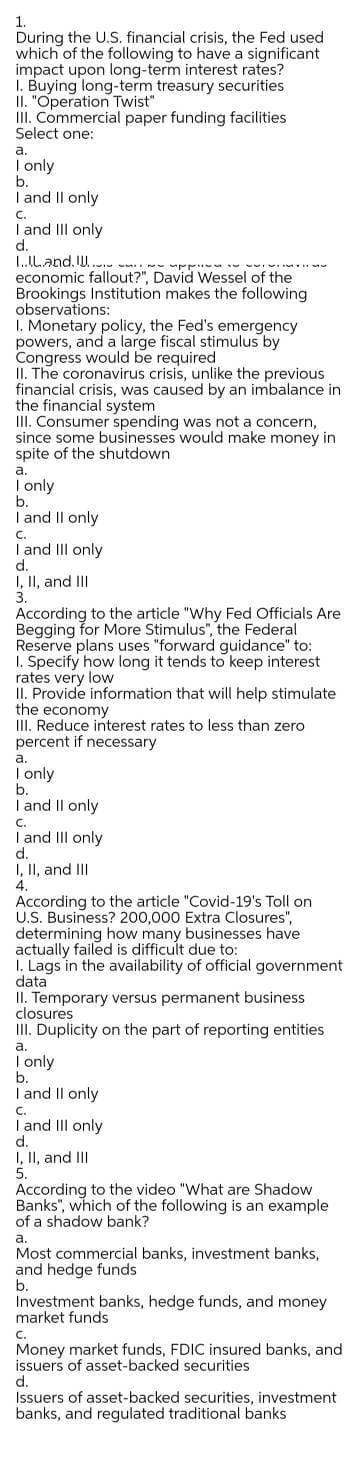

1.

During the U.S. financial crisis, the Fed used

which of the following to have a significant

impact upon long-term interest rates?

I. Buying long-term treasury securities

II. "Operation Twist"

III. Commercial paper funding facilities

Select one:

а.

I only

b.

I and Il only

C.

I and II only

d.

L.ILand. IU.

economic fallout?", David Wessel of the

Brookings Institution makes the following

observations:

1. Monetary policy, the Fed's emergency

powers, and a large fiscal stimulus by

Congress would be required

II. The coronavirus crisis, unlike the previous

financial crisis, was caused by an imbalance in

the financial system

III. Consumer spending was not a concern,

since some businesses would make money in

spite of the shutdown

а.

| only

b.

I and Il only

C.

I and III only

I, II, and II

3.

for More Stimulus", the Federal

Reserve plans uses "forward guidance" to:

I. Specify how long it tends to keep interest

rates very low

II. Provide information that will help stimulate

the economy

III. Reduce interest rates to less than zero

percent if necessary

а.

| only

b.

I and Il only

C.

I and II only

d.

I, II, and III

4.

According to the article "Covid-19's Toll on

U.S. Business? 200,000 Extra Closures",

determining how many businesses have

actually failed is difficult due to:

1. Lags in the availability of official government

data

II. Temporary versus permanent business

closures

Duplicity on the part of reporting entities

а.

Tonly

b.

I and Il only

C.

I and III only

I, II, and III

5.

According to the video "What are Shadow

Banks", which of the following is an example

of a shadow bank?

а.

Most commercial banks, investment banks,

and hedge funds

b.

Investment banks, hedge funds, and money

market funds

C.

Money market funds, FDIC insured banks, and

issuers of asset-backed securities

d.

Issuers of asset-backed securities, investment

banks, and regulated traditional banks

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning