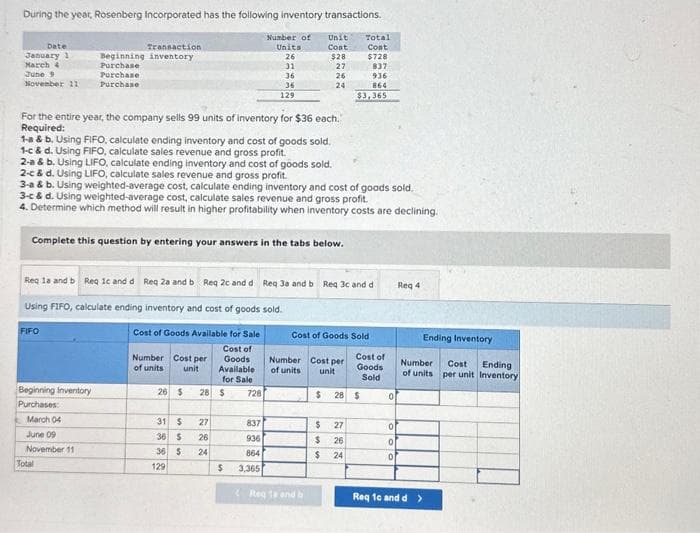

During the year, Rosenberg Incorporated has the following inventory transactions. Number of Unit Cost $28 27 Transaction Beginning inventory Purchase Purchase November 11 Purchase Date January 1 March 4 June 9 Units 26 31 36 36 129 26 24 For the entire year, the company sells 99 units of inventory for $36 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. Total Cont $728 837 936 864 $3,365

During the year, Rosenberg Incorporated has the following inventory transactions. Number of Unit Cost $28 27 Transaction Beginning inventory Purchase Purchase November 11 Purchase Date January 1 March 4 June 9 Units 26 31 36 36 129 26 24 For the entire year, the company sells 99 units of inventory for $36 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. Total Cont $728 837 936 864 $3,365

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 51E: Inventory Costing Methods On June 1, Welding Products Company had a beginning inventory of 210 cases...

Related questions

Topic Video

Question

Hh1.

Account

Transcribed Image Text:During the year, Rosenberg Incorporated has the following inventory transactions.

Number of

Units

26

31

36

36

129

Date

January 1

March 4

June 9

November 11

Transaction

Beginning inventory

Purchase

Purchase

Purchase

Beginning Inventory

Purchases:

March 04

June 09

November 11

Total

For the entire year, the company sells 99 units of inventory for $36 each.

Required:

1-a & b. Using FIFO, calculate ending inventory and cost of goods sold.

1-c & d. Using FIFO, calculate sales revenue and gross profit.

2-a & b. Using LIFO, calculate ending inventory and cost of goods sold.

2-c& d. Using LIFO, calculate sales revenue and gross profit.

3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold.

3-c & d. Using weighted-average cost, calculate sales revenue and gross profit.

4. Determine which method will result in higher profitability when inventory costs are declining.

Complete this question by entering your answers in the tabs below.

Req 1a and b Req 1c and d Req Za and b Req 2c and d Req 3a and b Req 3c and d

Using FIFO, calculate ending inventory and cost of goods sold.

FIFO

Cost of Goods Available for Sale

Cost of

Goods

Available

for Sale

Number Cost per

of units unit

26 $

31 $

36 $

36 $

129

28 $

27

26

24

$

728

837

936

864

3,365

Unit Total

Cont

$728

837

Cost

$28

27

26

24

S

Cost of Goods Sold

Number Cost per

of units unit

Req 18 and b

936

864

$3,365

$ 27

$ 26

$24

Cost of

Goods

Sold

$ 28 $

0

0

0

0

Req 4

Ending Inventory

Number Cost Ending

of units per unit Inventory

Req 10 and d >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT