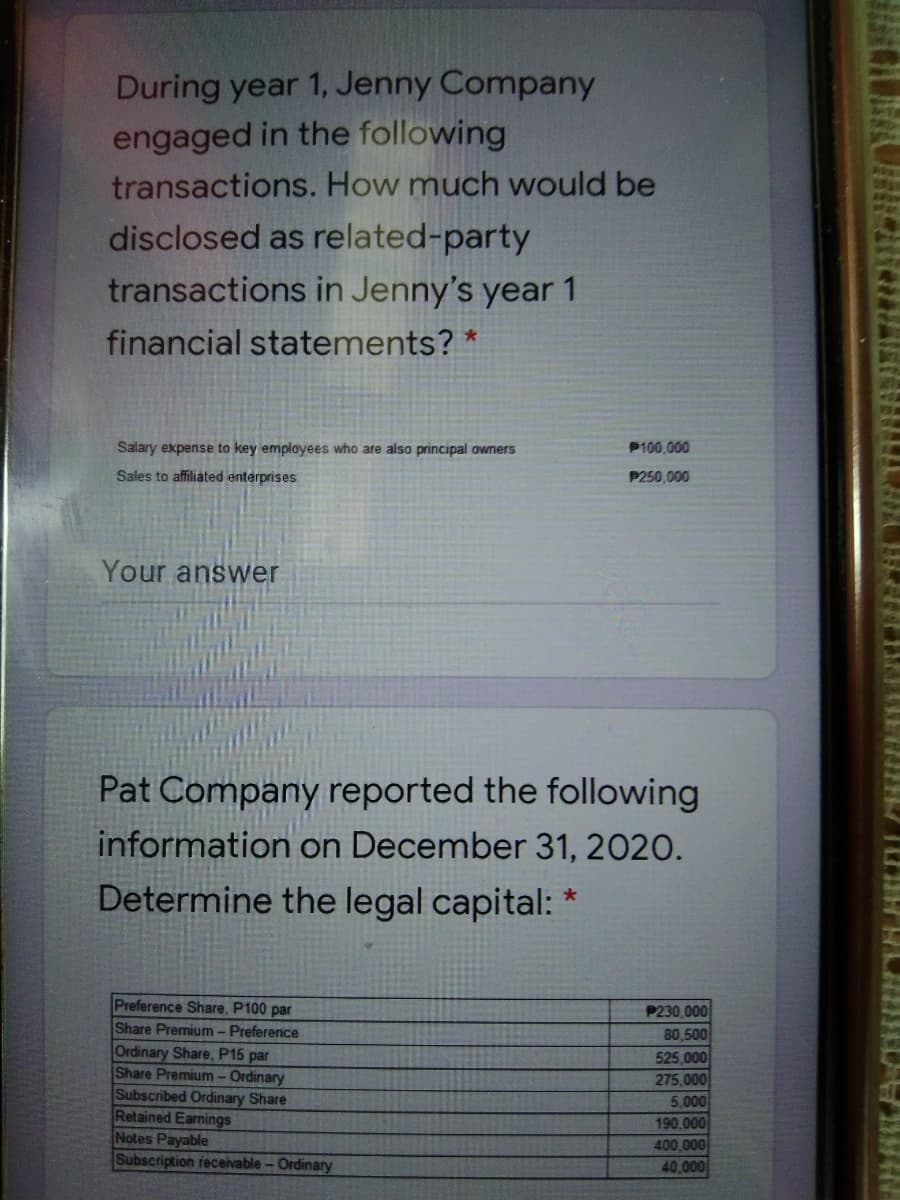

During year 1, Jenny Company engaged in the following transactions. How much would be disclosed as related-party transactions in Jenny's year 1 financial statements? * Salary expense to key employees who are also principal owners P100,000 Sales to affiliated enterprises P250,000

During year 1, Jenny Company engaged in the following transactions. How much would be disclosed as related-party transactions in Jenny's year 1 financial statements? * Salary expense to key employees who are also principal owners P100,000 Sales to affiliated enterprises P250,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:During year 1, Jenny Company

engaged in the following

transactions. How much would be

disclosed as related-party

transactions in Jenny's year 1

financial statements? *

Salary expense to key employees who are also principal owners

P100,000

Sales to affiliated enterprises

P250,000

Your answer

Pat Company reported the following

information on December 31, 2020.

Determine the legal capital:

Preference Share, P100 par

Share Premium - Preference

Ordinary Share, P15 par

Share Premium -Ordinary

Subscribed Ordinary Share

Retained Earnings

Notes Payable

Subscription receivable-Ordinary

P230,000

80,500

525,000

275,000

5,000

190.000

400,000

40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning