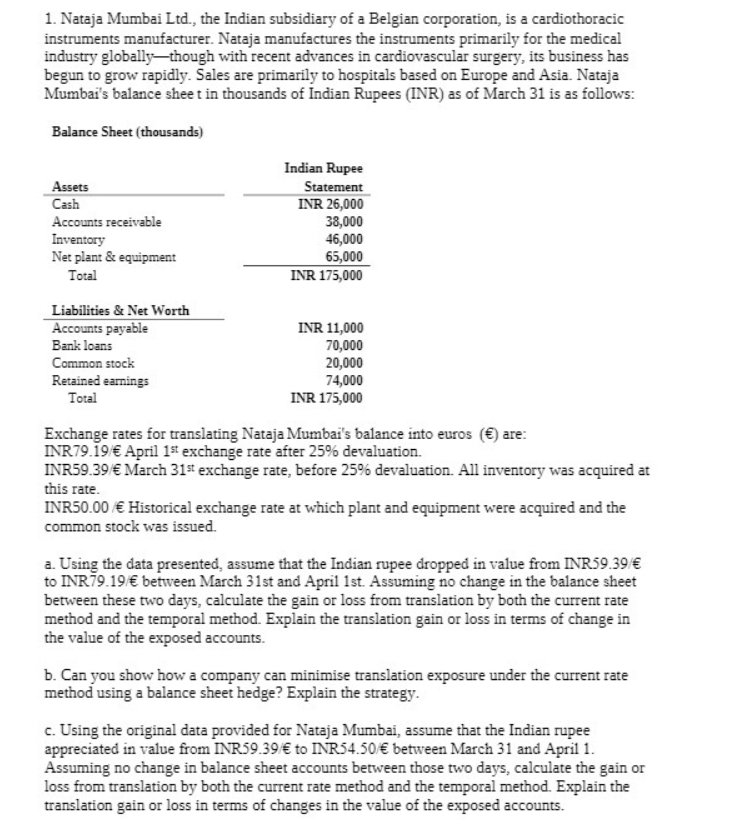

1. Nataja Mumbai Ltd., the Indian subsidiary of a Belgian corporation, is a cardiothoracic instruments manufacturer. Nataja manufactures the instruments primarily for the medical industry globally-though with recent advances in cardiovascular surgery, its business has begun to grow rapidly. Sales are primarily to hospitals based on Europe and Asia. Nataja Mumbai's balance shee t in thousands of Indian Rupees (INR) as of March 31 is as follows: Balance Sheet (thousands) Indian Rupee Statement INR 26,000 38,000 46,000 65,000 INR 175,000 Assets Cash Accounts receivable Inventory Net plant & equipment Total Liabilities & Net Worth Accounts payable Bank loans Common stock Retained earnings Total INR 11,000 70,000 20,000 74,000 INR 175,000 Exchange rates for translating Nataja Mumbai's balance into euros (€) are: INR79.19 € April 1* exchange rate after 25% devaluation. INR59.39/ € March 31* exchange rate, before 25% devaluation. All inventory was acquired at this rate. INR50.00 € Historical exchange rate at which plant and equipment were acquired and the common stock was issued. a. Using the data presented, assume that the Indian rupee dropped in value from INR59.39/€ to INR79.19/€ between March 31st and April 1st. Assuming no change in the balance sheet between these two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation gain or loss in terms of change in the value of the exposed accounts. b. Can you show how a company can minimise translation exposure under the current rate method using a balance sheet hedge? Explain the strategy. c. Using the original data provided for Nataja Mumbai, assume that the Indian rupee appreciated in value from INR59.39 € to INR54.50€ between March 31 and April 1. Assuming no change in balance sheet accounts between those two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation gain or loss in terms of changes in the value of the exposed accounts.

1. Nataja Mumbai Ltd., the Indian subsidiary of a Belgian corporation, is a cardiothoracic instruments manufacturer. Nataja manufactures the instruments primarily for the medical industry globally-though with recent advances in cardiovascular surgery, its business has begun to grow rapidly. Sales are primarily to hospitals based on Europe and Asia. Nataja Mumbai's balance shee t in thousands of Indian Rupees (INR) as of March 31 is as follows: Balance Sheet (thousands) Indian Rupee Statement INR 26,000 38,000 46,000 65,000 INR 175,000 Assets Cash Accounts receivable Inventory Net plant & equipment Total Liabilities & Net Worth Accounts payable Bank loans Common stock Retained earnings Total INR 11,000 70,000 20,000 74,000 INR 175,000 Exchange rates for translating Nataja Mumbai's balance into euros (€) are: INR79.19 € April 1* exchange rate after 25% devaluation. INR59.39/ € March 31* exchange rate, before 25% devaluation. All inventory was acquired at this rate. INR50.00 € Historical exchange rate at which plant and equipment were acquired and the common stock was issued. a. Using the data presented, assume that the Indian rupee dropped in value from INR59.39/€ to INR79.19/€ between March 31st and April 1st. Assuming no change in the balance sheet between these two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation gain or loss in terms of change in the value of the exposed accounts. b. Can you show how a company can minimise translation exposure under the current rate method using a balance sheet hedge? Explain the strategy. c. Using the original data provided for Nataja Mumbai, assume that the Indian rupee appreciated in value from INR59.39 € to INR54.50€ between March 31 and April 1. Assuming no change in balance sheet accounts between those two days, calculate the gain or loss from translation by both the current rate method and the temporal method. Explain the translation gain or loss in terms of changes in the value of the exposed accounts.

Chapter22: International Financial Management

Section: Chapter Questions

Problem 4P

Related questions

Question

100%

solve both parts asap

Transcribed Image Text:1. Nataja Mumbai Ltd., the Indian subsidiary of a Belgian corporation, is a cardiothoracic

instruments manufacturer. Nataja manufactures the instruments primarily for the medical

industry globally-though with recent advances in cardiovascular surgery, its business has

begun to grow rapidly. Sales are primarily to hospitals based on Europe and Asia. Nataja

Mumbai's balance shee t in thousands of Indian Rupees (INR) as of March 31 is as follows:

Balance Sheet (thousands)

Indian Rupee

Assets

Cash

Statement

INR 26,000

38,000

46,000

65,000

INR 175,000

Accounts receivable

Inventory

Net plant & equipment

Total

Liabilities & Net Worth

Accounts payable

INR 11,000

70,000

20,000

74,000

INR 175,000

Bank loans

Common stock

Retained earnings

Total

Exchange rates for translating Nataja Mumbai's balance into euros (€) are:

INR79.19€ April 1s exchange rate after 25% devaluation.

INR59.39 € March 31 exchange rate, before 25% devaluation. All inventory was acquired at

this rate.

INR50.00 € Historical exchange rate at which plant and equipment were acquired and the

common stock was issued.

a. Using the data presented, assume that the Indian rupee dropped in value from INR59.39/€

to INR79.19€ between March 31st and April 1st. Assuming no change in the balance sheet

between these two days, calculate the gain or loss from translation by both the current rate

method and the temporal method. Explain the translation gain or loss in terms of change in

the value of the exposed accounts.

b. Can you show how a company can minimise translation exposure under the current rate

method using a balance sheet hedge? Explain the strategy.

c. Using the original data provided for Nataja Mumbai, assume that the Indian rupee

appreciated in value from INR59.39 € to INR54.50€ between March 31 and April 1.

Assuming no change in balance sheet accounts between those two days, calculate the gain or

loss from translation by both the current rate method and the temporal method. Explain the

translation gain or loss in terms of changes in the value of the exposed accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT