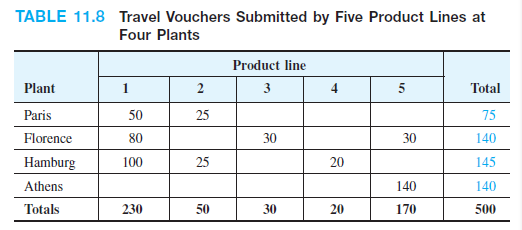

TABLE 11.8 Travel Vouchers Submitted by Five Product Lines at Four Plants Product line Plant 1 2 3 4 5 Total Paris 50 25 75 Florence 80 30 30 140 Hamburg 100 25 20 145 Athens 140 140 Totals 230 50 30 20 170 500 Using the traditional method, indirect costs are estimated using an indirect cost rate that is developed using some basis. Table 11.5 includes possible bases and sample cost categories that may be allocated using each basis. The indirect cost rate is calculated using the relation estimated total indirect costs Indirect cost rate [11.13] estimated basis level City Employees Allocation Paris 12,500 $214,777 Florence 8,600 147,766 Hamburg 4,200 72,165 Athens 3,800 65,292 29,100 $500,000

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

A U.S.-based multinational pharmaceutical firm with four plants in Europe uses traditional methods to distribute the annual business travel allocation on the basis of workforce size. Last year $500,000 in travel expenses were distributed, according to as shown, at a rate of 500,000 / 29,100 = $17.18 per employee. A switch to ABC allocates the $500,000 in travel expenses on the basis of the number of travel vouchers, categorized by travelers working on each product line. In ABC terminology, travel is the activity and a travel voucher is the cost driver. as shown details the distribution of 500 vouchers to each product line by plant. Not all products are produced at each plant. Use the ABC method to allocate travel expenses to each product line and each plant. Compare plant-by-plant allocations based on workforce size (traditional) and number of travel vouchers (ABC).

![Using the traditional method, indirect costs are estimated using an indirect cost

rate that is developed using some basis. Table 11.5 includes possible bases and

sample cost categories that may be allocated using each basis. The indirect cost

rate is calculated using the relation

estimated total indirect costs

Indirect cost rate

[11.13]

estimated basis level

City

Employees

Allocation

Paris

12,500

$214,777

Florence

8,600

147,766

Hamburg

4,200

72,165

Athens

3,800

65,292

29,100

$500,000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Facd962c6-9466-40bb-8ed8-397d858d1161%2Fe1c49900-041b-4eb9-a277-d6d771f8fe3b%2Fisb95lu.png&w=3840&q=75)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps