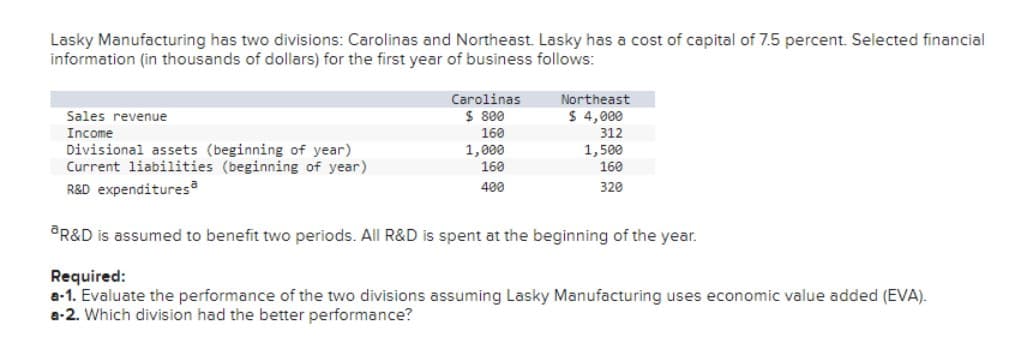

Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expenditures Carolinas $ 800 160 Northeast $ 4,000 312 1,000 1,500 160 160 400 320 R&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). a-2. Which division had the better performance?

Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expenditures Carolinas $ 800 160 Northeast $ 4,000 312 1,000 1,500 160 160 400 320 R&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). a-2. Which division had the better performance?

Chapter12: Balanced Scorecard And Other Performance Measures

Section: Chapter Questions

Problem 3PA: Macon Mills is a division of Bolin Products. Inc. During the most recent year, Macon had a net...

Related questions

Question

Transcribed Image Text:Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial

information (in thousands of dollars) for the first year of business follows:

Sales revenue

Income

Divisional assets (beginning of year)

Current liabilities (beginning of year)

R&D expenditures

Carolinas

$ 800

160

Northeast

$ 4,000

312

1,000

1,500

160

160

400

320

R&D is assumed to benefit two periods. All R&D is spent at the beginning of the year.

Required:

a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA).

a-2. Which division had the better performance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub