Dynamic World Vista Industries (DWVI) wishes to estimate its cost of capital for use in analyzing projects that are similar to those that already exist. The firm's current capital structure, in terns of market value, includes 30 percent corporate bond, 10% irredeemable loan notes, 10% preference shares and 50%ordinary shares. The firm's corporate bond has an average yield to maturity of 8.3%. DWVI also has an irredeemable loan notes currently trading at GHC40 ex interest, an interest rate of five (5) percent. Its preference shares have a GHC70 par value, an 8 percent dividend, and are currently selling for GHC76 per share. DWVI's beta is 1.05, return on riskless asset is 4% and the return on the GSE (the market proxy) is 11.4%. The industry is in 40% marginal tax bracket. Required: What are DWVI's pre-tax costs of debts, preference shares and ordinary shares? Calculate DWVI's weighted average cost of capital (WACC) on both a pre-tax and after-tax basis. Vhich WACC should DWVI uses when making investment decisions and why?

Dynamic World Vista Industries (DWVI) wishes to estimate its cost of capital for use in analyzing projects that are similar to those that already exist. The firm's current capital structure, in terns of market value, includes 30 percent corporate bond, 10% irredeemable loan notes, 10% preference shares and 50%ordinary shares. The firm's corporate bond has an average yield to maturity of 8.3%. DWVI also has an irredeemable loan notes currently trading at GHC40 ex interest, an interest rate of five (5) percent. Its preference shares have a GHC70 par value, an 8 percent dividend, and are currently selling for GHC76 per share. DWVI's beta is 1.05, return on riskless asset is 4% and the return on the GSE (the market proxy) is 11.4%. The industry is in 40% marginal tax bracket. Required: What are DWVI's pre-tax costs of debts, preference shares and ordinary shares? Calculate DWVI's weighted average cost of capital (WACC) on both a pre-tax and after-tax basis. Vhich WACC should DWVI uses when making investment decisions and why?

Chapter17: Multinational Capital Structure And Cost Of Capital

Section: Chapter Questions

Problem 14QA

Related questions

Question

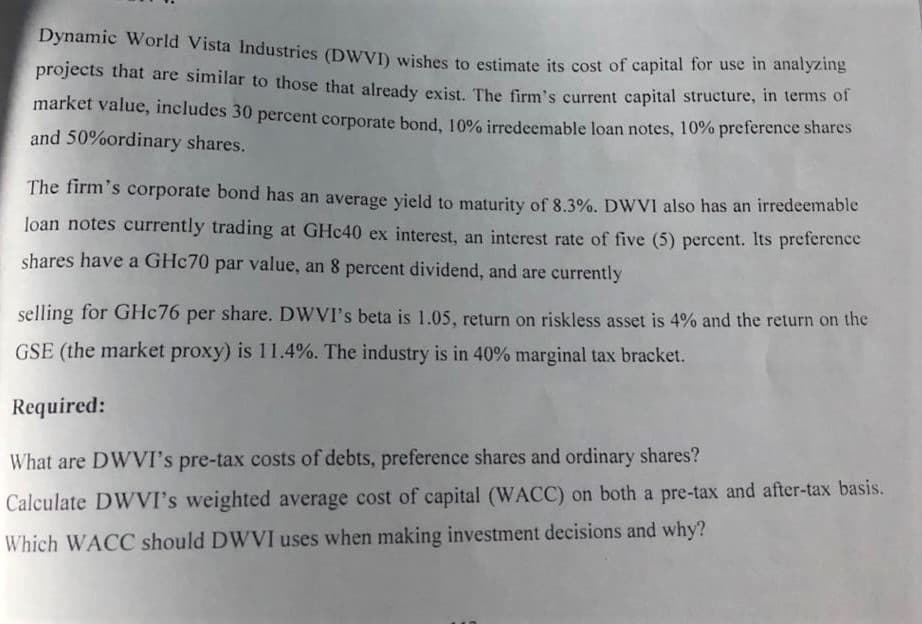

Transcribed Image Text:Dynamic World Vista Industries (DWVI) wishes to estimate its cost of capital for use in analyzing

projects that are similar to those that already exist The frm's current capital structure, in terms of

market value, includes 30 percent corporate bond, 10% irredeemable loan notes, 10% preference shares

and 50%ordinary shares.

The firm's corporate bond has an average yield to maturity of 8.3%. DWVI also has an irredeemable

loan notes currently trading at GHC40 ex interest, an interest rate of five (5) percent. Its preference

shares have a GHC70 par value, an 8 percent dividend, and are currently

selling for GHC76 per share. DWVI's beta is 1.05, return on riskless asset is 4% and the return on the

GSE (the market proxy) is 11.4%. The industry is in 40% marginal tax bracket.

Required:

What are DWVI's pre-tax costs of debts, preference shares and ordinary shares?

Calculate DWVI's weighted average cost of capital (WACC) on both a pre-tax and after-tax basis.

Which WACC should DWVI uses when making investment decisions and why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT