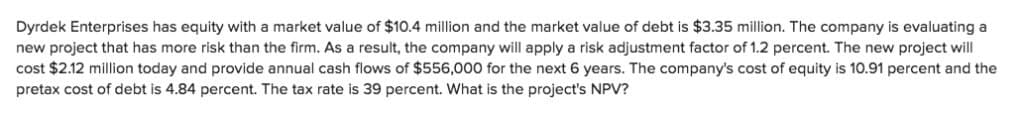

Dyrdek Enterprises has equity with a market value of $10.4 million and the market value of debt is $3.35 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.2 percent. The new project will cost $2.12 million today and provide annual cash flows of $556,000 for the next 6 years. The company's cost of equity is 10.91 percent and the pretax cost of debt is 4.84 percent. The tax rate is 39 percent. What is the project's NPV?

Dyrdek Enterprises has equity with a market value of $10.4 million and the market value of debt is $3.35 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.2 percent. The new project will cost $2.12 million today and provide annual cash flows of $556,000 for the next 6 years. The company's cost of equity is 10.91 percent and the pretax cost of debt is 4.84 percent. The tax rate is 39 percent. What is the project's NPV?

Chapter11: Capital Budgeting And Risk

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:Dyrdek Enterprises has equity with a market value of $10.4 million and the market value of debt is $3.35 million. The company is evaluating a

new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.2 percent. The new project will

cost $2.12 million today and provide annual cash flows of $556,000 for the next 6 years. The company's cost of equity is 10.91 percent and the

pretax cost of debt is 4.84 percent. The tax rate is 39 percent. What is the project's NPV?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College