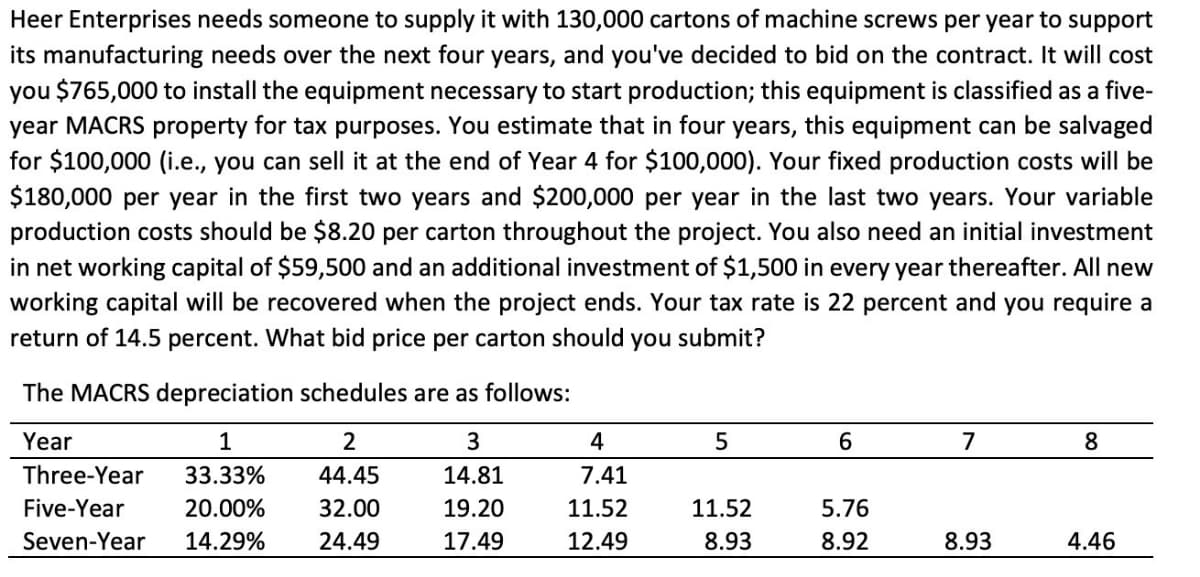

Heer Enterprises needs someone to supply it with 130,000 cartons of machine screws per year to support its manufacturing needs over the next four years, and you've decided to bid on the contract. It will cost you $765,000 to install the equipment necessary to start production; this equipment is classified as a five- year MACRS property for tax purposes. You estimate that in four years, this equipment can be salvaged for $100,000 (i.e., you can sell it at the end of Year 4 for $100,000). Your fixed production costs will be $180,000 per year in the first two years and $200,000 per year in the last two years. Your variable production costs should be $8.20 per carton throughout the project. You also need an initial investment in net working capital of $59,500 and an additional investment of $1,500 in every year thereafter. All new working capital will be recovered when the project ends. Your tax rate is 22 percent and you require a return of 14.5 percent. What bid price per carton should you submit? The MACRS depreciation schedules are as follows: Year 1 2 3 4 5 6 7 8 Three-Year 33.33% 44.45 14.81 7.41 Five-Year 20.00% 32.00 19.20 11.52 11.52 5.76 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46

Heer Enterprises needs someone to supply it with 130,000 cartons of machine screws per year to support its manufacturing needs over the next four years, and you've decided to bid on the contract. It will cost you $765,000 to install the equipment necessary to start production; this equipment is classified as a five- year MACRS property for tax purposes. You estimate that in four years, this equipment can be salvaged for $100,000 (i.e., you can sell it at the end of Year 4 for $100,000). Your fixed production costs will be $180,000 per year in the first two years and $200,000 per year in the last two years. Your variable production costs should be $8.20 per carton throughout the project. You also need an initial investment in net working capital of $59,500 and an additional investment of $1,500 in every year thereafter. All new working capital will be recovered when the project ends. Your tax rate is 22 percent and you require a return of 14.5 percent. What bid price per carton should you submit? The MACRS depreciation schedules are as follows: Year 1 2 3 4 5 6 7 8 Three-Year 33.33% 44.45 14.81 7.41 Five-Year 20.00% 32.00 19.20 11.52 11.52 5.76 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

Transcribed Image Text:Heer Enterprises needs someone to supply it with 130,000 cartons of machine screws per year to support

its manufacturing needs over the next four years, and you've decided to bid on the contract. It will cost

you $765,000 to install the equipment necessary to start production; this equipment is classified as a five-

year MACRS property for tax purposes. You estimate that in four years, this equipment can be salvaged

for $100,000 (i.e., you can sell it at the end of Year 4 for $100,000). Your fixed production costs will be

$180,000 per year in the first two years and $200,000 per year in the last two years. Your variable

production costs should be $8.20 per carton throughout the project. You also need an initial investment

in net working capital of $59,500 and an additional investment of $1,500 in every year thereafter. All new

working capital will be recovered when the project ends. Your tax rate is 22 percent and you require a

return of 14.5 percent. What bid price per carton should you submit?

The MACRS depreciation schedules are as follows:

Year

1

2

3

4

5

6

7

8

Three-Year

33.33%

44.45

14.81

7.41

Five-Year

20.00%

32.00

19.20

11.52

11.52

5.76

Seven-Year 14.29% 24.49

17.49

12.49

8.93

8.92

8.93

4.46

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning