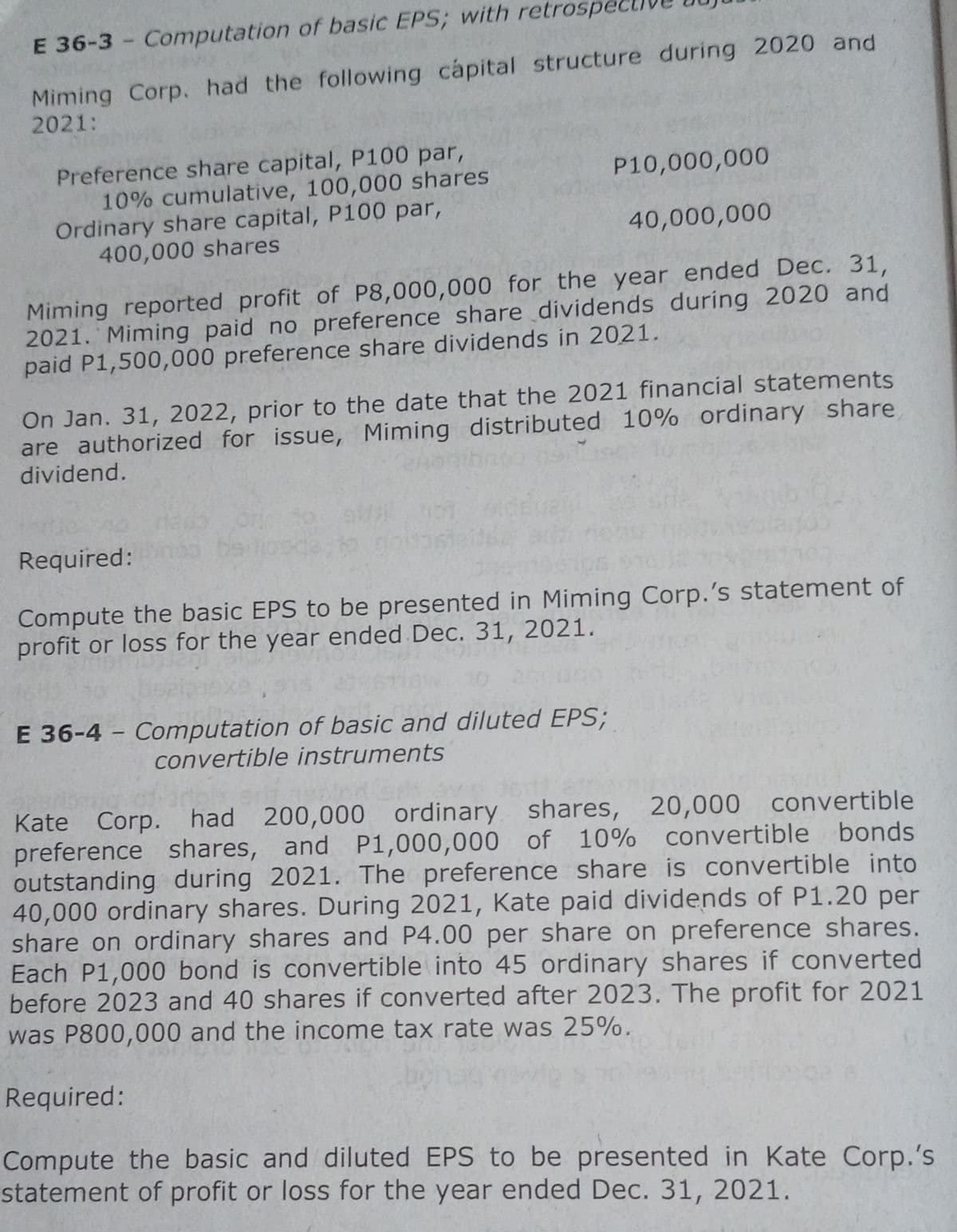

E 36-3 Miming Corp. had the following capital structure during 2020 and 2021: Preference share capital, P100 par, 10% cumulative, 100,000 shares Ordinary share capital, P100 par, 400,000 shares P10,000,000 40,000,000 Miming reported profit of P8,000,000 for the year ended Dec. 31, 2021. Miming paid no preference share dividends during 2020 and paid P1,500,000 preference share dividends in 2021. On Jan. 31, 2022, prior to the date that the 2021 financial statements are authorized for issue, Miming distributed 10% ordinary share dividend. Required: Compute the basic EPS to be presented in Miming Corp.'s statement of profit or loss for the year ended Dec. 31, 2021.

E 36-3 Miming Corp. had the following capital structure during 2020 and 2021: Preference share capital, P100 par, 10% cumulative, 100,000 shares Ordinary share capital, P100 par, 400,000 shares P10,000,000 40,000,000 Miming reported profit of P8,000,000 for the year ended Dec. 31, 2021. Miming paid no preference share dividends during 2020 and paid P1,500,000 preference share dividends in 2021. On Jan. 31, 2022, prior to the date that the 2021 financial statements are authorized for issue, Miming distributed 10% ordinary share dividend. Required: Compute the basic EPS to be presented in Miming Corp.'s statement of profit or loss for the year ended Dec. 31, 2021.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 67E: Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its...

Related questions

Question

Transcribed Image Text:E 36-3 - Computation of basic EPS; with retrospe

Miming Corp. had the following capital structure during 2020 and

2021:

Preference share capital, P100 par,

10% cumulative, 100,000 shares

Ordinary share capital, P100 par,

400,000 shares

P10,000,000

40,000,000

Miming reported profit of P8,000,000 for the year ended Dec. 31,

2021. Miming paid no preference share dividends during 2020 and

paid P1,500,000 preference share dividends in 2021.

On Jan. 31, 2022, prior to the date that the 2021 financial statements

are authorized for issue, Miming distributed 10% ordinary share

dividend.

Required:

Compute the basic EPS to be presented in Miming Corp.'s statement of

profit or loss for the year ended Dec. 31, 2021.

E 36-4 - Computation of basic and diluted EPS;

convertible instruments

Kate Corp. had 200,000 ordinary shares, 20,000 convertible

preference shares, and P1,000,000 of

outstanding during 2021. The preference share is convertible into

40,000 ordinary shares. During 2021, Kate paid dividends of P1.20 per

share on ordinary shares and P4.00 per share on preference shares.

Each P1,000 bond is convertible into 45 ordinary shares if converted

before 2023 and 40 shares if converted after 2023. The profit for 2021

was P800,000 and the income tax rate was 25%.

10% convertible bonds

Required:

Compute the basic and diluted EPS to be presented in Kate Corp.'s

statement of profit or loss for the year ended Dec. 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning