e at the The net revenue at the end of year 2 is $4,000. The net revenue at the end of year 3 is $6,000. The net revenue at the end of year 4 is $10,000. This includes revenue from operations and sale of the used equipment. The interest rate is 5%. What is the levelized net revenue with four equal payments at the end of years 1 to 4 if the annuity factor is given by 1- (1+i) (1.05)4 .05 = 3.54

e at the The net revenue at the end of year 2 is $4,000. The net revenue at the end of year 3 is $6,000. The net revenue at the end of year 4 is $10,000. This includes revenue from operations and sale of the used equipment. The interest rate is 5%. What is the levelized net revenue with four equal payments at the end of years 1 to 4 if the annuity factor is given by 1- (1+i) (1.05)4 .05 = 3.54

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 4CDQ: How would each of the following costs be classified if units produced is the activity base? a....

Related questions

Question

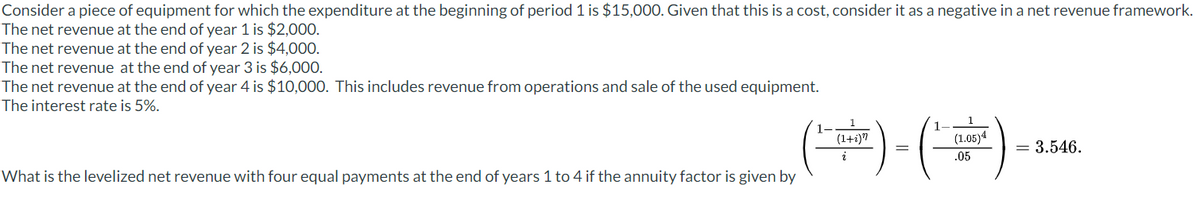

Transcribed Image Text:Consider a piece of equipment for which the expenditure at the beginning of period 1 is $15,000. Given that this is a cost, consider it as a negative in a net revenue framework.

The net revenue at the end of year 1 is $2,000.

The net revenue at the end of year 2 is $4,000.

The net revenue at the end of year 3 is $6,000.

The net revenue at the end of year 4 is $10,000. This includes revenue from operations and sale of the used equipment.

The interest rate is 5%.

What is the levelized net revenue with four equal payments at the end of years 1 to 4 if the annuity factor is given by

(1+i)"

1

(1.05)4

.05

= 3.546.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning