Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1iM

Related questions

Question

(a) If Roxy Inc. were to be 100% equity financed, what would be a reasonable estimate of the expected return on Roxy's equity? What is Roxy's WACC? expected

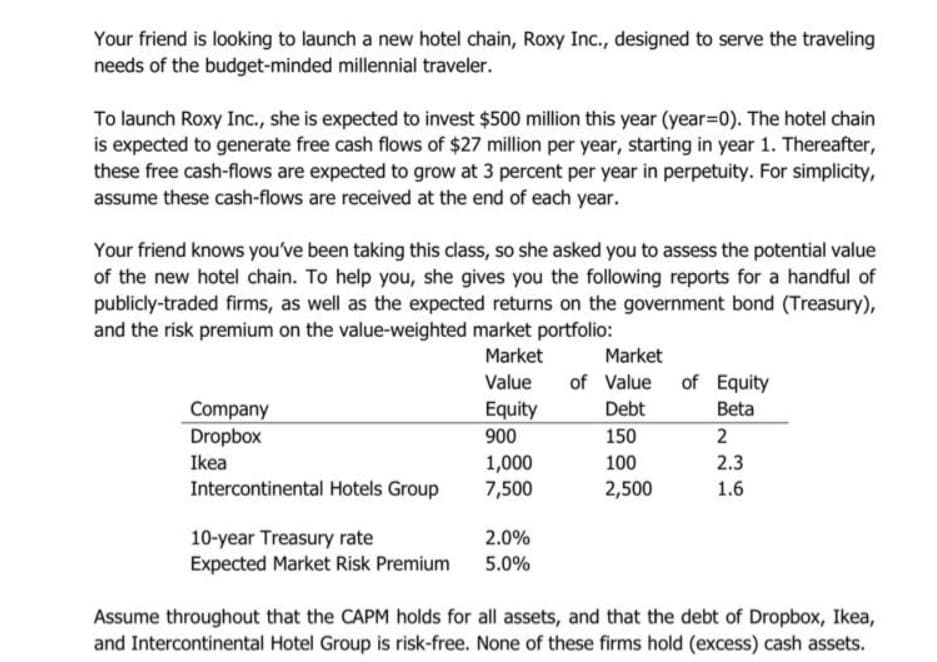

Transcribed Image Text:Your friend is looking to launch a new hotel chain, Roxy Inc., designed to serve the traveling

needs of the budget-minded millennial traveler.

To launch Roxy Inc., she is expected to invest $500 million this year (year=0). The hotel chain

is expected to generate free cash flows of $27 million per year, starting in year 1. Thereafter,

these free cash-flows are expected to grow at 3 percent per year in perpetuity. For simplicity,

assume these cash-flows are received at the end of each year.

Your friend knows you've been taking this class, so she asked you to assess the potential value

of the new hotel chain. To help you, she gives you the following reports for a handful of

publicly-traded firms, as well as the expected returns on the government bond (Treasury),

and the risk premium on the value-weighted market portfolio:

Market

Value

Equity

900

Company

Dropbox

Ikea

Intercontinental Hotels Group

10-year Treasury rate

Expected Market Risk Premium

1,000

7,500

2.0%

5.0%

Market

of Value

Debt

150

100

2,500

of Equity

Beta

2

2.3

1.6

Assume throughout that the CAPM holds for all assets, and that the debt of Dropbox, Ikea,

and Intercontinental Hotel Group is risk-free. None of these firms hold (excess) cash assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College